Rockall,

a Broadridge Business

I’m Head of Risk… I Need Answers

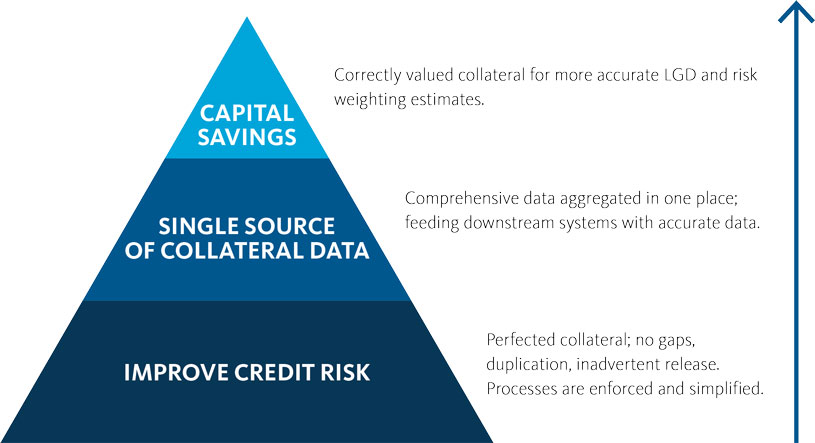

For credit risk improvement, Broadridge offers a comprehensive management system for your banking book collateral and many-to-many credit ecosystem linkages that delivers credit data accuracy and aggregation. With our product, COLLATE, we can help answer critical questions like:

Can I show that I am managing risk in the loan book?

Is there a way to demonstrate collateral maintenance across my loan book? Can I show that all my collateral is accurately valued and secure? And that loan book housekeeping is up to date? Flags and alerts help in an operational way. But, at a macro/business-line level, it is important to see to what extent collateral is falling out of date. I need to be able to measure this if I want to manage it down the line. I would like an overall “collateral health metric” showing that each loan is secured with tracing to the location where the supporting documentation lives, that they are accurately valued with the valuation history over the life of the loan, and that they are maintained with UCC filings up to date, insurance and environmental reports correctly in place, and more.

How can I measure and aggregate collateral status across the portfolio?

Can I get a view on which business lines are operating in a capital-efficient way and supported by collateral that is better-rated than others? Where do I need to focus my education and collateral IQ training in order to boost awareness to help underpin bank profitability and reduce credit risk? This is particularly important in a world where not all collateral is created equal.

How can I demonstrate to loan underwriters and customer-facing staff the capital impact of their collateral decisions?

Less so for retail mortgages, but for other lending decisions like comparing unfinished building projects to complete and occupied, there is a real incentive for lenders to push for tight completion deadlines. By demonstrating the profitability impact upfront, or by using a measurable metric, bank decisions can be influenced positively with profitability in mind and likewise with compensation and bonus.

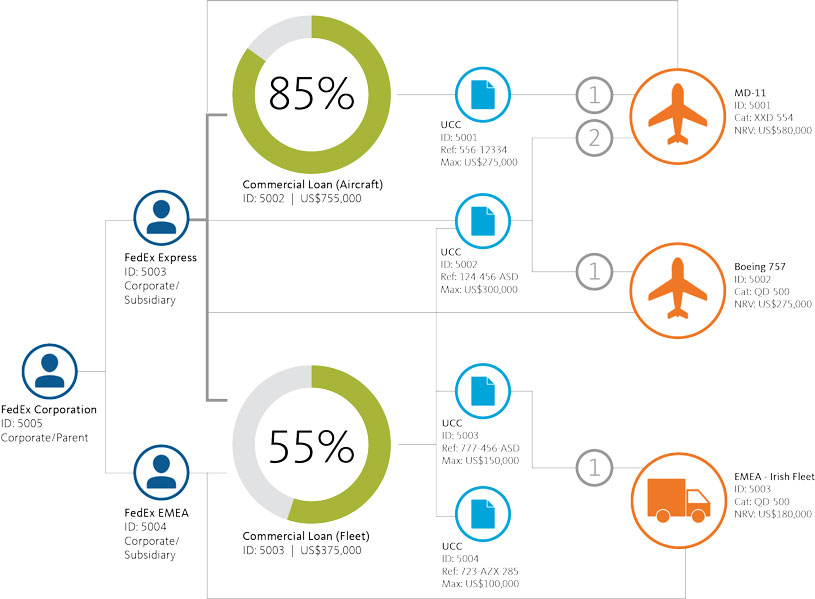

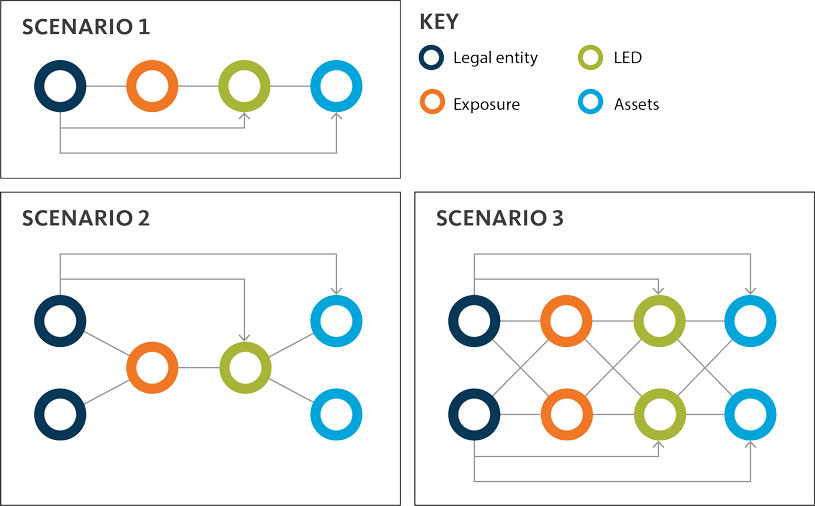

Can I show that I am allocating collateral efficiently across my complex loans?

The ability to show how collateral is currently being assigned would be a start. Some of my loans are extremely complex and change over time. Can I get a dynamic picture of the various layers involved and the seniority of collateral in each loan framework? Is there a way of highlighting, as these loans evolve, the optimal assignment of collateral across the loans for capital adequacy purposes?

How can I trace where loan agreements/commitments have changed without a correlating change in collateral cover?

The folks down the line are incentivized on writing business, but not necessarily on securing it. I need to be able to spot any emerging underlap in LTV coverage across the book and to be able to drill down to see which credit lines are in deficit.

Is there a way of measuring gaps between my loan and collateral data and to show how I am closing it over time? How can I solve for gaps in my data?

There are “known unknowns” in my loan books. While I can certainly enforce most of my liens, I can’t always show that I have a sufficient grasp on collateral to justify full capital relief or to support my credit risk reporting models. I would like a metric or chart that shows how the improved processes and systems that I have introduced are helping to materially change that story. In other words, by demonstrating a better grasp on collateral, can I show how capital relief is improving?

Are there business insights I can glean from my collateral data?

I know that if my data was comprehensive and accurate with full lineage, I could also produce data sets to help my other senior colleagues answer questions such as “Is there more ‘lendability’ in my book?”

My risk role can be enhanced beyond pure “risk management” into something more strategic by delivering real business insights through harvesting the data in my systems. It can only help my brand and support the bank if I can track and show where LTV values are changing to the point where we can offer more credit to valued/strategic clients.

Can I help my capital adequacy/treasury colleagues manage cost-of-capital at a corporate level?

By tracking LTV targets across the loan book, can I help the bank justify and secure a better internal rating model for assessing capital adequacy? As the interest rate environment changes, this could be a real win for the bank. My systems have the data to power that, but only if I can spin it up into an aggregated corporate view of LTVs with a granular drill-down capability to identify areas for improvement and rationalization.

These challenges are resolved with golden-source collateral data with our banking book collateral management technology, Rockall COLLATE. It creates a world where every collateral relationship – between customers, exposures, facilities and liens – is tracked, confirmed and available with one click. Collateral is correctly and efficiently classified based on accurately maintained valuations; granular information can be easily aggregated; and a clear view of the credit risk landscape is available at any level.

Contact Us

Welcome back, {firstName lastName}.

Not {firstName}? Clear the form.