ESG-related Litigation: British American Tobacco

The Class Action Case Files

Portfolio monitoring and asset recovery of growing global securities class actions can be daunting.

Broadridge can help simplify the complex

Just the Facts:

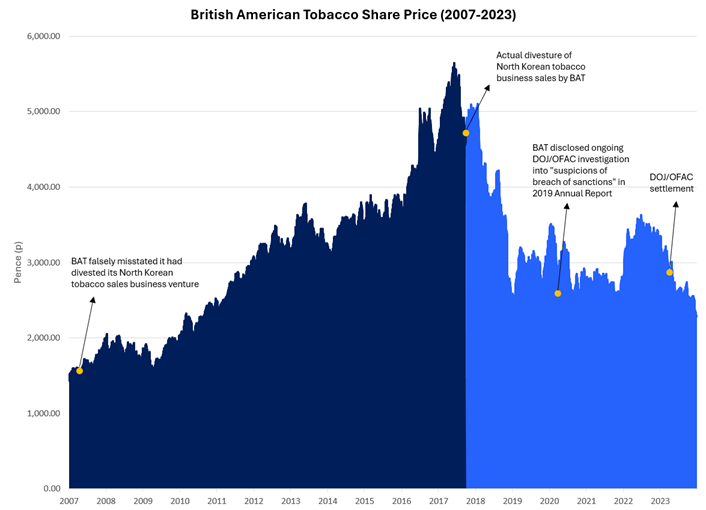

British American Tobacco plc (BAT) (LSE: BATS; JSE: BTI) is a London-based company founded in 1902 that manufactures and sells cigarettes and other tobacco and nicotine products. In April 2023, the U.S. Department of Justice (“DOJ”) accused BAT of violating U.S. bank fraud and sanctions laws (including the Weapons of Mass Destruction Proliferators Sanctions Regulations) by conducting business with North Korea through a network of front companies in Singapore and China. These alleged ESG-related corporate governances, compliance oversights, risk managements, and sanction breaches facilitated hundreds of millions of dollars in transactions that allegedly supported North Korea’s weapons programs. BAT and its subsidiary entered into a Deferred Prosecution Agreement (“DPA”) on April 25, 2023, and agreed to pay $629 million in combined penalties and fines to resolve the criminal charges with the DOJ and related civil enforcement by the U.S. Department of the Treasury’s Office of Foreign Assets Control (“OFAC”), marking the largest-ever settlement between OFAC and a non-financial institution.1

The day the $629 million settlement was announced, BAT’s share price began a downward drop that continued for several months. BAT’s share price also suffered several significant drops prior to this, including a 3.3% drop on April 14, 2020, and a 6.6% drop on July 28, 2022.

In light of this scandal, several leading law firms intend to bring claims in the UK under the Financial Services and Markets Act 2000, which provides statutory liability and redress in circumstances involving false or misleading statements, omissions, or delays made to the market. Investors who traded BAT securities during the relevant period when BAT allegedly misled the investing public about its North Korean business operations and related disclosures may be eligible to join such claims.

In speaking with Broadridge, Andrew Hill of Fox Williams, whose firm is preparing to file a claim on behalf of BAT investors, shared that “According to the OFAC settlement agreements, BAT appears to have gone to extraordinary lengths to actively engage in business with North Korea, in flagrant breach of the US sanctions regime. This appears to demonstrate BAT’s clear disregard for the company’s own corporate governance and compliance standards and a reckless disregard as to the potential financial and reputational consequences of such misconduct.”

“The egregiousness of BAT’s conduct has clearly been recognised by the U.S. authorities, given the size of the combined penalties, and by the market. We hope that this, together with the Fox Williams claimant group’s securities litigation will also have a “chilling effect” on any further corporate misconduct of this kind at BAT and among public companies more widely.”

These claims arise amid the much-anticipated UK Civil Justice Council’s (“CJC”) final report and recommendations to Parliament following the Supreme Court’s contentious PACCAR verdict, which sent shockwaves through the litigation finance industry by potentially impacting many existing funding agreements entered into by institutional investors, as discussed in our coverage of the decision, PACCAR: Implications for Institutional Investors.2

The CJC’s recommendations strongly support the litigation finance industry and collective redress actions by recommending that the government reverse the PACCAR verdict via legislation and enact “light-touch” statutory regulation to the third-party litigation funding market.3 While Parliament has not yet acted, it is evident that the CJC and the litigation funding industry are aligned, and further developments are anticipated. Helpfully, Andrew Hill of Fox Williams has confirmed that the Fox Williams structure (DBA between the firm and investors) is not impacted by the PACCAR verdict.

If you invested in BAT during the relevant period, it is crucial to act swiftly to protect your rights as the limitation period for claims may soon expire. Contact Broadridge today for a confidential assessment and guidance on your potential claim. Don’t miss your opportunity to seek redress. Act now to preserve your interests.

Case Challenges

UK OPT-IN LITIGATION

As part of the UK’s opt-in litigation mechanism, if an investor wishes to participate in one of these actions, it must proactively join the litigation from the outset. Claimants will be required to liaise directly with a law firm and litigation funder, and the process can be longer and more involved. Further, there are multiple cases that could proceed on parallel tracks. In order to weigh their various options, claimants must understand the differences between the cases, legal theories, damage calculations, and potential outcomes. They must also understand how their trading patterns may impact their losses, which requires a detailed individual review. Finally, the various firms and funders may have different or preferable contractual terms.

ENGLISH LAW AND CLAIM FILING

As part of the UK’s opt-in litigation mechanism, an investor must proactively join the litigation before the case is filed in Court via a process known as “opting in.” Depending on the particular claim(s) being pursued, claimants may also be required to demonstrate “reliance” as part of their claim, and further, the claimant’s identity may be discoverable as interested parties may access the list of claimants on petition to the Court. Thus, to weigh the various options, claimants must fully understand the differences between the cases and any specific requirements for bringing a claim.

LITIGATION COSTS

Participating in an opt-in litigation may involve additional costs and additional contractual relationships. Unlike a U.S. class action, each potential claimant is treated separately, and each individual case has its own funding and paperwork requirements. Typically, there are fees associated with filing in these matters. Funding agreements and costs will differ depending on the case, the law firm, and the litigation funder.

DOCUMENTATION REQUIRED

Registration in an opt-in proceeding often requires all investors to submit supporting documentation to prove their claim in advance of settlement. Other documentation usually requested is corporate information proving legal entity status. Failure to provide adequate supporting documentation may lead to an incomplete registration. Institutions that had many relevant transactions, for example, will need significant planning and clean preparation of work to prove their claims and maximize recovery.

OLD RELEVANT PERIOD

Most financial institutions and individuals typically keep copies of statements, broker confirmations, and house data relating to their accounts for seven years. Here, the relevant period began 16 years prior. Consequently, it may be difficult for potential claimants to (a) provide transaction information beyond seven years, and (b) provide all required supporting documentation.

Each year billions of dollars are being left on the table.

Find the right advocate who can help you maximize recoveries.

1 See Press Release, U.S. Dep’t of Just., U.S. Obtains $629 Million Settlement with British American Tobacco to Resolve Illegal Sales to North Korea, Charges Facilitators in Illicit Tobacco Trade, (April 25, 2023), https://www.justice.gov/archives/opa/pr/united-states-obtains-629-million-settlement-british-american-tobacco-resolve-illegal-sales.

2 See PACCAR: Implications for Institutional Investors, /article/wealth-management/paccar-implications-for-institutional-investors.