Asset managers and fund boards are facing heightened scrutiny from regulators related to the oversight of fund costs, performance, and value for money. Whether looking at the May 2022 ESMA reports on costs and fees, the impact of Consumer Duty, or the March 2023 “Dear Chair” letter from the Central Bank of Ireland (CBI) there is a clear call to ensure fees charged to investors are reasonable and that there is a robust on-going process in place to monitor and evaluate cost and performance. The value is a multi-dimensional concept, and it is important not to jump to face-value conclusions.

Broadridge has a 30-year history of providing market-leading independent Board Reporting for its clients. As both ESMA and the CBI have highlighted, independent analysis of fees and performance should occur at least annually. Broadridge’s industry insights and thought leadership on the most challenging items related to value for money oversight include:

- Establishing a methodology for on-going cost and performance reviews

- Creation of independent peer groups

- Evaluation of management fee charges and OCF

- Evaluation of fund performance and risk

- Evaluation and validation of value provided by the fund

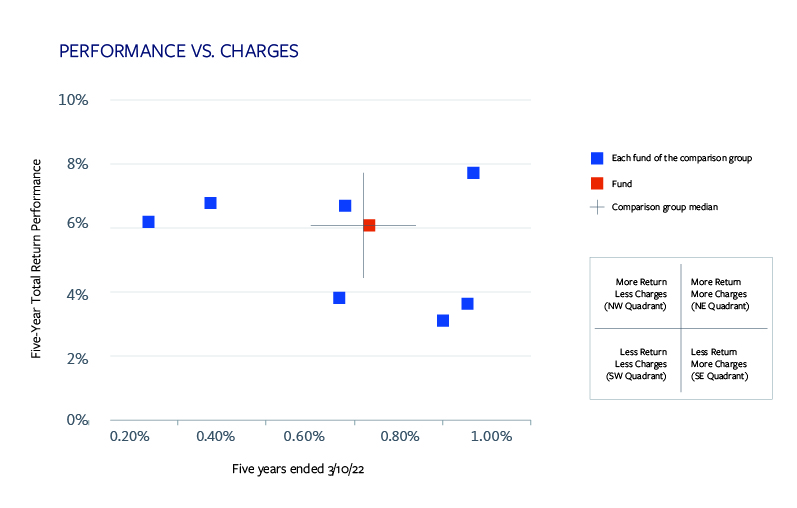

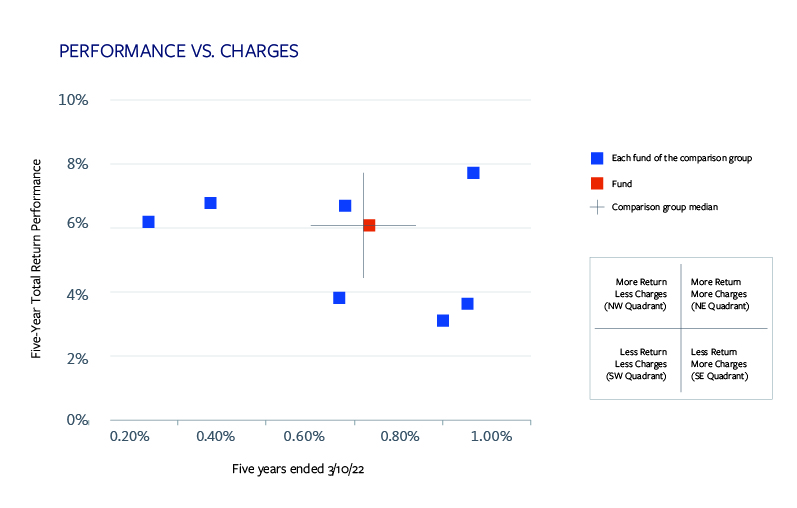

Below we demonstrate how Broadridge’s analytics can highlight multiple dimensions of value for a fund, empowering boards with the most rounded picture on which to make their judgement. Here we assess a large-cap fund with a blended tilt. An initial conclusion of underperformance and high expenses based on rankings is further contextualized with other factors such as fund size, volatility and risk awareness that provide a comprehensive analytical view:

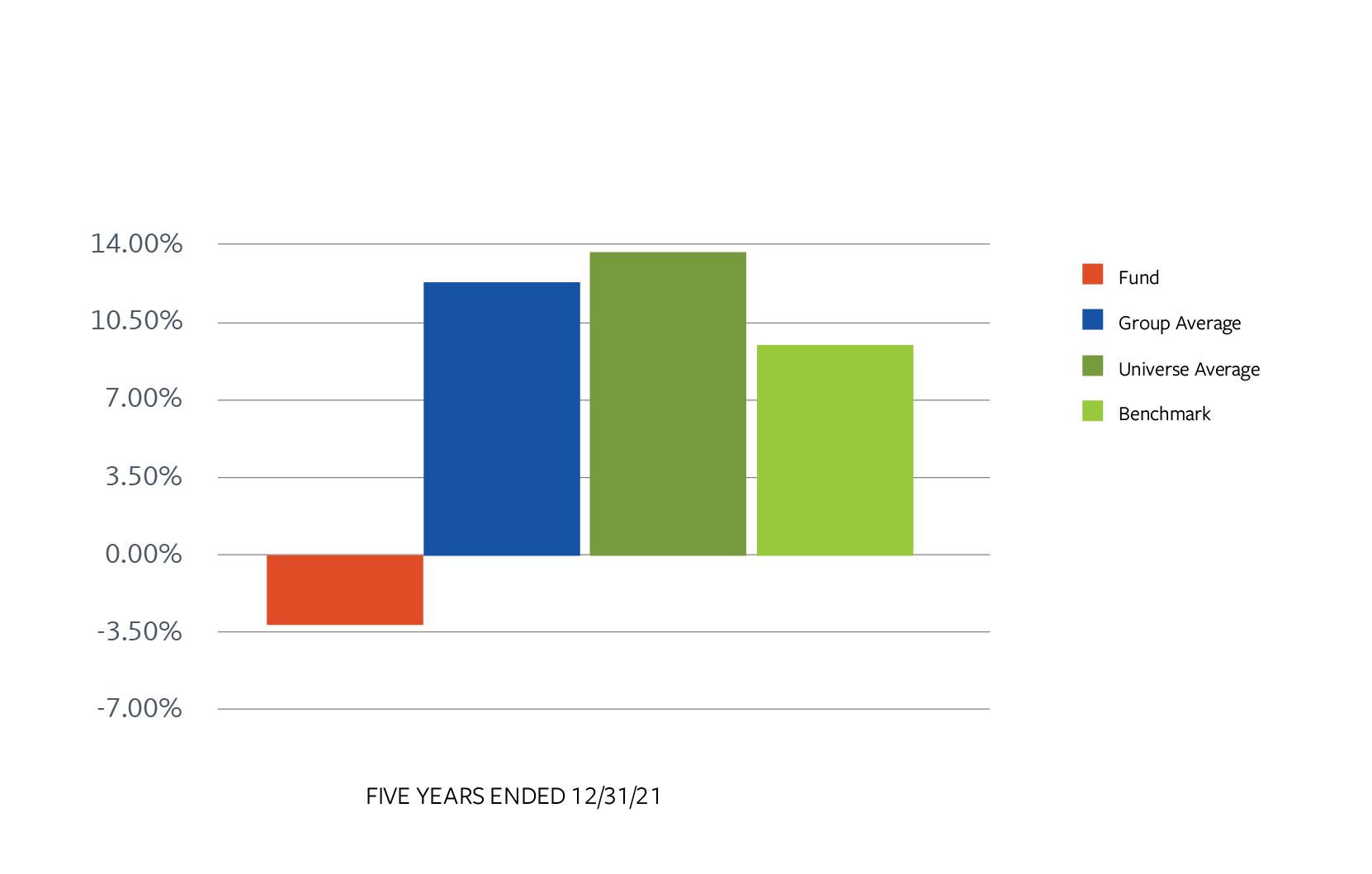

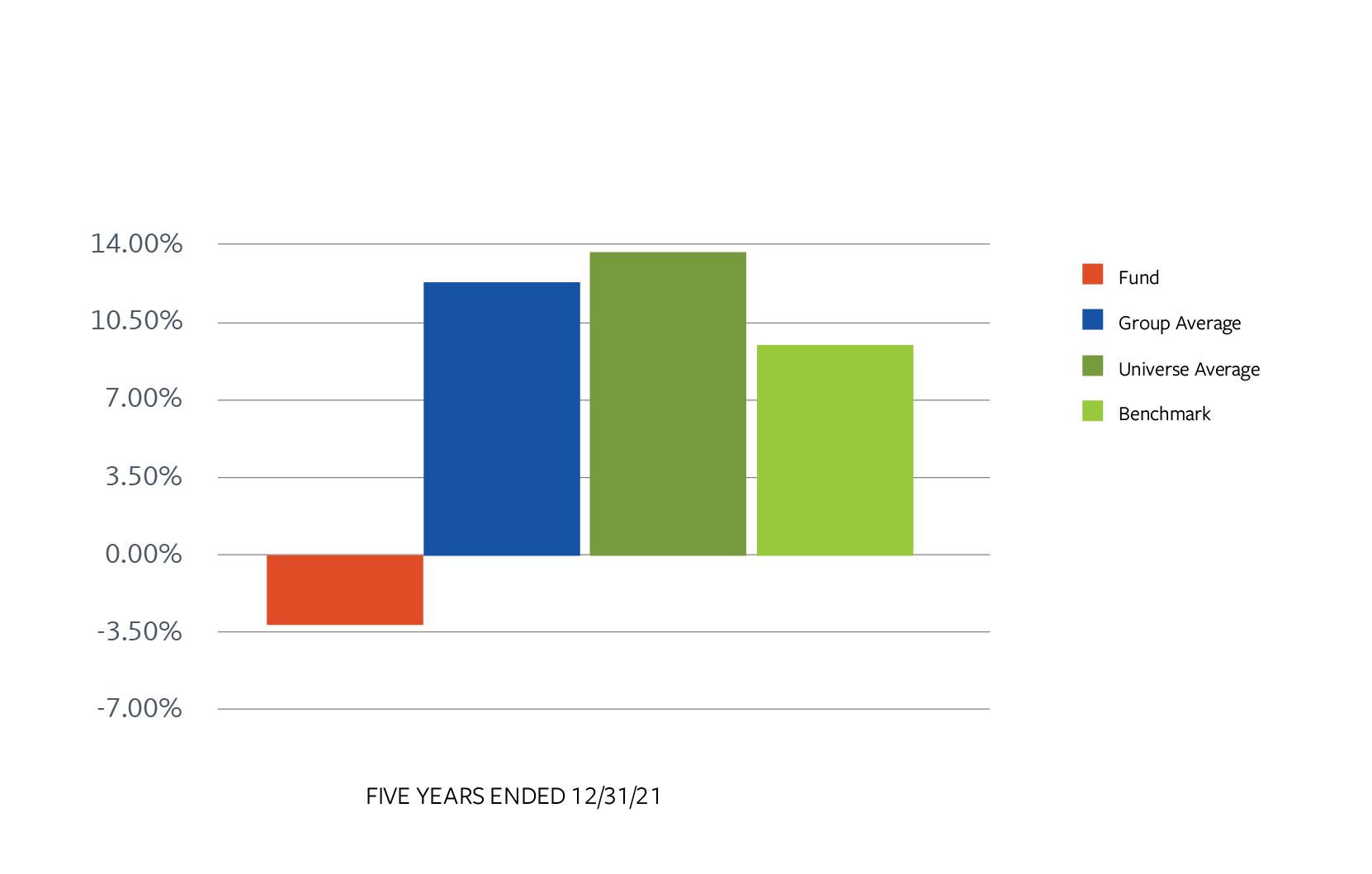

Five-Year Net Total Return

- The fund has high relative costs and low relative performance versus its peers, in addition to also underperforming its index.

- Based strictly on these measures, you may say the fund is not providing value.

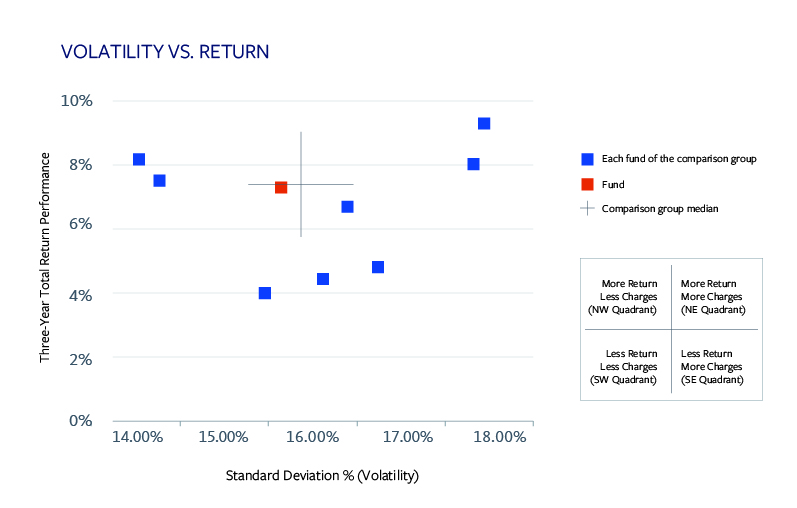

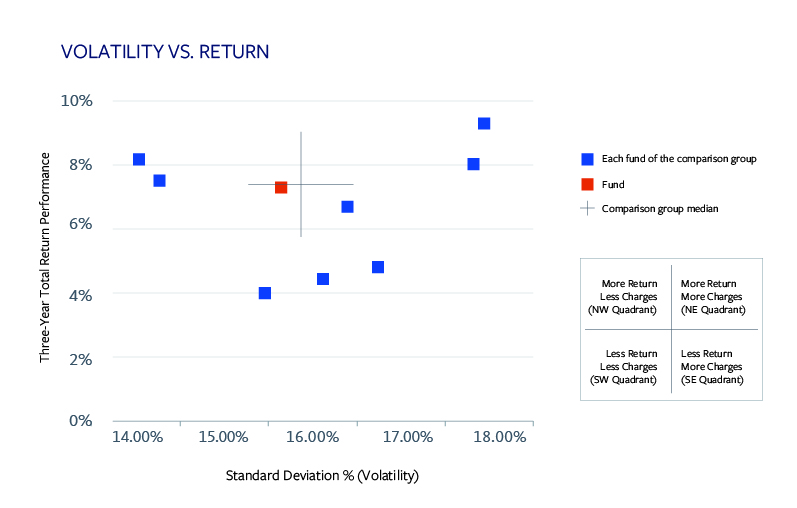

However, the story begins to change when additional criteria is pulled in —meaning that the board can have a detailed discussion and analysis of the fund that goes beyond face value.

- The fund is less volatile than its peers, thereby reducing risk for investors.

- The fund has the second smallest AUM versus its Comparable Market Rates peers, indicating costs may go down as the fund gathers more assets.

- The fund is positioned as “risk-aware” and, based on analysis of various risk measures, is executing on that aspect of its investment mandate quite well.

Through Broadridge’s additional insights, it becomes clear that this fund is providing value based on its stated investment objective.

Broadridge works with each asset manager and board to develop a meaningful solution to cost and performance oversight. This creates a standarised process and methodology to start the review and provides reasonable metrics to identify funds that need “further review” to fully determine their value. We implement a robust process that supports recommendations of regulators and helps the board and management efficiently and effectively address funds that require modifications or additional oversight.