What's Your Financial Wellness Score?

Our lives are measured by scores—from SAT to credit to sleep scores. Even our cholesterol is put to the test. So how is it our financial health and security is unilaterally judged by how much money we’ve amassed? Certainly, there are financial scores for risk and diversification. But those can’t accurately measure the underlying indicators of one’s overall financial wellbeing.

In wealth management, the average advisor-based client relationship is graded not by one’s overall financial stability but by assets under management, or AUM. Yet AUM as a measurement or driver of one’s financial wellbeing is antiquated and ineffective. This is because it’s detracted by a primary focus on investments as opposed to a more holistic view of a client’s wallet share, including their assets and liabilities.

We only get a probability-of-success metric against one’s goal, or at least a concept of one, from advisors and investors who are more advice oriented, or who have financial plans in place. But those represent only about 33 percent of Americans, according to a recent Schwab Modern Wealth Survey1. Certainly, a financial plan metric comes close to helping investors understand the likelihood for achieving their individual financial goals. But a metric charting whether or not you’re on track to meet your financial goals for, say, funding your child’s college education or your own retirement, is singular in nature and can’t fully capture the overall progression and essence of the current state of your financial wellbeing. That is to say, financial wellness is not a one-stop destination. Instead, it’s a journey—one that’s winding and dynamic. And one that needs continual assessment and adjustment to maintain course.

Reinventing the Score

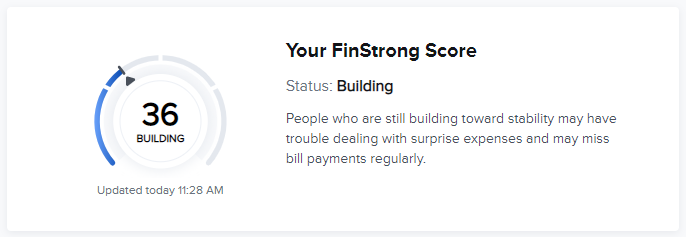

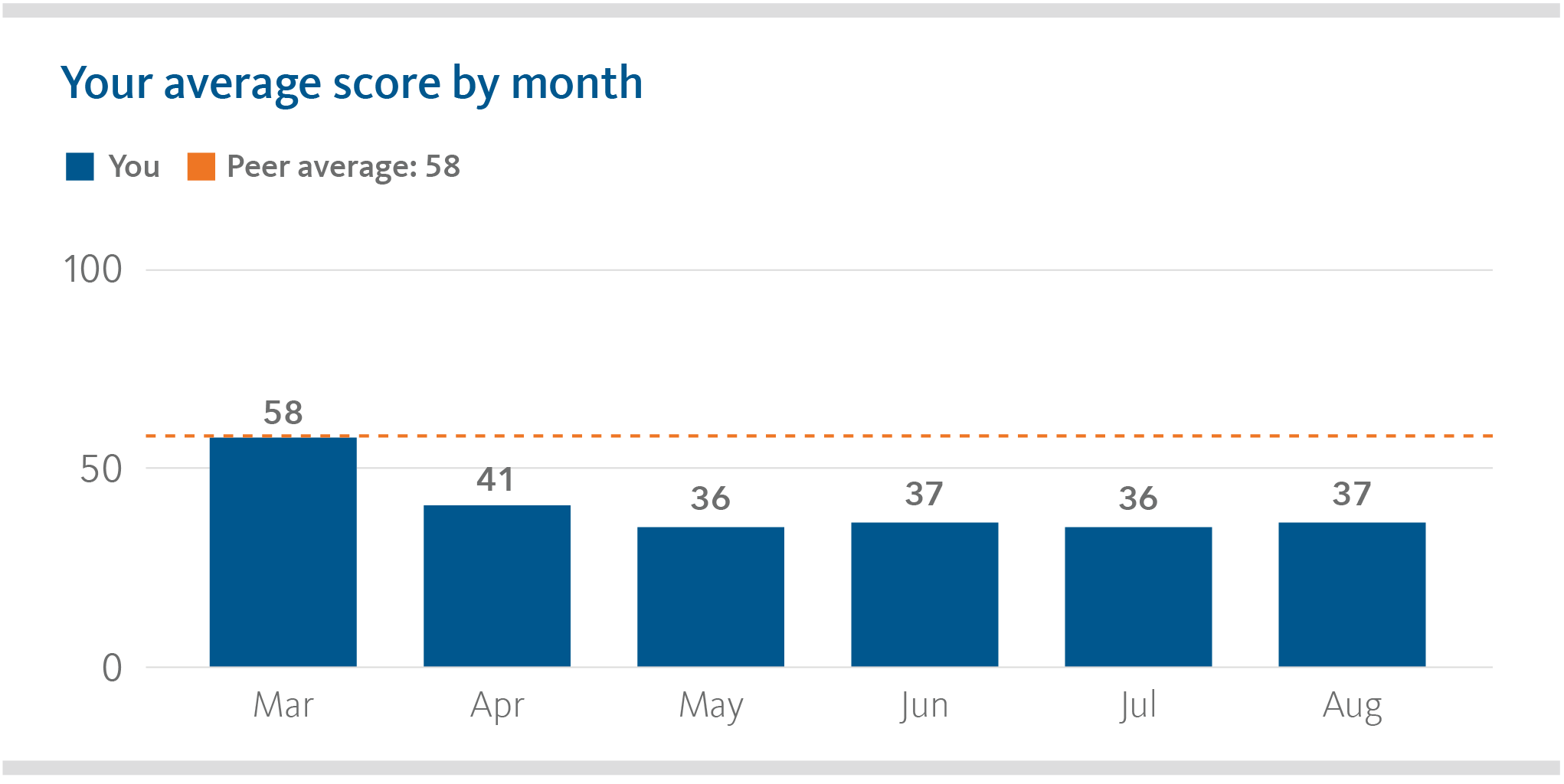

To accomplish this, we need a simple measurement or score that can help anyone determine their current financial strength relative to their income, spending and life stage. This score should account for one’s age, dependents, employment situation, savings accumulation, debt and spending behaviors. But a score with no context or perspective is still irrelevant. It needs to also reference a viable group or a comparable demographic to see if that individual is on pace, ahead of the game, or trailing behind.

Getting a score like this isn’t a new concept, but one that has traditionally required an investor to take on their own initiative and is often based on the results of a questionnaire. For instance, the Consumer Financial Protection Bureau offers a no-cost, 10-question assessment to gauge how people feel about their financial security and freedom2.

At Broadridge, we believe that a true financial score can only be derived by unlocking the power of data. From there, you uncover the financial insights you need to create an individualized, quantitative score—one that’s calculated using a proprietary algorithm able to identify multiple factors, like whether you’re spending more than you earn and/or if you’re paying bills on time. And one that involves a gamified experience to keep interest strong. These features provide an investor with a simple and easy-to-understand score and thematic definition of where they are financially versus complicated rate of return calculations across various statements.

We also want investors to have a visual comparative ranking to clearly depict their progress against a comparable peer group. This will help them see where they stand relative to others in the same age bracket, income level and lifestyle demographic, and serves to act as a social driver to promote positive change.

Unify and Visualize for More Actionable Insights

A secure and reliable open finance platform makes these capabilities possible, giving investors the ability to consolidate all their accounts within one online dashboard that uses the latest tokenized technology to mitigate breaks in passwords and multi-factor authentication. By leveraging direct, Open Authentication (OAuth) connections with institutions, investors have complete control over the data they share while enjoying full transparency into their current financial picture.

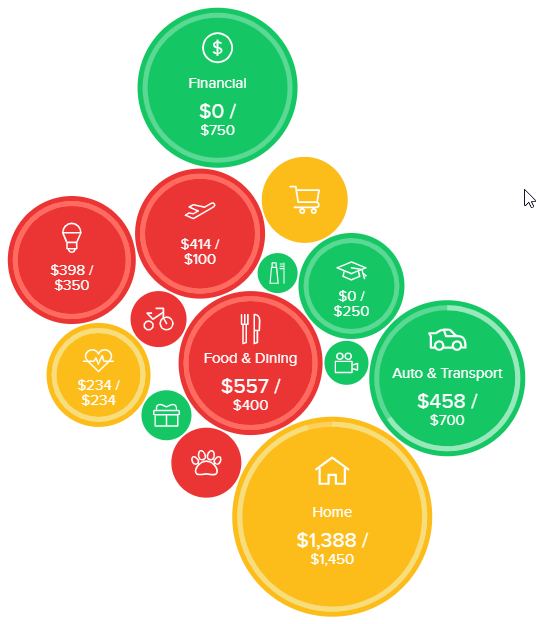

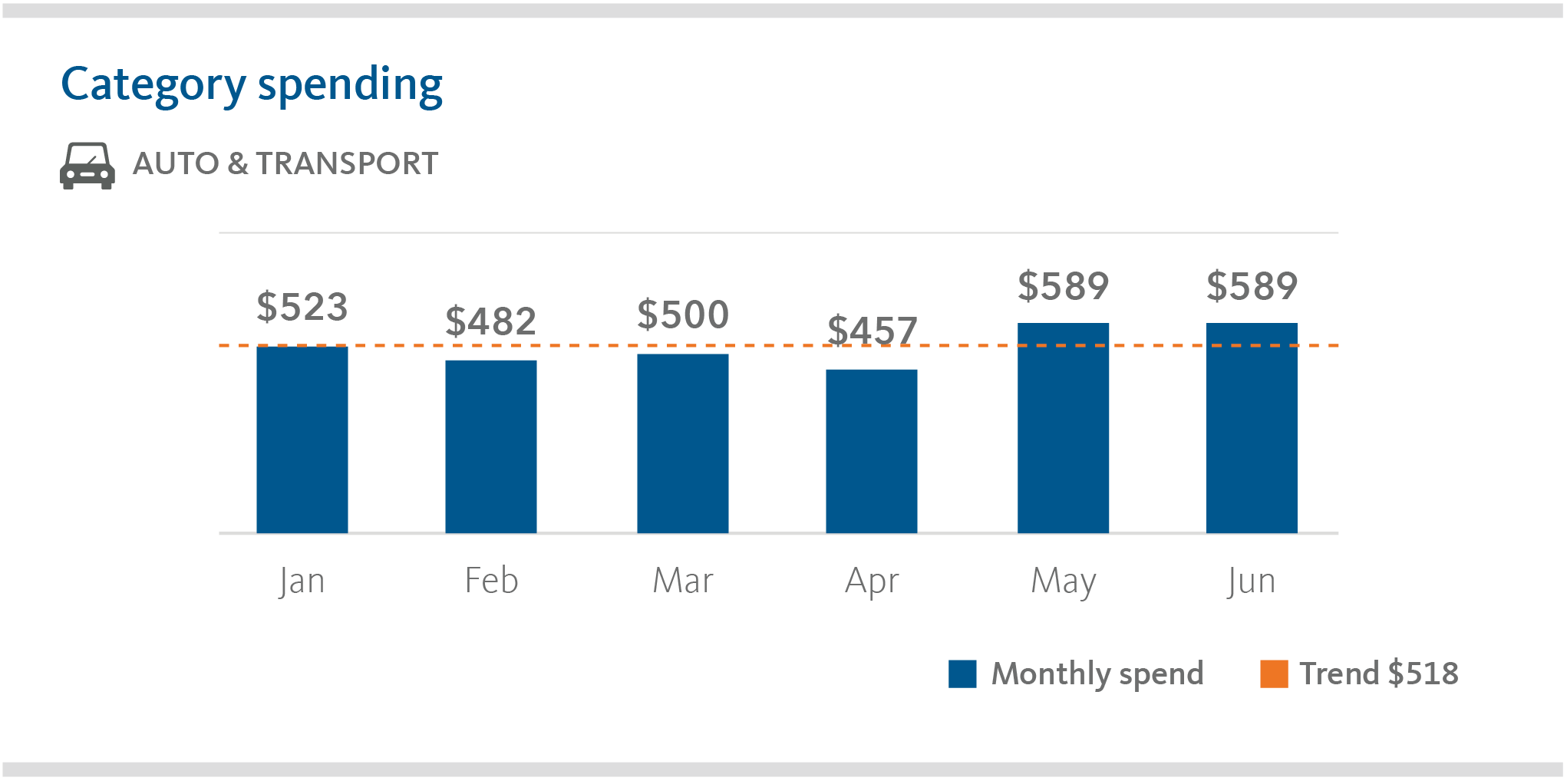

But beyond unifying an investor’s data, this data needs to be visualized into actionable experiences that uncover strategies, so investors can become even more financially sound.

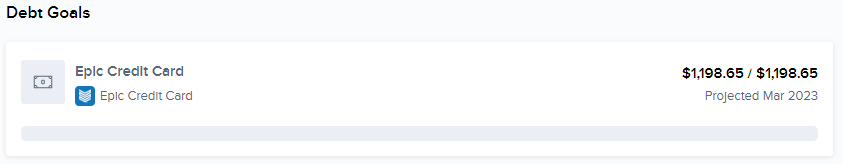

A dynamic and illustrated solution with custom budgeting capabilities would help an investor see exactly where their money is going (such as if they’re spending too much on that BMW), versus where they’re not allocating enough, such as emergency savings. It would also highlight hypothetical scenarios quickly, so investors and advisors would know exactly how to adjust income distributions throughout the month. With this insight, you could easily define and refine goals, such as allocating more to debt management or to retirement, adjusting your budget to reach those goals even faster.

Finally, an automated notification system would deliver insights that correlate with financial activity such as fees, deposits or withdrawals, especially when out of sync with spending behavior trends. This additional feature would help an investor continually balance and fine-tune their financial picture.

Democratizing Financial Wellness

At Broadridge, we believe financial wellness tools should be democratized for all individuals—that is, available to all, regardless of wealth or income level. And we aim to empower our advisor and investor communities to improve their financial strength through our investment in and steadfast dedication to making new and innovative solutions readily available across all market segments.

1 https://www.schwab.com/learn/story/5-ways-financial-planning-can-help

Let’s talk about what’s next for you

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Thank you.

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |