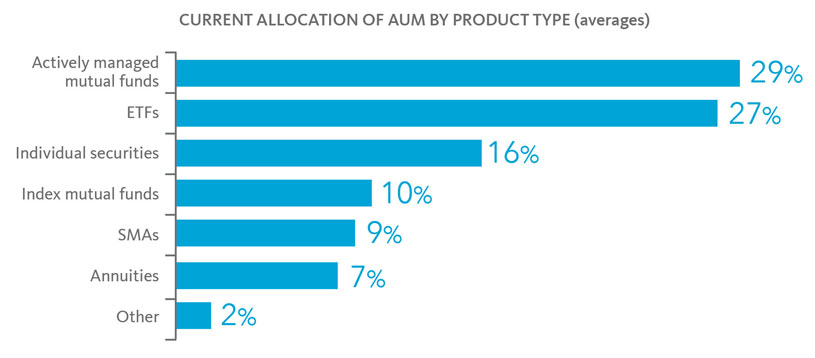

Today, actively managed mutual funds are more commonly used than ETFs—but only by a small margin. A younger generation of advisors tend to prefer low-cost ETFs over actively managed mutual funds, which is driving ETF adoption.

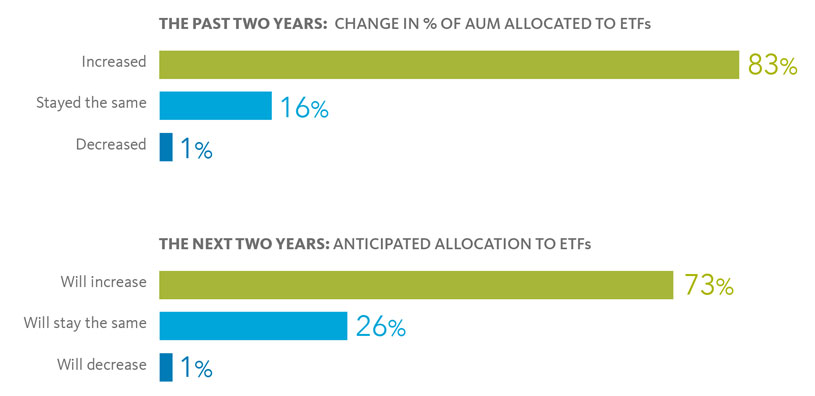

In the past two years, ETF allocations increased almost 25%. Advisors anticipate a similar increase to continue into the next two years also. These findings reflect larger market trends.

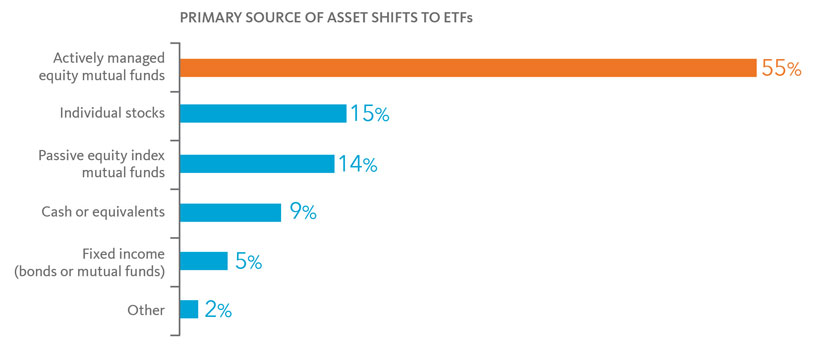

55 percent of advisors say actively managed mutual funds are the primary source from which they plan to reallocate assets into ETFs. So you can expect actively managed mutual funds to remain especially vulnerable.

Looking toward next

As ETFs become the primary choice for advisors, asset managers may be challenged to reconfigure fund lineups and product development. Meanwhile, distribution heads will need to think through how to support sales and marketing.

Want more? Read the complete study here.