The Digital Asset Revolution: Preparing for the Next Generation of Financial Markets

Executive Summary

Regardless of where cryptocurrency valuations head, the underlying rails will be valuable and transformative — ushering in a new era of digital assets. At every financial services firm, senior leadership should be incorporating crypto into their broader company strategy. That initiative should start immediately.

To be clear, this is not about making a case for the valuation of bitcoin or any other cryptocurrency. Rather, this is about the underlying rails being built to support the cryptocurrency ecosystem. Regardless of where cryptocurrency valuations head, the underlying rails will be valuable and transformative — ushering in a new era of digital assets beyond cryptocurrency.

Much like the advent of the internet, this is an “innovate or fall behind” moment. Companies that prepare now by building for the new digital asset ecosystem will be well-positioned to capitalize on opportunities created by the digital asset revolution

This paper draws on data from a survey of 275 financial institutions on the buy-side and sell-side on their plans to offer crypto services.

It traces the evolution of the crypto and broader digital asset world and projects how the digitization of traditional assets will reshape the financial services industry going forward. It also provides recommendations to help firms prepare for the coming era of digital assets.

Survey Methodology

This paper presents results from the Broadridge Crypto Adoption Survey. In the summer of 2021, Broadridge conducted a survey of 275 financial institutions, including asset managers, capital markets firms, custodian banks and wealth managers in North America, Europe and Asia-Pacific. Respondents were asked about current cryptocurrency offerings and future cryptocurrency strategies. They also were asked about their overall perspectives on emerging cryptocurrency technologies and products.

Introduction

Digital assets are on track to transform the financial services industry. It’s no longer a matter of if, but when.

Despite wild gyrations in cryptocurrency valuations, companies behind the scenes are steadily building an infrastructure that could someday run huge parts of the global financial system. The ecosystem these pioneers are building for digital assets and decentralized finance (DeFi) can be used to digitize and “tokenize” almost any asset. Blockchain innovations are already enabling the creation of new products. These include new digital-only assets as well as tokenized versions of traditional assets. These products are appearing in areas as diverse as art, real estate, private company shares and even high yield loans.

This proliferation is attracting new investors and participants to cryptocurrency — a process that will only intensify as open crypto networks lower barriers to entry and a consistent regulatory framework takes shape. In addition, emerging demand from institutions is combined with a 24/7/365 trading cycle, crypto lending and leverage capabilities, and improved ease-of-transacting and investor security to create highly liquid markets for digital assets. This momentum will, in turn, attract new issuers and service providers, continuing the cycle of growth.

Cryptocurrency innovation and asset digitization have the potential to affect almost every part of the financial services industry. While most functions provided by traditional financial services firms will still be necessary in an era of digital assets, they will likely take place on blockchain infrastructure. This migration will alter the existing landscape of market participants and service providers. By simplifying the customer value chain, digitization will merge functions performed by exchanges, custodians, and broker-dealers while diminishing the need for other intermediaries.

Keeping pace with these changes won’t be easy. According to the results of Broadridge’s Crypto Adoption Survey, one-third of financial institutions have started to prepare for the coming digital asset era by implementing at least preliminary crypto-related strategies. We expect that share to increase dramatically as the underlying infrastructure matures, investor adoption grows, and a greater portion of the traditional financial system takes notice.

At every financial services firm, senior leadership should be incorporating crypto (and digital assets by default) into their broader company strategy. That initiative should start immediately. Much like the advent of the internet, this is an innovate or die moment. Companies that ignore crypto will put themselves at risk of being gradually marginalized and potentially even disintermediated from core businesses. On the other hand, companies who prepare now by building for the new digital asset ecosystem will be well positioned to capitalize on opportunities created by the digital asset revolution.

This paper will trace the evolution of the crypto and broader digital asset world, project how the digitization of traditional assets will reshape the financial services industry going forward, and provide recommendations to help firms prepare for the coming era of digital assets.

Remaking Traditional Roles

Asset digitization has the potential to alter the roles of traditional financial services intermediaries:

- Issuers’ ability to access digital networks for capital raising could change their relationships with investment banks. Private company shares could also become easier to transact and program, simplifying capital raises and improving liquidity for investors, founders and employees.

- The tokenization of mutual funds will simplify administration and servicing. This will allow asset managers and issuers of the underlying securities to communicate directly with shareholders through digital networks, reinventing and simplifying the beneficial ownership model.

- Digital asset exchanges will take on roles previously held by brokers and custodians.

- Open blockchain networks will transform asset servicing, including tax accounting, staking, voting, record-keeping and other functions.

The Growth and Evolution of Digital Assets

Cryptocurrencies are growing, evolving and spreading through markets at an astounding rate.

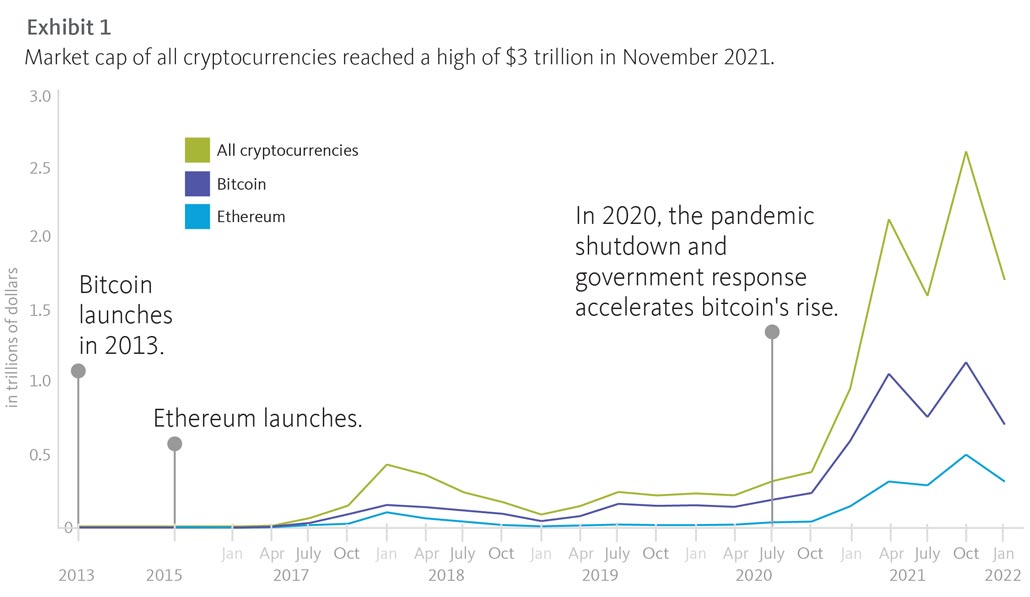

Digital currencies didn’t really exist outside of a handful of technology labs until the launch of bitcoin in 2009.1 The first bitcoin rivals didn’t emerge until 2011. Since then, cryptocurrency market cap has soared, with some dizzying ups and downs. The aggregate valuation of cryptocurrencies reached a high of $3 trillion in November 2021, climbing from just $1.5 billion in 20132 before tumbling back below $2 trillion in January 2022. For the past five years, trading volumes have grown at triple-digit compound annual growth rates (CAGRs). That growth reflects the incredibly rapid build-out of the blockchain infrastructure and the mainstream adoption of crypto.

While other revolutionary technologies took decades to mature from invention to mainstream adoption, crypto has reached its inflection point at a much faster pace. Based on Broadridge’s internal analysis and experience, as well as conversations with some of the industry’s most prominent players, we believe we are now in the second of four phases in the evolution of digital assets. We also believe that the time frame for this evolution will likely accelerate given the intense pace of development and investment in the space:

"The aggregate valuation of cryptocurrencies reached a high of $3 trillion in November 2021, soaring from just $1.5 billion in 2013."

Digital Asset Evolution

Phase 1

Crypto as an Asset Class (2009-2020)

The first phase of “crypto” centered on currencies. The technology was innovative but unproven and prone to illegal activity, while the asset class itself took on a speculative nature. Major cryptocurrency networks — like bitcoin and ethereum — evolved from ideas to phenomena while advancing technologically with the help of developers and early adopters. Alternative coins (“altcoins”) were also launched to capitalize on market hype or internet “memes,” with some, like dogecoin, finding surprising (yet temporary) success, and others eventually collapsing. Initial investment in the sector was driven by a relatively small group of tech-savvy individuals, with participation eventually expanding to the broader retail universe and, more slowly, to institutions. Although cryptocurrencies themselves got the headlines, the most important innovation in this phase occurred below the surface. This is where the industry invented and built out blockchain-based infrastructure to support crypto trading, lending, taxes, records, custody, valuation and other functions.

Phase 2

Introduction of New Digital Asset Classes (2020-2025)

The second phase of the crypto evolution is marked by the rapid expansion of digital assets. This occurred through the launch of new cryptocurrencies, the mainstream adoption of governance and utility tokens, and the proliferation of NFTs. Unlike past financial innovations that have been developed in isolated geographies and taken years to expand, crypto infrastructure is being built with a global mindset. Multibillion-dollar companies are now being funded in a decentralized manner through digital asset offerings, using governance tokens as proxies for traditional shares. Investors are piling into non-fungible tokens, excited by the prospect of pure digital ownership. Maturing products and infrastructure are attracting a more mainstream retail audience, capturing attention from both institutions and regulators and giving rise to the first DeFi applications. In this phase, we also see the first meaningful progress in digitizing real-world assets, shifting the focus of industry development from cryptocurrencies to a much broader array of digital assets. Regulatory frameworks are starting to take shape. This is slowly eliminating the uncertainty that has held back institutional participation.

Phase 3

Hybrid Legacy/Digital Asset Environment (2025-2030)

The third phase of crypto evolution will be marked by emerging adoption and collaboration among the business and regulatory communities. This could lead to the digitization of equities, bonds and other traditional securities through tokenization or direct digital issuance. Getting there will require an infrastructure scalable and reliable enough to support the trading of digital assets on a global scale. Once that infrastructure is deployed, financial services intermediaries may see their roles diminish as decentralized technology becomes pervasive. In this phase, technological innovation could evolve trading, clearing and settlement infrastructure, and expand direct ownership of assets. We may also see a rise in the use of digital cash (stablecoins, Central Bank digital currencies, etc.) for settlement. Furthermore, it will significantly alter the role of investor engagement and other key aspects of the existing financial market structure.

Phase 4

Majority Digital Asset Environment (2030 and Beyond)

Although it is difficult to predict exactly what the final phase of crypto evolution will look like, the world is likely moving toward a digitized framework for investable assets built on blockchain-based networks. More than threequarters of the participants in a 2022 survey by Arca Labs3 believe most securities will be digitized and settled on a blockchain in the next five to 10 years. This transition will require the development of new approaches that exceed our traditional market structure in safety and efficiency, with equivalent or enhanced trust and risk models. In this new marketplace, digital assets and coins could become the foundation for capital raising. Broadened participation, easy access to global assets and friction-free servicing could be the defining characteristics of a more participatory economy that rewards all participants and gives individuals better control over their data and assets.

The Current State of Crypto

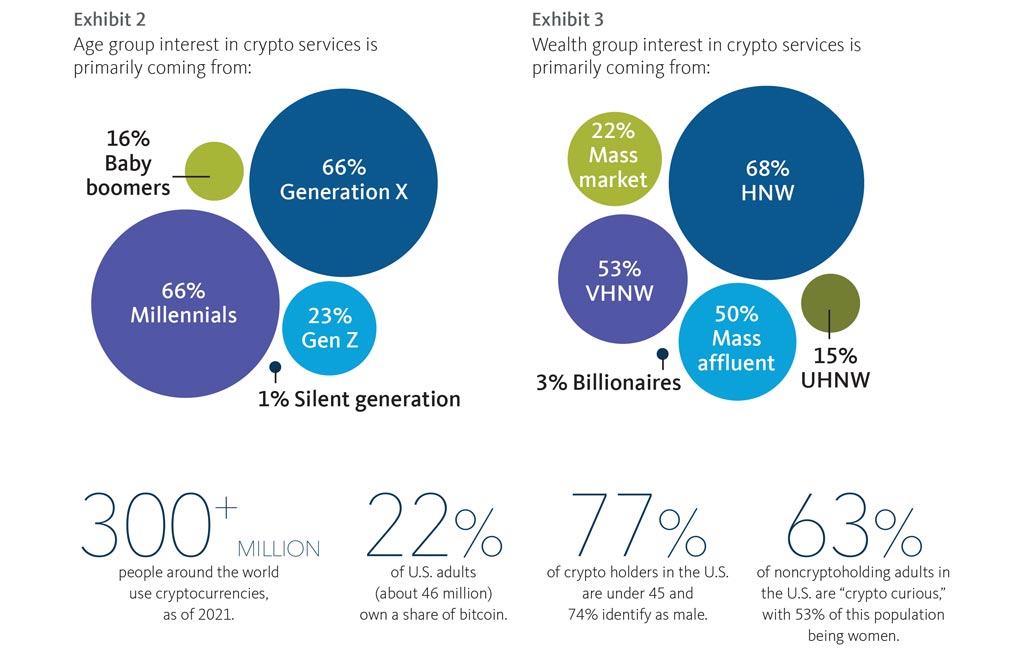

Soaring valuations and trading volumes in cryptocurrencies have been fueled by exponential growth in the investor base. Worldwide, the estimated number of crypto users has grown from about 1 million in 2013 to 300-plus million4 today.

Millennials and Generation Xers are driving the interest in cryptocurrencies in the mass affluent, high net worth, and very high net worth categories. So far, cryptocurrencies have proven much less enticing to the ultra-rich.

Among institutional investors, hedge funds like Brevan Howard and Tudor Investment Corp. have been on the cutting edge of crypto investing, as have endowments like Harvard and Yale, and crypto-focused funds like Grayscale, Galaxy Digital and Pantera Capital. However, traditional asset managers have taken a more cautious approach. That will change as markets for digital assets develop and mature, and the global regulatory framework begins to take shape, potentially bringing trillions of new investment dollars into crypto.

Building an Industry

Broadridge expects institutional spending on digital asset infrastructure to increase tenfold over the next five years.

That growth will be driven by both digital-asset-focused firms and traditional financial services companies. In the former category, digital asset startups are so well funded that they are at little, if any, disadvantage to incumbents when it comes to funding. (See Sidebar: Funding Web3)

Funding WEB3

Investors are pouring billions of dollars into the build-out of Web3 through traditional funding mechanisms and new digital tokens.

The first generation of the World Wide Web (Web1) was defined by clunky connections, rudimentary websites and early browsers. Web2 emerged from that foundation. It has been characterized by the change from static web pages to dynamic or user-generated content and the growth of social media. Tech giants like Google and Meta, formerly known as Facebook, grew out of this phase. Finally, Web3 represents a new paradigm in which data will be interconnected in a decentralized way through blockchains. This blockchain infrastructure will support a new generation of decentralized applications and digital assets.

Web3 is giving rise to new funding mechanisms — digital ownership tokens — that are democratizing early-stage investing. Decentralized Autonomous Organizations (DAOs) — which represent a new form of the traditional company structure built on crypto and blockchains — saw their treasury assets balloon by 40 times last year. This saw them climb to $16 billion from just $400 million in 2020, according to crypto research and data provider Deep DAO. Over the same period, the number of individuals and institutions participating in DAOs increased 130 times to 1.6 million in December 20215.

Venture capital firms have become agnostic about ownership form. They are flooding the space with capital through both traditional equity and digital token investments. From 2020 to 2021, venture capital investments in the digital asset ecosystem increased 450% to $33 billion, a figure that represents 5% of total VC investment.6

Incumbents are hardly ceding the space. JP Morgan alone is planning to spend $12 billion this upcoming fiscal year on technology, including blockchain and Web3. Investments like this are pushing traditional financial services firms from the research stage to live cryptocurrency offerings. In 2021, top-tier banks like JP Morgan, Goldman Sachs, Bank of America and Deutsche Bank made headlines by announcing the launch of crypto trading desks. Large wealth managers like Morgan Stanley and Wells Fargo started providing access to crypto through products and funds, often in partnership with crypto-focused firms like Paxos and NYDIG. In addition, major institutions like BlackRock, Fidelity Investments, State Street, and BNY Mellon have started to support digital asset custody.

Despite these high-profile entrants, only 7% of traditional financial services firms are currently offering cryptocurrency services to clients, according to our survey. About a quarter are either researching crypto or are in the process of developing cryptocurrency products or services. The relatively slow response from traditional financial services firms has opened the door for new entrants like Coinbase and FTX, which have rushed in to fill the void and been rewarded with multibillion-dollar valuations.

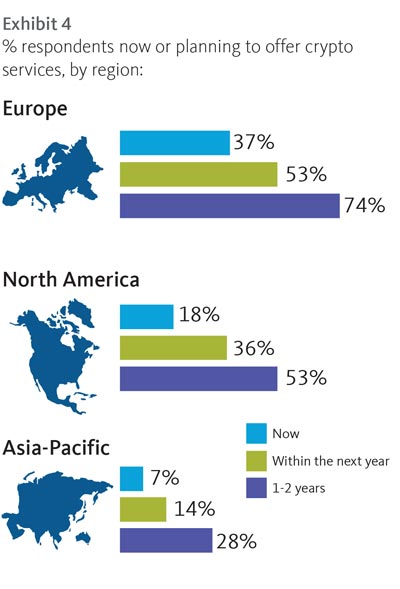

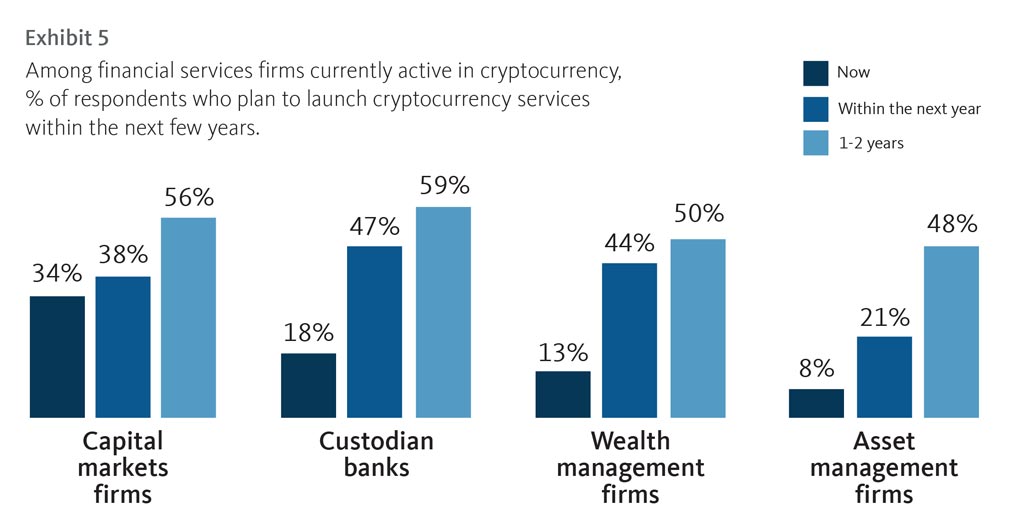

Only about a third of traditional financial services firms plan to sit out crypto entirely, and firms with plans to engage in the ecosystem expect to move quickly. More than half of traditional firms describing themselves as active in the space plan to offer at least one cryptocurrency product or service within the next 24 months. Exhibits 4 and 5 show how those plans break down by region and firm type.

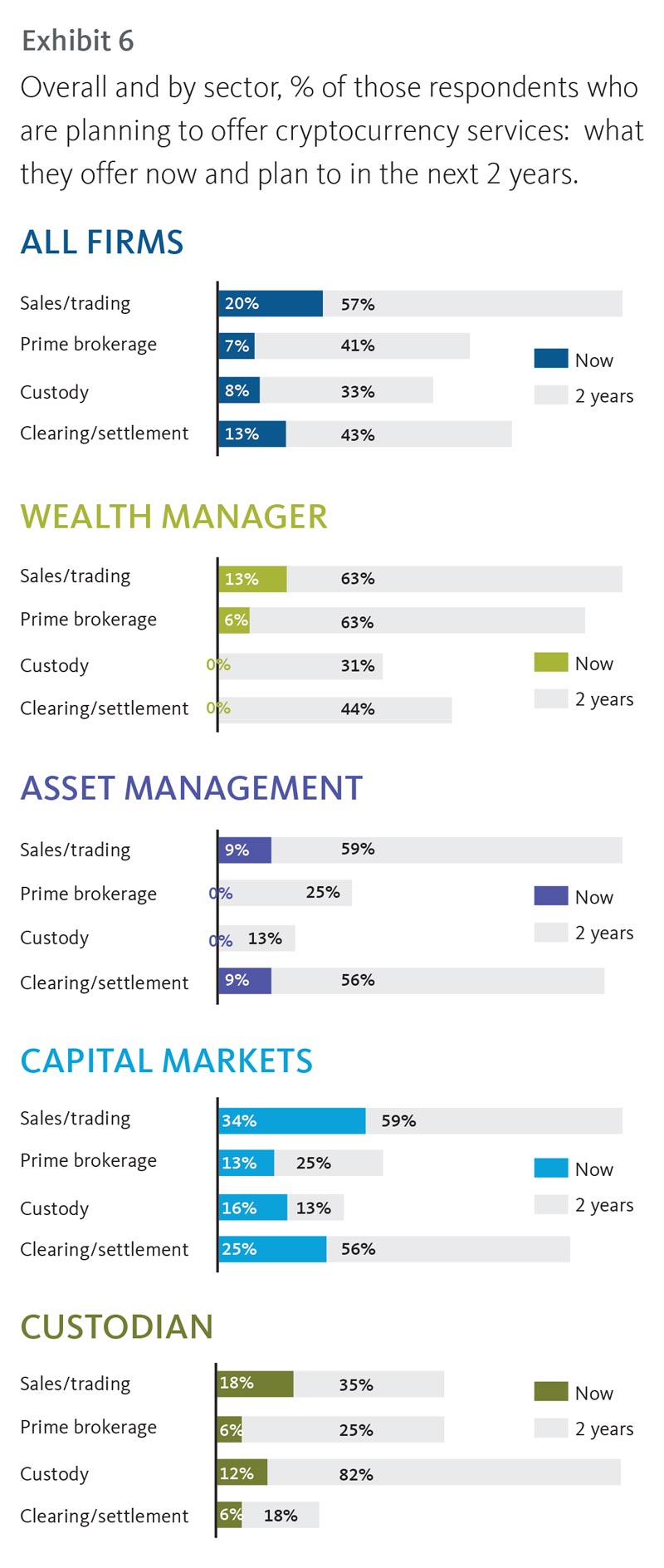

As shown in Exhibit 6, most institutional-focused cryptocurrency offerings launched in the next two years will be in sales and trading.

More than half of traditional firms describing themselves as active in the space plan to offer at least one cryptocurrency product or service within the next 24 months.

Beyond Cryptocurrencies

The most forward-thinking institutions are already starting to look beyond digital currencies and towards the digitization and tokenization of traditional asset classes. For example, global market infrastructure provider Deutsche Börse recently launched its D7 post-trade platform, which enables end-to-end digital securities processing. The new cloud-backed and DLT-ready D7 platform will allow market participants to digitize financial products with continuing access to both existing central and distributed infrastructures. The D7 platform paves the way for same-day issuance and paperless, automated straight-through processing for the entire value chain of issuance, custody, settlement, payment and asset servicing for digital securities. As of mid-2022, over 80% of German securities will be eligible for digitization via D7, representing a dramatic evolutionary step for German and European financial markets.7 Similarly, the Swiss Financial Market Supervisory Authority (FINMA) recently authorized the Swiss Digital Exchange (SDX) to go live with a fully regulated, integrated-trading settlement and custody infrastructure based on distributed ledger technology for digital securities.8

Similar developments are occurring in the US, albeit more slowly. DTCC will soon begin testing a DLT-based settlement platform designed to deliver T+0 settlement. In 2021, Paxos launched its Paxos Settlement Service, a blockchain-based bilateral settlement network for U.S. equities. Paxos has already partnered with six major broker-dealers, including ABN AMRO, Bank of America, Credit Suisse, Instinet, Société Générale and Wedbush Securities. It is now applying for full clearing agency registration with the Securities and Exchange Commission. Finally, in January 2022, the U.S. Federal Reserve Board released a discussion paper examining the potential benefits and risks of a U.S. central bank digital currency. This is a tacit signal of regulatory acceptance and a sign of what may be to come.9

Growth Drivers and Impediments

For many financial services firms, clients are leading the way on crypto. As shown in Exhibit 7, demand from clients is the No. 1 reason cited by custodian banks and wealth managers for offering cryptocurrency services. In particular, wealth managers are feeling pressure to engage in crypto to maintain relationships with clients enticed by other platforms now offering cryptocurrency trading.

As shown in Exhibit 8, institutions that have not launched cryptocurrency offerings cite regulatory concerns and cybersecurity as their main reasons for their hesitance. These are legitimate concerns. Cryptocurrencies have proven vulnerable to security breaches, with even well-known names like Crypto.com experiencing losses of millions of dollars due to security breaches. In addition, many financial services firms lack the expertise needed to develop products or even advise clients about cryptocurrencies and digital assets.

Demand from clients is the number one reason cited by custodian banks and wealth managers for offering crypto services.

Crypto Regulation

Regulatory concerns were cited by 60% of institutional respondents to the Broadridge Survey as the reason they have no current plans to offer cryptocurrency services. Although that impediment will give way as regulatory uncertainty subsides, it’s hard to predict how long the process will take.

Regulators in some of the world’s biggest markets are still in the early stages of studying crypto and putting together preliminary regulatory frameworks for the sale and trading of digital assets.

In the short term, the establishment of comprehensive regulatory regimes for digital assets will increase capital and operational costs on market participants. New rules will likely drive industry consolidation, especially involving smaller underfunded firms. Over the longer term, however, those regulations will set the foundation for a reliable market structure that provides confidence to market participants. This in turn will help to draw in a broader universe of investors, including a growing number of institutional investors. Ultimately, it could be action by regulators that propels digital assets to new levels of adoption.

Select Digital Asset Regulatory Developments

- According to Forbes, U.S. Congress has introduced no fewer than 35 bills dealing with crypto, blockchain and central bank digital currencies (CBDCs). As these bills are debated, the SEC, Commodity Futures Trading Commission and Federal Reserve have all taken independent steps to research and regulate crypto. For example, in October 2021, the SEC approved the first bitcoin futures exchange-traded fund and is reviewing more crypto ETF applications. That same month, the Biden administration called on Congress to pass legislation that limits stablecoin issuance to insured banks. In March 2022, Joe Biden signed an executive order mobilizing the U.S. federal government to create a holistic strategy for digital asset regulation that promotes innovation while enhancing protections for consumers and the global financial system. Notably, it directs the Federal Reserve to research and potentially develop a CBDC. It also instructs the Treasury Department to partner with other agencies to develop policy recommendations that address the growth of digital assets and its implications for financial markets.

- The European Union is debating its Markets in Crypto-Assets (MiCA) proposal. This would establish transparency, governance and consumer protection standards for cryptocurrencies. The legislation aims to provide a regulatory framework for digital assets for EU member states by 2025.

- As the regulatory gears grind on in the EU and U.S., other countries are taking concrete steps to establish their own regulatory frameworks for crypto. For example, Switzerland last year passed legislation designed to establish a solid legal basis for the development of crypto markets. Also in 2021, Thailand’s SEC drafted new rules around the custody of digital assets intending to strengthen investor protections, and South Korea’s Financial Transaction Reports Act required all crypto exchanges to register with the country’s Financial Services Commission. Lastly, in February 2022, India took steps toward legitimizing digital assets, announcing plans to launch a digital currency in 2023 and unveiling an official tax regime for cryptocurrencies and NFTs.

- While central banks in as many as 87 countries are exploring the possibilities of CBDCs,10 China is already actively testing a virtual yuan, and Nigeria and a few Caribbean countries are in the early stages of launching their own CBDCs. The U.S. Federal Reserve and the European Central Bank are studying the issue.

- China banned cryptocurrency transactions and bitcoin mining in 2021, and Russia has proposed a ban on mining. As a result, mining operations have migrated to other parts of the world and are increasingly being done at a lower dollar and environmental cost.

The Transformation of Securities Trading

The digitization of securities will change the roles of traditional market participants, including broker-dealers, exchanges, transfer agents, custodians, depositories and clearinghouses. In the most extreme cases, these businesses could be entirely disintermediated.

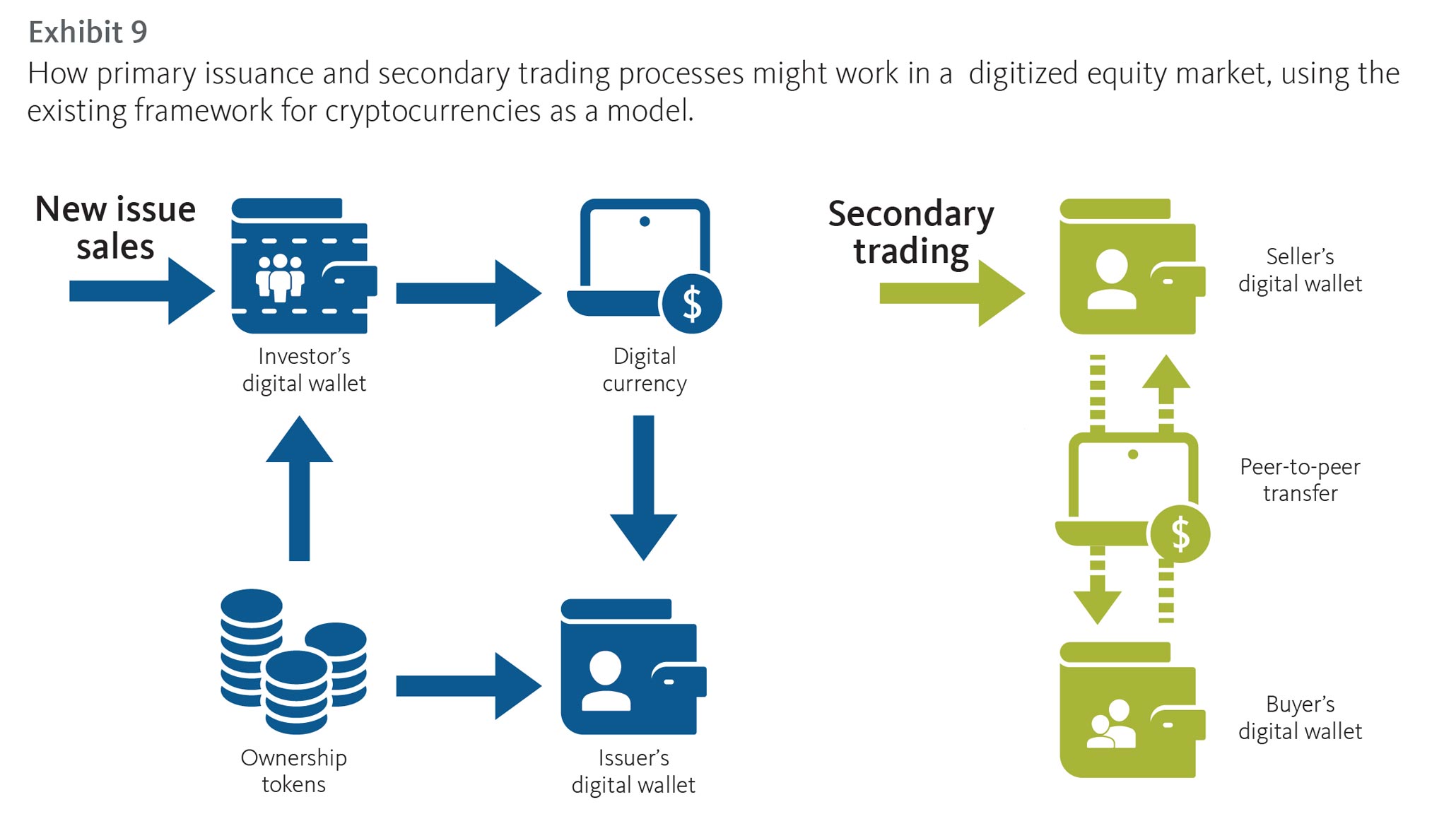

In this section, we examine how primary issuance and secondary trading processes might work in a digitized equity market, using the existing framework for cryptocurrencies as a model.

Primary Issuance

In a world of digitized assets, the initial steps in securities issuance will remain largely unchanged. Companies will engage investment banking, legal and regulatory partners to file the necessary regulatory disclosures related to the digital security offering. Investment banks and company executives will be tasked with underwriting and marketing the issuance.

A key difference will be how and to whom the initial shares are issued. It is likely that digital securities offerings will be open to a broader set of investors. This could include enthusiastic customers, key partners and other stakeholders, in addition to traditional institutional investors. The initial exchange of money for shares will be done through digital wallets on distributed ledgers. This sees the issuer transmitting tokens representing security ownership to the investors’ wallets and investors sending digital money to the wallet of the issuer.

This process creates a direct link between the issuer and the investor. The issuer has delivered a token representing ownership directly to the investor, who in turn has given the issuer capital to finance their business. There is no need for distinctions between registered shareholders and beneficial owners, although anonymous ownership could still exist. This process also does not require transfer agents and singularly focused custodians to keep diligent records of securities ownership. It is all visible on the ledger.

Secondary Markets

Once issued and sold, digital securities are held in digital wallets. Investors looking to trade a digital security would have two options: 1. Go to a centralized exchange that makes a market in the security either directly or through a broker; or 2. Go to a decentralized exchange (DEX) similar to Uniswap, which is purely peer-to-peer in nature and leverages smart contracts and liquidity pools to make markets.

Centralized exchanges hold the largest share of the market today. Liquidity, regulatory compliance, investor accessibility, and price certainty tend to be better in the centralized model. Centralized exchanges like Coinbase also play the role of custodian and broker while offering other crypto-native, value-add services. Fees are charged to customers on a per-transaction basis, with additional services (including custody) offered free of charge.

Decentralized exchanges are crypto-native platforms in which users contribute digital assets to liquidity pools in exchange for yield, thereby creating a decentralized market for the security. Despite lower fees, decentralized exchanges have struggled to gain adoption among lay users due to knowledge gaps, liquidity struggles, and a general lack of regulatory oversight. However, as user knowledge grows and development continues, decentralized exchanges may someday supplant their centralized peers. For now, centralized exchanges have the edge, but DEX volume is growing rapidly. (See “Business Booming for Centralized and Decentralized Crypto Exchanges below.)

Once an investor has chosen a medium in which to transact, the rest of the process is simple. The digital shares are exchanged for money, which could be fiat (if at a centralized exchange) or another stablecoin or cryptocurrency. The shares are now held in the investor’s wallet, and the transaction is recorded on a distributed ledger or in the custodian’s omnibus account for record-keeping.

In this model, the roles of traditional brokers, depositories, transfer agents, clearinghouses and even custodians are either merged, reduced or fully eliminated. Centralized exchanges, digital wallets and blockchains eliminate the need for a complex web of intermediaries. Trades are cleared and settled on distributed ledgers with the help of smart contracts, and ownership is easily downloadable from the ledger. Investors have custody options. Custody can be done either:

- On a segregated basis with a custodian-managed wallet service

- In an omnibus custody account managed by the custodian, or

- Through a noncustodial wallet managed directly by the investor.

Institutional trading could remain insulated from these changes, or it could be transformed by new technology. For example, technology solutions that anonymize transactions could allow institutional shareholders to trade large blocks of securities without the help of a broker while minimizing market impact or slippage. The widespread adoption of those tools would have significant implications for market makers and other intermediaries.

Business Booming for Centralized and Decentralized Crypto Exchanges

Cryptocurrency trading volumes exploded in 2021. According to data from digital asset research firm, The Block, most of that trading took place on centralized crypto exchanges, where trading volumes increased 689% to more than $14 trillion.11 By far, the largest global centralized exchange is Binance, which facilitated 67% of total volume in 2021. Decentralized exchanges (DEXs) processed roughly $1 trillion in trading volumes in 2021. Despite the smaller relative size, DEX volume grew faster, up 858% in 2021. More than threequarters of decentralized exchange activity takes place on Uniswap.12

Centralized exchanges, digital wallets and blockchains could eliminate the need for a complex web of intermediaries.

Digital Securities: Ownership and Communication Enhancements

Security tokens can include smart contracts in which shareholder rights and corporate actions are built directly into the token. Through embedded smart contracts, a security token might pay dividends, allow for profit-sharing, or designate certain voting rights. These rights can also be further securitized, allowing owners to transfer certain share rights separately from their outright ownership of the security.

Digital assets also allow for a direct relationship between investors and issuers, easing the flow of communication. These features are already on display in decentralized autonomous organizations (DAOs) and various other crypto projects in which project organizers “airdrop” digital goods to owners. For example, the creators of the Bored Ape Yacht Club (a popular NFT) have airdropped additional content and NFTs to the Ape token holders, such as the Bored Ape Kennel Club, which provides owners with a dog to match their apes. The creators of Bored Ape didn’t have to check who owned the NFTs; the wallet is a matter of public record. If you had an Ape but sold it, you wouldn’t receive the airdrop.

Although all these digital dogs and apes might seem silly, the technology represents an important new feature in the value chain of the securities industry. Moreover, these capabilities could have broad application in an era where stakeholder capitalism and investor engagement are becoming more important.

What Should Firms be Doing Today to Prepare for the age of Digital Assets?

Blockchain technology and asset digitization have the potential to upend nearly every aspect of traditional financial services. The oncoming digital asset landscape will displace at least some intermediaries and service providers, while creating lucrative new opportunities for others.

How should financial service firms prepare for this disruptive future? As a starting point, firms must understand the specific ways crypto and digital assets, in general, will alter markets and financial services and determine whether — and to what extent — those changes will affect current business lines.

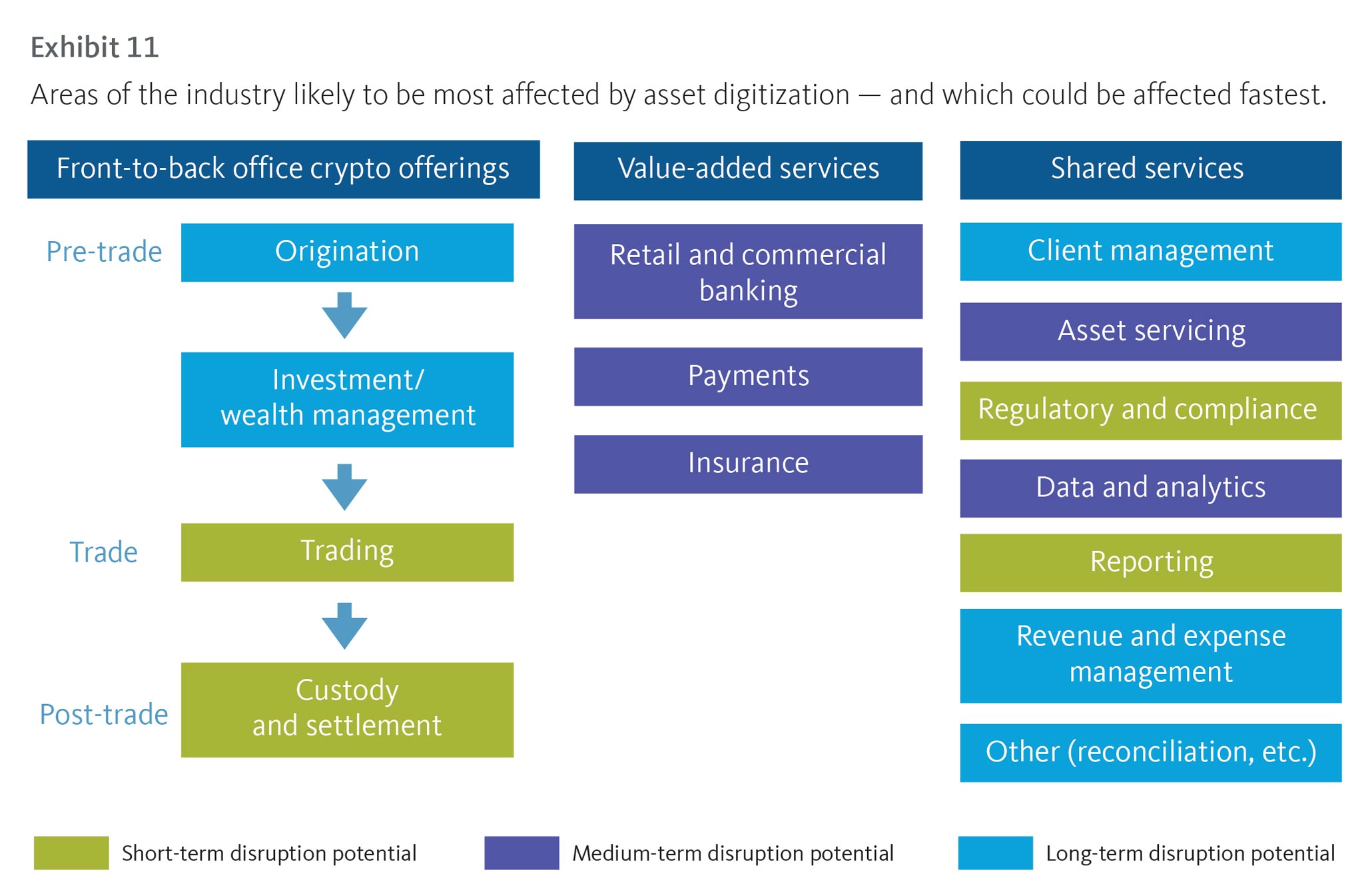

Exhibit 11 shows areas of the industry likely to be most affected by asset digitization and where the impact is most immediate.

After carefully assessing how the landscape will evolve and the amount of time available to prepare, firms must define their role(s) in the new digital market structure. In some cases, existing revenue drivers may remain essentially unchanged.

In other cases, a company might identify areas of disruption and new opportunities that require a shift in approach to preserve the core business. In the most extreme instances, firms might need to radically change course to avoid being disintermediated or to replace revenue sources at risk of major reduction or elimination.

There is still time for traditional financial services providers to adjust, although this window is closing at an accelerating pace. Despite the speed with which crypto has exploded into the marketplace, fully digitized securities markets are likely still several years away. Regulations and roles of various parties are yet to be properly defined. However, as with each innovation in the securities markets, the likely outcome will be further democratization, volume growth, and a shift towards more automated processes. It is vital that financial institutions view crypto and digital assets not as a new business line but as the next generation of their existing securities business.

In Web1 and Web2, much of the focus for financial service firms was on inward-facing investments that enhanced efficiency. Although firms across the industry did roll out customer-facing applications and launch digital products, these efforts often took a backseat to internal digital transformations that lowered costs. That focus on internal efficiency left a gap in the marketplace that was quickly exploited by fintech companies, whose valuations have soared in recent years.

Financial services firms cannot afford to take that approach with cryptocurrencies (and digital assets more broadly). The sheer disruptive potential of asset digitization requires a more fundamental and strategic review of the business model. To avoid getting sidelined, financial service firms should go back to their core value propositions and redefine their role in the emerging world of digital assets.

Start with the customer and think about the following questions.

- What differentiated services does your firm offer to customers today?

- What will those services look like in a digitized asset ecosystem?

- How will customer needs change, and how is your firm positioned to meet them?

- What new products and services will drive demand?

- What value-added functions can your company provide in this new paradigm?

Think incrementally. Your first step should be to outline a plan for getting involved in the crypto ecosystem, offering at least limited crypto services to clients. Through this process, your company will be simultaneously laying the groundwork to support the future of digital securities.

Recommendations

Broadridge recommends that financial institutions take the following key steps to prepare for the shift to digital assets:

- Start early and study the market. Companies that position themselves for the future with planning and investment will have the best chance to flourish. Conversely, firms that ignore the rising digital asset tide will be at risk of disintermediation.

- Designate and empower a point person. Recognize digital assets as a key focus area and appoint a leader to drive and legitimize the initiative within the organization.

- Identify the opportunity set. Task business heads with identifying new revenue opportunities in digital assets within their markets and customer bases.

- Prepare your business. Audit existing business lines and products to identify areas vulnerable to crypto disintermediation and create strategies to adapt revenue streams to the changing landscape.

- Partner strategically. Given the rate of change in the digital asset space and the high demand for talent, explore strategic partnerships to advance the firm’s digital asset capabilities.

- Collaborate with your peers and customers. The crypto industry is in its nascent stages, and collaboration is the best way to de-risk your exposure and gain valuable feedback.

- Learn by doing. The only way to truly understand the risks and opportunities of this complex new technology is to engage. Use crypto as a means of experimenting around what is potentially to come with the digitization of traditional asset classes.

Conclusion

Make no mistake: There will be a role for traditional financial institutions in the digital asset economy. Consumers, investors and institutions will continue to value safe and reliable intermediaries who can protect and grow their assets. Traditional finance (TradFi) firms are well positioned to bring the certainty and security of traditional securities markets to a digitized world.

To ensure their future viability, companies must act immediately. To date, only about a third of financial services companies have taken action by offering cryptocurrency products or services to their clients or creating plans to do so soon. According to Broadridge’s Crypto Adoption Survey, capital markets firms are expected to lead the way, likely driven by short-term revenue opportunities and long-term threats of disruption.

By following the lead of these early movers, financial services firms will be taking advantage of a brief window to seize on potentially massive opportunities created through asset digitization. Today, innovators are still building out the technology infrastructure that will support digital asset markets and rule makers are still creating the regulatory frameworks that will govern them. But blockchain and crypto technology is permeating markets and economies at an unprecedented pace. Regardless of how financial services executives feel about the current valuations of bitcoin, other cryptocurrencies and NFTs, they should be taking steps to understand how crypto and digital assets will change their business and turn their efforts towards preparing for a digitized future. Both the risks and opportunities are simply too large to ignore.

Footnotes

- The pseudonymous “Satoshi Nakamoto” published his seminal bitcoin white paper in 2008.

- https://blog.coinbase.com/digital-asset-policy-proposalsafeguarding-americas-financial-leadership-ce569c27d86c

- https://www.globenewswire.com/en/newsrelease/2022/01/20/2370026/0/en/Arca-Labs-Study-Finds-77-of-Capital-Market-Participants-Believe-Traditional-Securities-will-be-Digitized-in-5-10-Years.html

- https://triple-a.io/crypto-ownership/

- https://twitter.com/DeepDAO_io/status/1476540745427218432

- https://blockworks.co/report-vcs-invested-33b-in-crypto-and-blockchain-startups-in-2021/

- https://deutsche-boerse.com/dbg-en/media/press-releases/Deutsche-B-rse-launches-next-generation-digital-post-tradeplatform--2800582

- https://www.thetradenews.com/six-gains-regulatory-approval-for-digital-asset-exchange/

- https://www.federalreserve.gov/newsevents/pressreleases/other20220120a.htm

- https://www.atlanticcouncil.org/cbdctracker/

- https://www.theblockcrypto.com/linked/128526/centralizedcrypto-exchanges-14-trillion-trading-volume-2021

- https://www.theblockcrypto.com/linked/128500/decentralized-exchanges-saw-over-1-trillion-in-trading-volume-this-year

Let’s talk about what’s next for you

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Thank you.

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |