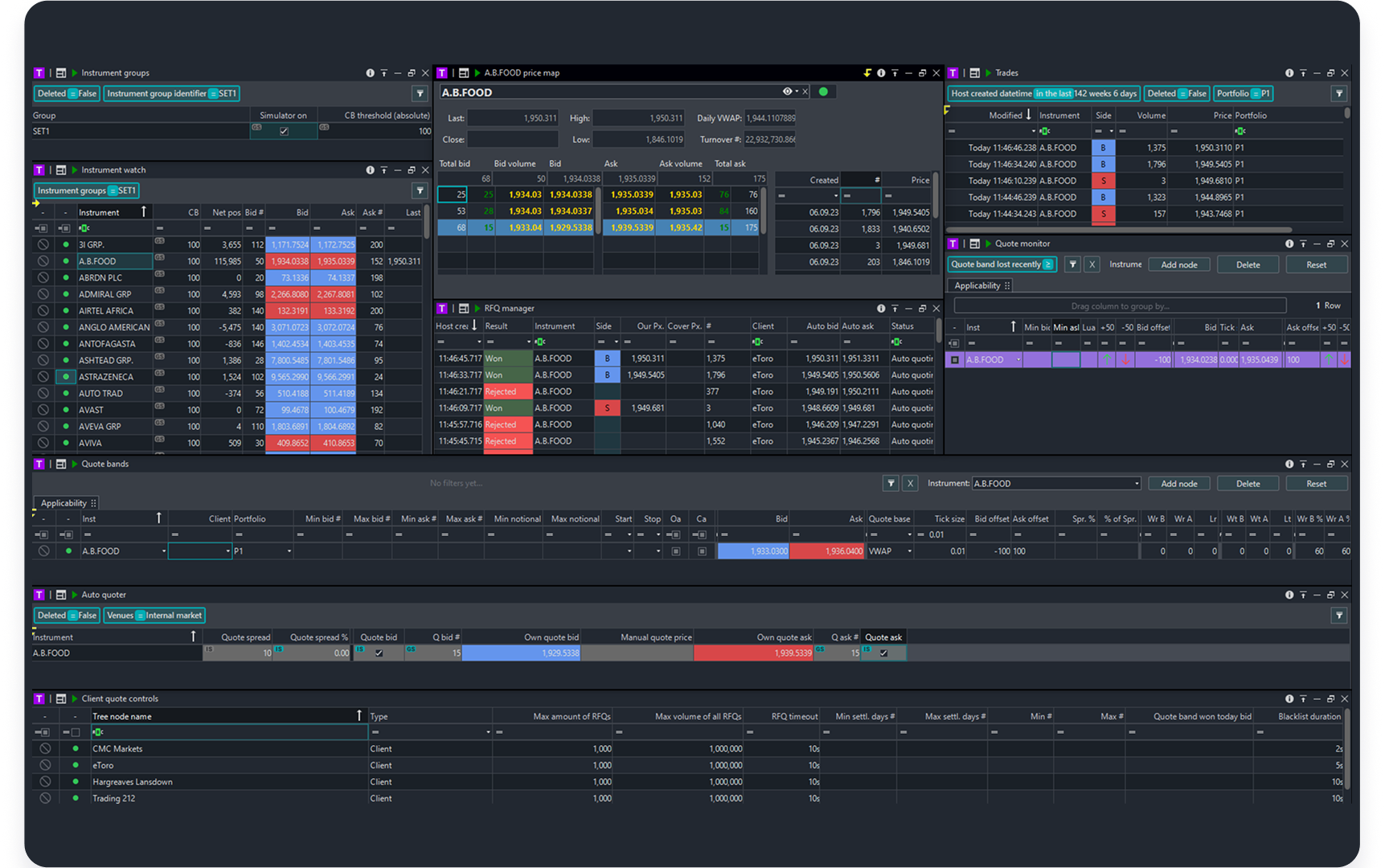

Our integrated platform, Tbricks, unites ETF pricing, composition management, hedging, market making & RFQ management and Internalization - in one scalable, automated environment. Engineered for speed, transparency, and control across assets, Broadridge helps trading desks optimize spreads, enhance execution efficiency, and manage risk with confidence in every market condition.

The platform that makes markets better

Performance. Agility. Scale. Broadridge powers the outcomes that define successful ETF market making.

Core ETF Market Making capabilities

Deliver accurate, consistent pricing across every asset class with built‑in scalability and flexibility.

- Extensive and customizable rule‑based proxy pricing for ETFs and individual constituents — including equity, fixed income and commodities

- Horizontal‑scaling infrastructure to manage high‑volume pricing demands

- Use Broadridge’s pricing models, your own, or integrate direct market price streams

Maintain full control and transparency over ETF compositions with automated data validation and workflow flexibility.

- Creation, redemption, and basket tracking support

- Powerful NAV and composition comparison from multiple sources with exception‑based workflows

- Real‑time iNAV impact analysis for tighter pricing control

- Direct integration with S&P Global and Ultumus plus file and database connectivity

Streamline exposure management and hedge with precision across currencies and asset classes.

- Real‑time position decomposition and netting for efficient hedging

- Aggregate or selective FX exposure management

- Extend or create your own hedging logic

Automate liquidity provision and price discovery with precision‑controlled, scalable market‑making infrastructure.

- Full‑support framework for continuous ETF market making

- Fully automated RFQ workflows with extensive venue connectivity

- Granular quote‑price control to include counterparty commissions and venue fees

- Highly scalable, co‑locatable infrastructure designed for low‑latency, mass quoting

Streamline execution workflows by seamlessly connecting internal liquidity, external venues, and automated RFQ handling for faster, more efficient, and controlled trading.

- Direct integration with Broadridge’s Systematic Internaliser (SI) architecture

- Initiate simultaneous back‑to‑back RFQs to internal desks or panels of market makers for riskless principal transactions

- Automate mark‑ups and RFQ/RFT handling using a flexible scripting language

Tbricks platform at a glance

-

Systematic trading, Market making, spreading, internalization, and more

-

Futures, Options, ETFs, Structured Products, Equities, FX and Fixed-income

-

Electronic quoting, Block trading, RFQ negotiation, Tiered pricing and more

-

150+ exchanges supported across three continents

-

Unrivalled broker network and data providers integration

-

100+ major clients including global tier 1 banks and sophisticated buy-side firms

-

Complete pricing, risk and execution solution

-

Fully hosted in co-location, managed or on-premise

-

Low latency and high-performance architecture

-

Microservice architecture supporting modular extension

-

App-based business solutions with source code

-

Build your own apps, extend ours, or let us implement

Related solutions

What's next for your business?

We want to hear more about what you need to improve your business and drive transformative innovation, efficiency, and growth.