The growth in the industry has added competitive pressure on firms to deliver greater value to investors by utilizing these new services. The complexity of these networks can highlight the limitations of aging legacy systems that are no longer cost effective or fit for purpose and ultimately need replacing with newer more capable solutions that can provide that edge for firms.

Broadridge Securities Financing and Collateral Management (SFCM) has focused on connectivity for many years as it is key to providing our clients full front to back Capital Markets solutions. It has been important to our success, and in recent years we have seen it become even more integral due the markets’ expectancy for greater integration and automation. SFCM creates links with external vendors such as market utilities, clearing houses, triparty agents and custodians to provide direct access to the markets and help our clients grow their business in today’s evolving industry. Equally important are the internal links that support data flows to other critical areas of the business such as settlements, legal and accounting to name a few. One of the first principles we look at when providing connectivity for our clients is the data quality. At all times we must ensure the data quality has not been compromised and the importance of having readily available data for other systems to consume effectively for further use.

Looking at Apple as an example, they have established an ecosystem where multiple products can be sold and integrated seamlessly across other Apple products, thus creating automation across devices and user experiences that are considered second to none. If we now look at Capital Markets and focus specifically on collateral management. Market participants expect a similar experience where products can integrate, processes are automated, and data can be communicated in real-time, so users are informed and able to make key decisions. The distinction is systems supporting Capital Markets must connect to multiple external and internal sources with no common interface and the value in connectivity providing real-time market access can be a game changer for firms. It can help prevent delays in feeding data back into the core trading systems and also reduce errors such as over selling, by having a real time view of available positions and profit opportunities. It can also reduce the risk of manual errors where vast amounts of data need processing in minimal timeframes, such as mobilizing collateral through the SWIFT network and settlement within short timeframes at custody and triparty agents.

Collateral management has evolved considerably in recent years, with some firms moving the function away from the operations department. It should be seen as a primary function and integrated across the clients’ ecosystem in order to deliver value across the business. Following recent innovative advances in technology we have seen a surge in automation while simultaneously reducing the burden and risks around manual processes. Feeding data through a clients’ ecosystem can be complex when dealing with multiple external and internal systems all behaving very differently. There may be fragmented data, limited data views, unconventional formats and availability at different times of the day. When we have data coming from different sources then tools may be required to help process the data, in a set order and into a consolidated format to add further control, ensuring no loss of productivity.

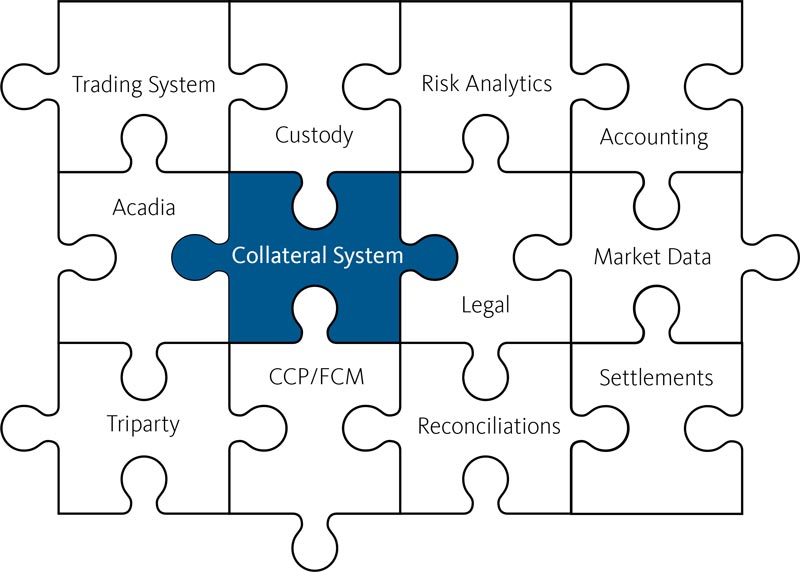

We continuously work with clients to help establish an efficient ecosystem where connectivity between systems is critical when supporting the daily activities and data flows across networks. The feed and control of new or amended data from legal systems to capture collateral agreements, information between investor departments or downstream settlement systems where data is fed between systems to notify of fails, and accounting to capture movements for record-keeping are just some of the essential pieces of the jigsaw we look at when delivering value to our clients. By having the links across the business and seamless integration to our securities finance platform we have seen clients benefit hugely from centralizing inventory management for trading and collateral activities where users are actively delivering increased value to their business.

The value in connectivity also comes in the form of creating networks with market utilities, third party vendors, clearing houses, triparty agents and custodians for a full front to back securities financing solution. The industry has taken positive steps towards standardization in recent years through various initiatives by ISDA, such as the Common Domain Model (CDM), the ISDA Standard Initial Margin Model (SIMM), digitization and smart contracts to name the higher profile areas. For the industry to achieve greater automation and sophistication in the collateral space we must seek further standardization in key areas and adopt these new initiatives into everyday practices.

One of these important areas where connectivity is critical in maintaining efficiency and automation across the industry, is in derivatives clearing. Volumes have risen significantly in recent years with mandatory clearing and Uncleared Margin Rules (UMR) set by the regulators as part of the global reform. Despite the increasing demand for derivatives clearing there is still a lack of standardization across the clearing houses. Investors need a clear view of the margin and collateral data produced daily so they are able to manage their exposures and mobilize collateral effectively. However, each clearing house and FCM produce different data sets which results in fragmentation across the industry and the need to separately interface to each clearing house; something that can be costly to maintain. At Broadridge, we support direct connectivity to global clearing houses and FCM’s to feed harmonized data into SFCM’s collateral management system. The connectivity removes the need for clients to have multiple interfaces to clearing houses and reduces the risk around data quality. Investors have an holistic view of margin and collateral across the entire derivatives clearing business and are able to rapidly mobilize eligible collateral in response to the margin call demands.

Over the years the industry has seen the increasing value in connectivity and more so in the collateral space where there are high levels of automation and sophistication available to deliver more advanced capabilities to firms. We expect to see a continued increase in demand for connectivity over the coming years as we see more and more innovation within the Capital Markets industry. Connectivity plays a key role in providing any business with a secure, stable and cost-effective ecosystem where the business can be scaled across global jurisdictions and operational 24/7 in some cases. This leads to greater opportunities for the business to grow and adapt to these challenging times ahead as we all look forward to leaving the global pandemic behind us.