Extended Overnight Trading: Opportunities and Considerations

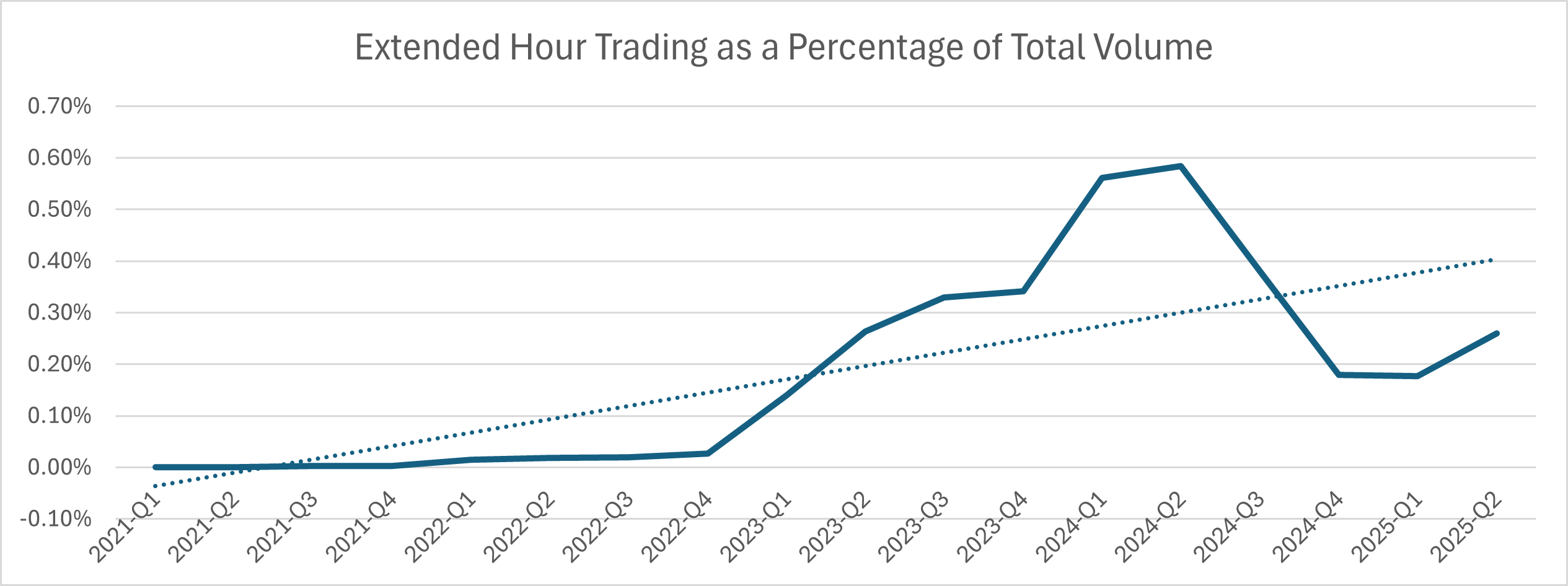

Overnight extended-hours trading, trading between 8:00PM and 4:00 AM (Eastern) is still a relatively small component of the overall daily equity trading activity. (Extended Trading Hour volume is estimated to be 26 bps of total volume in Aug 2025). However, notional volumes have been steadily increasing, led primarily by retail investors and participation from Asian markets.

The trading activity from APAC offers current opportunities for global firms looking to expand their footprint in these segments.

At present institutional investors remain on the sidelines. The introduction of the exchanges into the extended hour market, and the market transparency that will be provided by the SIPs will lead to increased institutional engagement, improving depth of the market and liquidity, and reducing volatility.

Operational Challenges

Extended trading hours bring a distinct set of challenges. Firms must ensure sufficient staffing to support overnight operations. Compliance departments must consider system enhancements and staffing required to adequately surveil overnight trading activity.

The compressed window between market closure and reopening introduces challenges in running core processes and producing the data necessary to support overnight order validation. Position and balance data that is typically calculated in overnight batch cycles must be available at 8:00PM to calculate buying power and support order validation algorithms.

Firms must also consider the infrastructure and processing changes required for real time trade reporting.

The NSCC’s move to 24x5 operation in June 2026 also provides an opportunity for risk mitigation. Clearing brokers operating in QSR/CC arrangements can lock in counterparties in real time, reducing counterparty risk exposure. Firms should consider taking advantage of the matching and novation provided by the NSCC in the overnight timeframes.

Conclusion

The evolving landscape in extended and overnight trading presents strategic growth opportunities for early movers.

- Wealth firms with online offerings have an opportunity for increased client capture as this market evolves

- Institutional firms should ensure they are able to service this market as the exchanges come online.

These opportunities come with operational and systems challenges firms must begin to address now to position themselves to take advantage of the new market structure.

What's next for your business?

We want to hear more about what you need to improve your business and drive transformative innovation, efficiency, and growth.