Rockall,

a Broadridge Business

Do Your Financial Advisors Have the Right Tools to Grow the SBL Channel?

Digital transformation is creating new opportunities for wealth managers to meet growing demand for securities-based lending.

Digital transformation is driving fundamental change across the banking and wealth management marketplace and, in the process, changing client expectations for service delivery. As consumers, we know the difference between a streamlined digital experience and traditional banking system interactions — and we know which experience we prefer. Banks do, too.

While digital transformation brings efficiencies and a change of pace, it also opens up a whole new market segment. Digitization enables streamlining and scalability to open previously inaccessible markets. Enter the mass affluent (MA). In our recent industry survey, 89% of respondents said that it is inevitable the MA segment will enter the securities-based lending (SBL) market within the next three years.

But how will wealth managers, brokers and advisors enable this sales channel?

“Uberizing” the wealth channel might be the goal, but so far the search for a holistic and future-ready wealth platform has been heavily focused on front-end activities like onboarding and execution-oriented functions. These are partially digitized, service-focused platforms. Banks are still faced with the challenge of leveraging them to effectively bring their products to a fully digitized customer base with associated middle- and back-office efficiencies and aggregation capabilities.

Broadridge is reimagining the broker/advisor space as a marketplace for wealth products, moving away from the given linear path of advisor-to-bank to product set. What about giving advisors better information about their wealth clients, including liabilities, and combining that with the power to pick products from a selection offered by multiple banks and institutions?

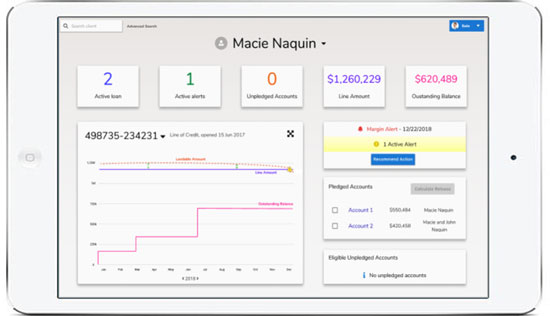

Presenting a dashboard that includes the client’s credit picture enables the advisor to efficiently balance the client’s assets, investment strategies and optimal credit products (potentially from multiple vendors), in the process strengthening wealth protection and creation and driving associated improvements in client trust and stickiness.

An aggregated view of credit within the client’s portfolio – exposing both sides of the client balance sheet – empowers the advisor to deliver and manage a more personalized and informed wealth advisory service with real impact on the bottom line. The advisor is given the hooks to originate wealth lending – potentially enabling them to trigger an application in the process, streamlining the client experience and accelerating time-to-service.

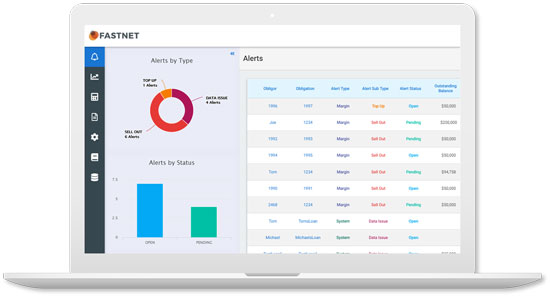

Our financial advisor dashboard currently includes:

- Client asset information integrated with credit activity

- A history of client activity with past alerts

- Portfolio evaluations and lendable amounts based on client profile, credit policy and concentration risk metrics

- Rapid release decisions for optimal CX

- Team-wide alert views so that OOMs can be actioned quickly and with traceability

Putting this information into the hands of the advisor accelerates and deepens the wealth sales channel while delivering on the holy grail of true digital credit CX for optimal value and risk management. It also positions wealth managers to develop a client self-service model.

Wealth managers can enable sales by presenting a more complete view of client assets and liabilities to the advisor, complete with SBL lendable amounts. This can be further enhanced by showing multiple SBL offers. In this way, the client balance sheet can be optimized and a scalable and streamlined customer experience delivered, all while building trust and loyalty.

Contact Us

Welcome back, {firstName lastName}.

Not {firstName}? Clear the form.