Transformation on Your Terms: Investor Expectations Driving the Agenda

Amidst changes in investor behavior and preferences, coupled with innovations in technology, the wealth management industry is evolving quicker than ever before. Investors increasingly expect a highly personalized digital experience. To deliver the desired experience and meet investor expectations, advisors need tools that drive at increased productivity and efficiency to successfully manage mass personalization at scale. Wealth management firms need to find ways to support their advisors by providing the right tools and strategies to help advisors deliver on investor expectations, all while growing their business.

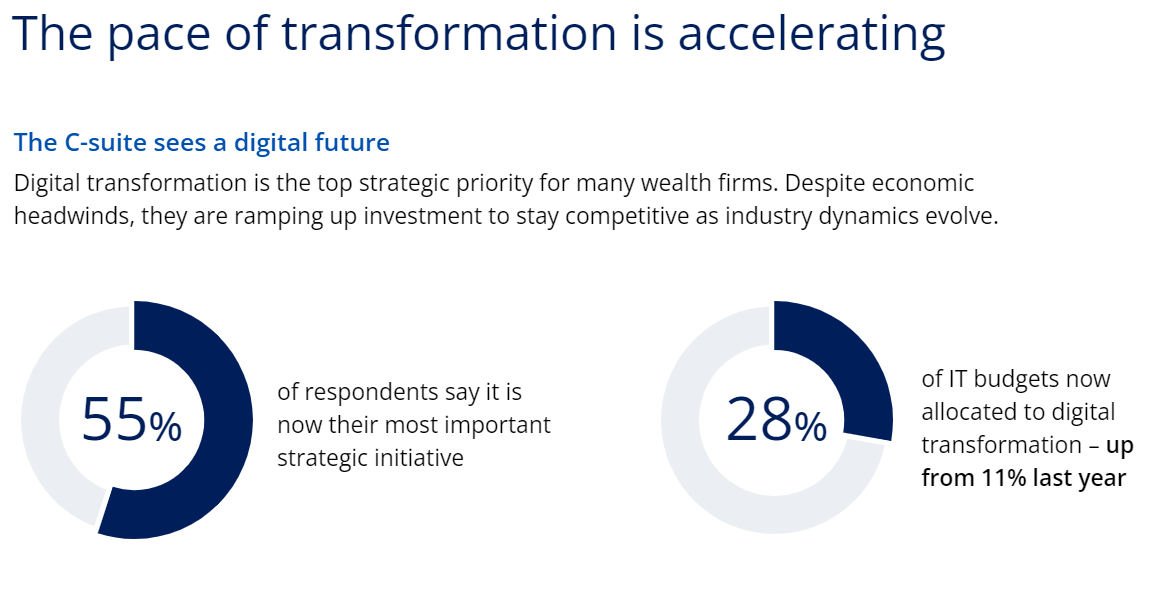

These firms are looking toward tech to enable digital transformation (DT) to solve some of these challenges and shrink the gap between what investors expect and what advisors can deliver in the fight to remain competitive and retain top talent. In fact, financial services firms are more than doubling the percentage of their IT budget they allocate to DT — dedicating around 28% in 2023, compared to 11% in 2022, according to Broadridge’s 2023 Digital Transformation and Next-Gen Technology Study.

Why are we seeing this increase in spend and prioritization of digital transformation? “Simply put,” says RP Sandilya, VP Business Development for Broadridge, “firms are investing in solutions to increase personalization of services and productivity.”

Productivity refers to both the firms’ productivity as well as the advisors’ productivity. Wealth management businesses need to attract and retain a diverse network of advisors and equip them with cutting-edge technology to increase productivity, while driving down operational costs, and enable advisors to service emerging investor needs, rising expectations, and preferences.

Sandilya continues, “Today’s investor is increasingly digitally savvy. And as technology advances, their expectations rise with respect to what advisors deliver — because they know what they want, they know how they want it, and they know what’s possible.”

According to the 2023 CX and Communications Consumer Insights report commissioned by Broadridge, consumer expectations for customer experience (CX) continue to rise (nearly doubling since 2019), as does dissatisfaction where companies’ efforts in this area aren’t keeping pace.

For this reason, firms need to account for the new, growing investor segments that require a personalized, digital customer experience (CX) that’s high-tech and smart.

A closer look at the changing landscape of financial services, fintech, and CX expectations reveals potential returns for firms that invest in DT — and the risks for those that do not. Insights from the 2023 DT study also reveal that the integration of AI is poised to support and enhance productivity and provide intelligent insights for financial advisors, investors, and operations professionals.

Donna Bristow, Chief Product Officer, North American Wealth & Investor Communications, Canada, says, “For firms to meet continuously rising investor expectations and remain competitive, they need to command greater operational efficiencies and reinvent themselves through focused, accelerated digital transformation.”

Exceeding investor expectations: The new benchmark for survival

In the wealth management industry, table stakes and a saturated market can make exceeding CX expectations a sizeable differentiator for client satisfaction. Conversely, according to the CX report, negative experiences run the risk of lost business.

A mere 14% of those surveyed say investment companies deliver the best customer experience. Only 10% say that retirement funds are getting it right, but, in contrast, 61% say banks are delivering the best experience. These responses reveal the significant gap between what investors expect and what companies in the wealth management space are delivering.

What do consumers want? Simplified, customized experiences rank at the top, but few get it right. According to the report, 92% of consumers think simplification is important. Yet only 35% of consumers believe the companies they do business with are providing simplified communications. Similarly, 81% of consumers say they want a customized experience, but only 28% say companies are “doing great” at this.

But it’s not solely about simplification and personalization. Sixty-nine percent of investors also stated that the quality (simplicity, relevance, and timeliness) of the communication they receive from an advisor or brokerage firm is a key contributor to their loyalty.

In the 2023 DT study, 67% of companies said that wealth management firms that do not focus on the customer experience will fall behind, but what exactly is at risk?

What’s at stake in the race to innovate

First, 61% of consumers indicate that they judge a company’s innovativeness based on the communications they send. Sixty-eight percent of consumers also said they have lost trust in a company due to a poor experience or communication. In short, every interaction matters, and consumers are taking notice of what companies are doing to enhance communications and digital experiences.

Secondly, when companies don’t deliver on consumer expectations, they run the risk of losing business. Sixty-nine percent of consumers indicated that they would look for alternative products or services after two or three negative experiences with a company. Moreover, 54% of consumers indicated they stopped doing business with a company because it did not personalize their experience. (This percentage was even higher among younger consumers.)

Bristow says, “If advisors aren’t getting the technology they need to meet the needs of their clients, they may leave and go to a firm that can offer that capability. And investors will do the same thing — they’ll start building a relationship with someone who can provide it.”

WHAT HAPPENS WHEN YOU GET IT RIGHT

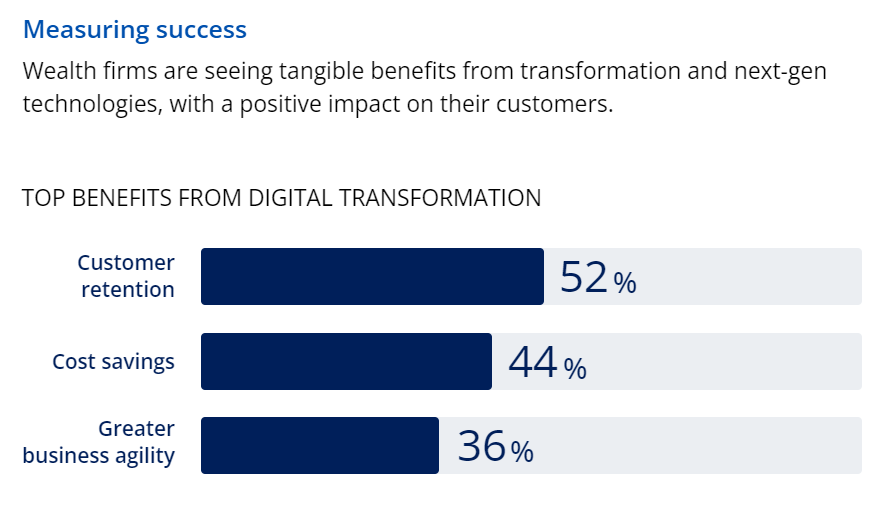

The rewards for delivering on customer experience expectations include enhanced loyalty, trust, and a willingness to go paperless (which boasts its own benefits). In the simplest of terms, however, the ultimate reward is that of client retention. Fifty-four percent of wealth firms say that client retention is a top benefit of DT and next-gen technologies. When clients get what they expect and more, they reward their advisor or brokerage firm with improved net promoter score (NPS), referrals, and retention.

The role of digital transformation in meeting CX expectations

Consumers want better digital experiences and better-quality communications (which, according to the CX study, impacts consumer perception of innovativeness). Meanwhile, 32% of companies represented in the DT study said that balancing innovation with conducting day-to-day business is a top concern. But as next-gen technologies mature, firms are reporting improvements in customer acquisition and retention, cost efficiencies, and faster time to market from their use. In other words, next-gen technologies support a more favorable digital environment for both firms and their clients, providing notable returns and making a strong case for DT investments.

While the hurdles to digital transformation are many, firms are finding that their efforts are worthwhile, as DT can improve productivity and supports the paperless workflows and communications that clients prefer.

Making transformation manageable

When analyzing the next steps on the DT journey, firms will have to identify the technology gaps, anticipate the needs of their clients, and prioritize internal needs to evaluate trade-offs as they form a go-forward strategy.

Technology modernization and simplification pose challenges and risks of their own. Where modernizing outdated legacy systems is concerned, some firms are taking a “lift-and-shift” approach to innovating legacy systems. But upgrades have a reputation for being expensive, time-consuming, and carrying a risk of negatively disrupting business functions.

“As an alternative,” explains Bristow, “forward-thinking wealth firms are tackling digital transformation by implementing innovative front-to-back-office wealth platforms based on open architectures and a suite of plug-and-play component solutions they can build upon, with a consistent CX, as business needs evolve.”

Implementing agile technology — with partners ready to support transformation now, coupled with a componentized approach — can help minimize risk and reduce spend as opposed to a riskier lift and shift project. “

This approach is more scalable, building a tech ecosystem that can evolve with the firm, emerging tech, and investor needs,” Bristow adds.

The incorporation of next-gen technologies and tools in the wealth management space is not a far-off or futuristic concept. Digital workstations, websites, AI, and predictive modeling, powerful data analytics, self-service tools, and digital marketing that engages clients with the right communication at the right time, through their preferred channels — these are real world solutions that firms are already implementing through cloud based and API solutions that integrate, piece-by-piece, with existing systems. And firms are already seeing tangible benefits.

“We’ve found that the top three benefits firms are seeing almost immediately as a result of their DT efforts and the incorporation of next-gen tools are customer retention, cost savings, and greater business agility,” Bristow reports.

ACCELERATION ON YOUR TERMS

In the face of rapidly advancing technology and a changing industry, modernizing, for many, is more manageable and effective when firms take a componentized approach with a trusted third-party provider. Through a combination of new technologies and customized strategies, firms can take a three-step, incremental approach to scale and accelerate their modernization:

- Modernize your tech stack on your terms

Through componentization with a third-party provider, firms can stipulate the level of financial investment and the timeline to implement their choice of solutions. This approach can empower firms to replace key components individually, without jeopardizing the functions of other systems, effectively lowering the risks and costs associated with modernization. A componentized approach and its advantages extend to major improvements for advisors, investors, and the firm’s overall digital transformation journey. - Amplify the investor experience with new technology

Embracing next-gen tools enables firms to deliver on consumer experience expectations and preferences at scale. Firms can personalize investor experiences through analytics and predictive insights and increase productivity by streamlining daily processes and tasks. This allows for the advisor to focus on value-add tasks to provide clients with a better investor experience. “

With the technologies and tools of today, we can provide that custom experience for customers,” Bristow says. “But from an advisor perspective, and a firm perspective, they can do it in an automated fashion. It allows advisors to give that experience without adding a lot of work into their already busy days.”

- Unlock the power of data for advisors

More than 70% of firms say AI is already significantly changing the way they work. Next-gen tools that harness AI and machine learning facilitate better decision-making through powerful analytics and predictive insights. The large volume of valuable data is something advisors could not process on their own: when given the right technology, they can use this information to personalize investor experiences and deliver better, data-driven recommendations without creating more work.

“We’ve seen that adding new, agile component solutions can help accelerate digital transformation and protect technology ecosystems against future obsolescence,” Sandilya concludes. “Where these next-gen tools are embraced, firms are already experiencing tangible benefits in the areas of advisor productivity and client satisfaction and retention.”

For firms that are eager to remain competitive, partnering with a reliable provider who can deliver the componentized technology solutions necessary to help them tackle transformation at scale will be key to unlocking success in the race to innovate and consistently hitting the moving target of client expectations.

Related Solutions

Contact Us about what’s next for you

Contact UsLet’s talk about what’s next for you

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Thank you.

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |