Asset Manager Harnesses Timely Market Share Data to Enable Sales

Unleashing opportunity with the most comprehensive market share data in the industry

Business Challenge

A leading asset manager wanted to refine its approach to measuring opportunity and market share within the intermediary-sold competitive landscape. The manager has products across active and passive mutual funds, money market funds, and ETFs, and sought a single comprehensive data and analytics solution to satisfy all its sales enablement needs. In addition to the broad product scope, the manager sought a total market picture, increased frequency of data, improved timeliness of data, and to eliminate expensive internal data management.

“Much of the market momentum is moving into ETFs. We know we’re using the best source because Broadridge is at the leading edge of creating the most timely and comprehensive analytics to identify where money is flowing.”

The Solution

The asset manager chose Broadridge Market Analytics as its new source for calculating intermediary-sold market share and opportunity with the following advantages:

- Category- and branch-level detail encompasses more investment vehicles, including mutual funds, ETFs, and money markets

- Upgrading from quarterly to monthly reporting capabilities, allowing wholesalers to react more quickly to market changes

- Dynamic, customizable analytics are delivered without requiring internal resources to collect, curate, and submit raw data

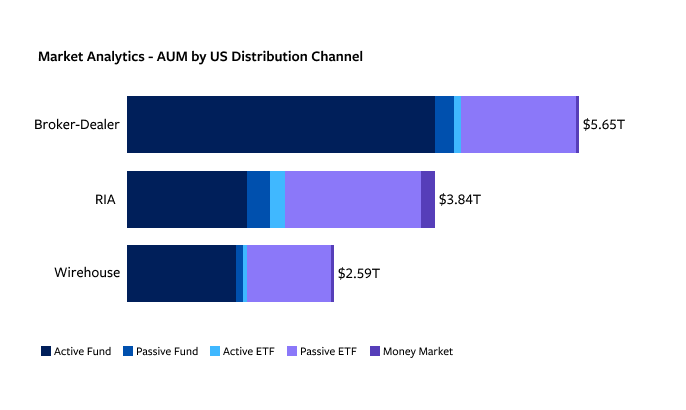

- A comprehensive view of financial intermediary sales, providing visibility into more than $12 trillion of AUM sold across the Broker-Dealer, RIA, and Wirehouse channels

The Process

The Broadridge service team collaborated closely with the client to:

- Design custom dashboard visualizations

- Define and implement client-specific channels and territories

- Create customized, timely reporting for the sales team including:

- Market share reports at the channel, territory, firm, office, and asset-class level

- Prioritized branch listings by territory including AUM, net flows, and market share

- Trend reports by Morningstar category

- Focus firm reporting in client-defined channels

The dedicated service team at Broadridge provided prompt customer assistance with reporting requests or questions. Our proactive approach includes regular check-ins and training sessions, fostering a strong partnership between Broadridge and its clients.

“We feel like we're anchored to the right data and analytics to really size the market, and to ensure that our wholesalers can target the best opportunities.”

The Result

By implementing Market Analytics, the firm was able to:

- Refine market share measurement. Having the most comprehensive dataset provides more accurate and timelier insights. Market Analytics empowers users to analyze intermediary-sold flows and asset positions and how they are trending by channel, firm, location, and asset category on a monthly basis.

- Set sales strategy. The client uses Market Analytics tactically to target underpenetrated locations where they should have a higher market share. Wholesalers have greater confidence knowing they are using timely and comprehensive data to target opportunities. Market Analytics also helps identify money on the sidelines through its comprehensive money market reporting capabilities, a valuable key input that isn’t consistently available anywhere else.

- Optimize and design wholesaler territories. Market Analytics helps sales management optimize wholesaler territory coverage so that wholesalers have viable and robust opportunities to raise money.

- Align compensation with performance. The Market Analytics data set provides greater confidence when evaluating a wholesaler’s effectiveness. Leadership can leverage these insights to set specific elements of compensation.

In Summary

The asset manager faced challenges in accurately measuring the competitive landscape of the intermediary-sold fund market. The existing methods were not providing the complete picture. They turned to Broadridge for the Market Analytics solution, which offers a more comprehensive dataset with a total assets picture of over $12 trillion and monthly data updates, allowing quicker responses to market changes. The Broadridge service team worked closely with the client to enhance and create customized, timely reporting. As a result, the client was able to measure market share more accurately, optimize wholesaler territories, and align compensation with performance.

To stay up to date on our latest research, powerful analytics products, and advisory services, become a Distribution Insights subscriber at distributioninsight.broadridge.com.

Let’s talk about what’s next for you

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Thank you.

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |