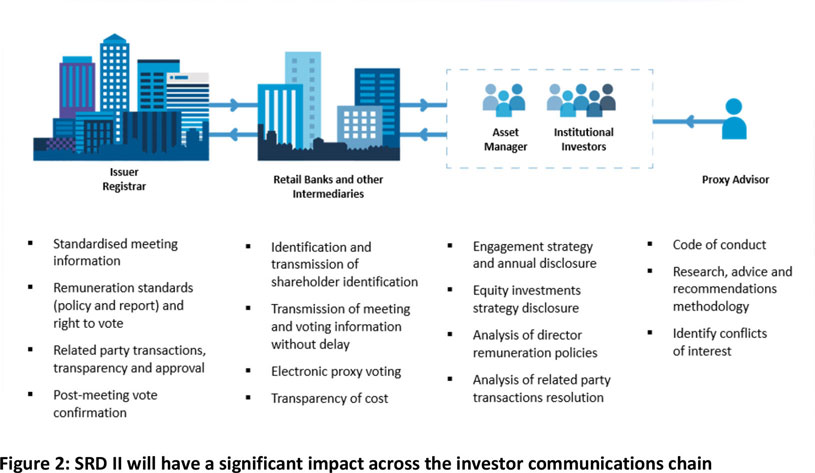

The updated Shareholder Rights Directive (SRD II) represents the biggest shift in European corporate governance standards and processes for many years. Throughout the investor communication chain, the Directive aims to increase transparency of communications and drive shareholder engagement levels, while also aligning to the wider trend of investors seeking to take a more active stewardship role in the companies in which they invest.

For retail banks and other intermediaries, SRD II has the potential to be particularly onerous in two core areas. It mandates the need to offer an effective proxy voting service, and the need to disclose shareholders when requested by share-issuing companies.

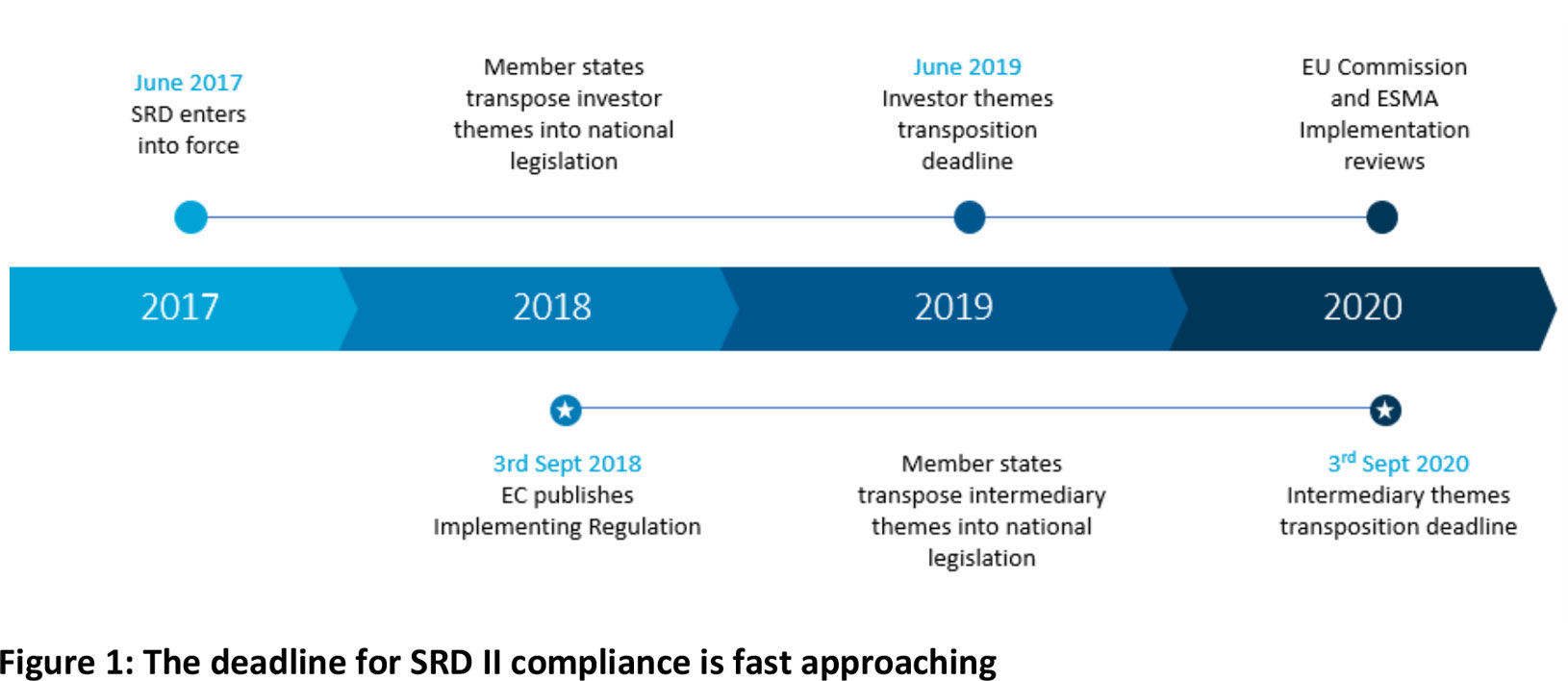

SRD II is in the process of being transposed into national law by European countries – retail banks and other impacted intermediaries face a compliance deadline of September 2020.

Four things you need to know

1. Which intermediaries are impacted?

While SRD II impacts all participants in the shareholder communications value chain - from issuer to investor - the impact on intermediaries such as retail banks is likely to be one of the greatest. It applies to firms across the retail and institutional securities services spectrum including retail and private banks, investment banks, brokers, wealth managers and equity advisors.

Globally, the Directive is far-reaching – it impacts all firms that hold or trade shares in EU-based issuers listed on regulated EU markets, irrespective of whether the firm is based inside or outside of the EU.

2. Offering a proxy voting service is now a requirement

Firms that have previously held the fiduciary responsibility of communicating issuer meetings, such as the global custodians, have a proven track record for servicing the proxy lifecycle, often supported by specialist service providers. However many more firms, such as the retail banks that will assume this fiduciary responsibility under SRD II, don’t have the technology or experience required to provide a fully compliant electronic proxy service to their underlying clients. Consequently, for retail banks the new SRD II proxy voting obligations will be a far bigger wake-up call.

Even firms with established in-house proxy capabilities need to take action, as the SLA and timelines associated to key activities have changed. For example the Directive requires the distribution of meeting agendas in stricter timeframes, vote reconciliation on a daily basis, and vote processing “without delay”. Totally new is the requirement that firms will also need to support all aspects of vote confirmation, including the timely e-confirmation of receipt and dissemination of post-meeting confirmation that the vote was counted, if requested.

3. Shareholder disclosure - security, authentication and data handling

As part of SRD II, there is a new requirement for intermediaries such as retail banks to disclose shareholders when requested to do so by issuers. The Directive will theoretically enable many share-issuing companies, for the first time, to build up a clearer picture of their shareholder base. However, intermediary firms are required to process these requests within 24 hours, while at the same time verifying the legitimacy of these requests.

Cyber security, timeliness and the need to remain compliant with multi-jurisdiction data handling rules are where the challenge lie for all intermediaries. Encryption requirements add complexity throughout the end to end chain of communications, requiring broad domain knowledge and an ability to address potentially challenging data needs.

Consider, for example, the scenario where shareholder disclosure requests are received by a retail bank from multiple issuer agents in a range of markets. The bank receiving the requests will need to be confident in the authenticity and legitimacy of each request before disclosing a potentially significant amount of sensitive client data to a third-party organisation. This situation will be further compounded if the bank is part of a longer chain of intermediaries such as custodian banks.

4. Fintech innovation for SRD II

As a neutral and independent service provider, Broadridge continues to invite discussion with all participants throughout the investor communications lifecycle, and across all regions.

In 2019 we announced our extended global proxy solution, geared to support all types of intermediary and especially retail banks that require a fast-track, first-time proxy capability that solves SRD compliance in all markets. It also supports those firms looking to find cost-effective solutions in order to respond to same-day agenda and vote communications and electronic vote confirmation.

Our solutions offer flexible delivery of meeting information and ballots to your clients through their chosen channel, enhancing the customer experience.

Last year we also announced our innovative Shareholder Disclosure platform to enable banks to fulfil all of their disclosure obligations in all EU markets as required under SRD II.

This article was published in Retail Banker International in February 2020