As Consumer Duty nears its second anniversary, asset managers’ grievances have become louder and the industry is collectively asking: ‘can we streamline and reduce overlaps, align the rules for AFMs, and deliver proportionate and clear reporting to the various stakeholders in the fund distribution chain?’

Assessment of Value Reporting and Consumer Duty – Complexity to Clarity

In June 2025, the Financial Conduct Authority’s (FCA) Quarterly Consultation Paper 25/16 (CP), acknowledged that it was time to review the requirements and level the playing field between Consumer Duty and the Assessment of Value (AoV) rules under the Collective Investment Schemes sourcebook (COLL).

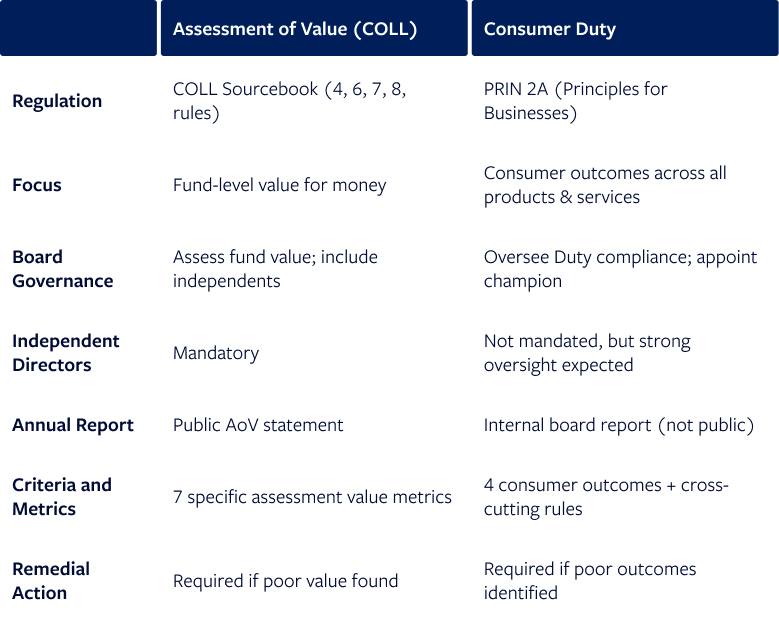

The two regulations were introduced at different times to address very different and specific challenges. Following the conclusions of the Asset Management Market Study, Assessment of Value regulations were introduced in 2019 to increase competition and enhance transparent pricing between asset managers and investors. Consumer Duty (initially only covering open-end products in July 2023, with the introduction of regulation covering closed-end products coming later, in July 2024), was introduced to provide a principles-based framework for the evaluation of delivery of good outcomes to retail customers across asset management, banking, and insurance services.

Although both regulations concerned value for money, the detailed AoV assessment rules go beyond the FCA’s principle-and-outcome-based Consumer Duty requirements, creating an uneven playing field and duplicity for asset managers distributing UK-authorised funds. This mismatch burdens asset managers with the unenviable task of retrofitting parallel management information.

The two regulations diverge further, insofar as Consumer Duty extends to all UK market participants proportionately in the distribution chain, irrespective of the fund’s origins, while AoV rules only apply to UK-Authorised funds: creating an uneven playing field between UK and non-UK Authorised Fund Managers (AFMs).

As Consumer Duty nears its second anniversary, asset managers’ grievances have become louder and the industry is collectively asking: ‘can we streamline and reduce overlaps, align the rules for AFMs, and deliver proportionate and clear reporting to the various stakeholders in the fund distribution chain?’

The consultation paper proposed to reduce and simplify many of the detailed reporting requirements and replace them with a general requirement that AFMs include a summary of the AoV in their annual financial reports, and by doing so provide greater flexibility to AFMs over what they publish, share, and how they comply.

Below we explore the efficacy of these requirements and assess and discuss where they could be clarified while keeping the overall reporting reasonable and manageable – without diluting oversight or investor protection.

Efficacy of the Regulations:

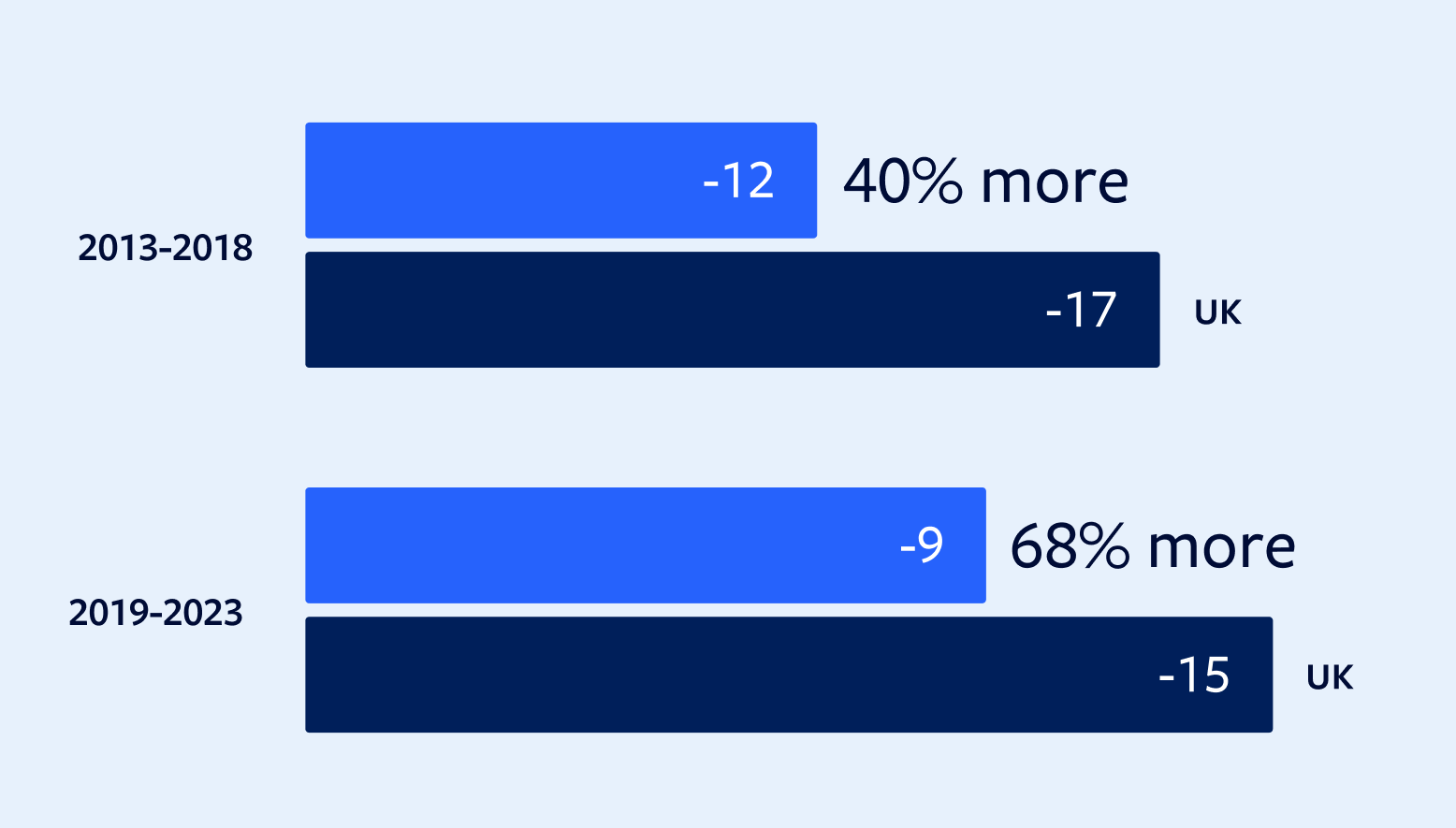

With more than five years of AoV, we can now measure its impact and efficacy on UK funds’ fees by comparing the periods immediately before and after the September 2019 launch of the Assessment of Value framework.

In a Broadridge Global Pricing Intelligence fee study, we observed that UK-domiciled funds saw average fees fall 68%* more than their closest competitors’ fee fall between 2019 and 2023, compared to a 40%* fall for the previous five years to 2018. The rate of UK fee compression post-2019 significantly exceeded its closest competitor markets in Luxembourg, Ireland, and the US.

While economic and market forces played a role, AoV’s requirements for transparent fund fees and value benchmarking have clearly demonstrated the impact enhanced regulatory measures in the UK have had on fee compression relative to other regions.

The transparency also enables the attention and scrutiny on value delivery from investors and industry media, shining an important spotlight on asset managers’ ability to deliver value for money.

Rationalising The Value-Duty Gap:

Having established that the AoV regulation has delivered on its objectives, and is here to stay, let’s focus on some of the key challenges faced by asset managers when implementing the requirements of Consumer Duty and Assessment of Value.

- Alignment: Mapping guidelines of common elements by the regulators eliminates duplicate assessments. AoV’s seven value criteria align closely with Consumer Duty’s outcomes and therefore there is a strong case to map common elements and reduce duplicity across these two regulations. For example, Consumer Duty’s price and value outcome shares similarities with AoV’s comparable market rates, management fee costs, performance, economies of scale, and comparable services.

- Assessment Periods: Harmonising assessment periods improves comparability of management information.

AoV requires managers to review performance over an appropriate timescale in accordance with a fund’s investment objectives; with the current practice being one, three, five, and/or 10-year historical period. Conversely, Consumer Duty assesses funds over the product lifecycle (historical and future). Harmonising both the assessment periods and the metrics to evaluate lifecycle value consistently across both regulations improves comparability. - Stakeholders: Equivalent standards and duty of care across the distribution chain drive collective accountability.

AoV rules apply to AFMs, but not to distributors and platforms, whereas Consumer Duty care extends across all market participants proportionately i.e. AFMs, distributors, financial advisers, platforms, and retail investors (including vulnerable customers). When distributing similar products, equivalent standards and proportionate duty of care from all market participants is important to ensure collective accountability. - Publishing: Proposals in Consultation Paper 25/16 to replace the publishing of annual AoV statement with AoV summaries would reduce costs but weaken investor scrutiny.

AoV mandates AFMs to publish an annual AoV statement, while Consumer Duty requires only an internal board report. Despite the FCA’s intentions to simplify and reduce reporting, the proposal in the consultation paper may lead to inconsistent disclosures and formats across firms, while increasing governance burdens on fund boards in determining what constitutes ‘sufficient’ reporting. It will also make it much harder for distributors and investors to evaluate if specific funds are delivering value, and for the media to scrutinise and challenge managers when funds don’t deliver value. - Board Independence: Harmonising board independence and governance standards and requirements ensures consistent oversight and value delivery.

For AFMs, AoV requires two independent directors or 25% of an independent board – whichever is higher – while Consumer Duty has no similar governance thresholds. Ensuring there is an equivalent level of independence, and standards are consistent across these two regulations will deliver an unbiased oversight that is consistent and comparable for investors. - Offshore asset managers: Funds distributed to UK investors should have the same duty of care irrespective of where they are domiciled.

Interestingly, a number of offshore managers are bridging this particular information gap by adopting an independently verified ‘AoV-light’ methodology: in doing so providing their fund boards, distributors, and investors with a consistent value for money methodology regardless of where the funds are sold.

Complexity to Clarity

Assessment of Value under Collective Investment Scheme (4, 6, 7, 8 rules) provides for an annual assessment of each scheme it manages, scrutinising whether the payments out of the scheme set out in the prospectus are justified within the context of the overall value delivered by AFMs, whereas Consumer Duty under Principles of Business (PRIN 12, 2A) sets broad principle-based standards to all market participants in the distribution chain to ensure good customer outcomes.

In the FCA’s Consultation Paper 25/16, the FCA proposes to simplify COLL’s AoV reporting requirements by replacing the annual AoV statement with an AoV summary disclosure in the annual report. Beyond this prescribed disclosure, it will be for the AFMs to decide how much information to include and best match the information needs of their distributors and investors.

For asset managers already grappling with industry headwinds, market volatility, and complex compliance demands, these reforms offer a welcome relief. However, as both COLL and Consumer Duty continue to demand a demonstrable duty of care and value for money services, the FCA must also take this consultation opportunity to address the other inherent challenges and complexities, and where possible provide further clarity on rationalising requirements, harmonising board governance standards, aligning assessment periods, and levelling the playing field between onshore and offshore managers.

Rationalising and simplifying non-value-added requirements, while clarifying guidance through best practice implementation guidelines, will bring collective accountability and serve as a much needed tonic to boost the UK domiciled fund management industry, which reached $2.4trn* (£1.7trn) in AUM in June 2025 for mutual and hedge funds ($2.8trn (£2.1trn) including investment trust, pension and insurance funds): underpinning the UK’s global leadership and aspirations for future growth.

*Data Sources: Broadridge’s Global Market Intelligence and Global Pricing Intelligence

The article was published in Funds Europe on 26 September 2025.

Discover what’s next

Discuss the ways our solutions can advance your business.