ESG reporting is simply good governance for the modern corporation. Investors expect transparency around risks, leadership, and how issuers treat shareholders and employees alike. The ESG moniker might be new, but the fundamental practices it embodies aren’t.

Staying Focused on the “Signal”

For years, ESG reporting has been a stalwart for issuers and investors. Businesses that are focused on sustainable financial performance tout their progress toward social, environmental, or good-governance goals, and investors track how corporations are making progress. This transparency means that when issuers benchmark and report on their progress, investors’ conviction increases, creating a symbiotic relationship that historically drives the economy forward.

The Numbers Tell the Real Story

Companies and their boards are increasingly focused on good governance and financial returns. To make meaningful progress in these areas, they will need the kind of information only data can provide in order to assess and execute.

Joseph Vicari, ESG Practice Lead at Broadridge, says large-cap companies are still bullish on ESG for the long haul. “In 2021, the majority of large cap companies voluntarily disclosed ESG data at a high rate, especially in areas of the environment,” he says. “The Broadridge ESG Analyzer data shows that 75% of large-cap companies disclosed Scope 1 emissions and 73% disclosed Scope 2 emissions. Additionally, 86% of these large caps published sustainability reports.”

These trends are not isolated to large-cap companies. In the mid-cap market, 69% of companies are publishing sustainability reports and 41% are disclosing Scope 1 emissions. The small cap market is taking notice and following suit, with 29% of companies under $2 billion in market cap publishing sustainability reports based on data from ESG Analyzer.

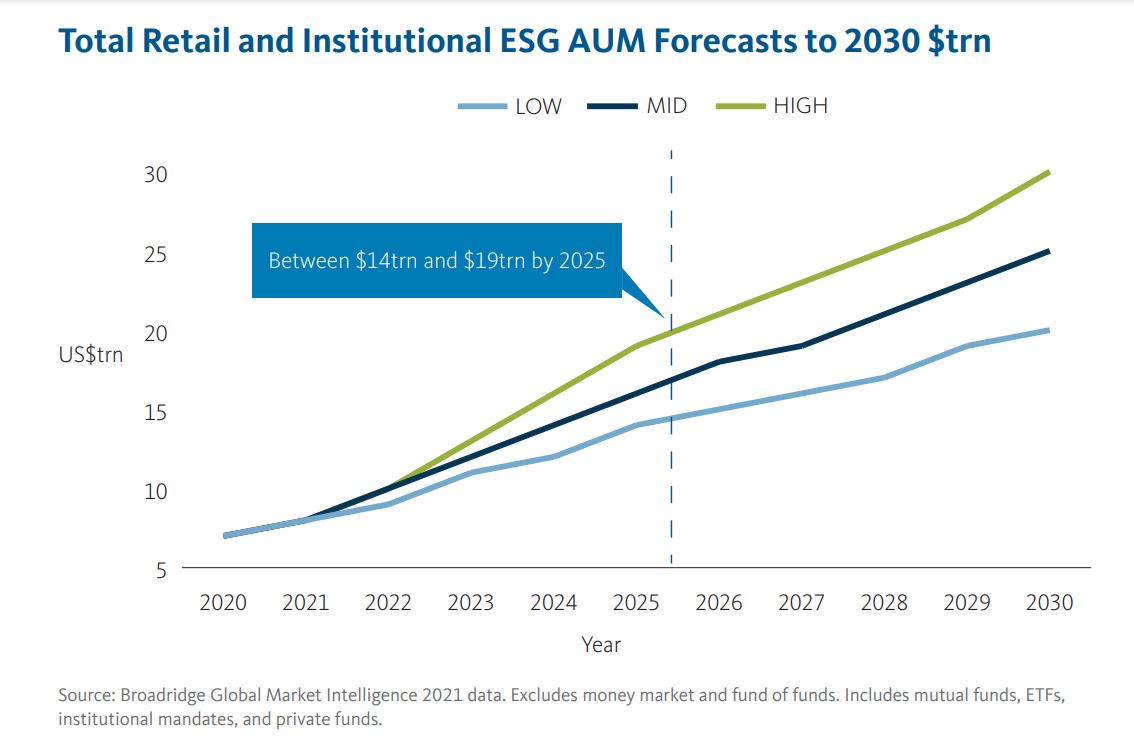

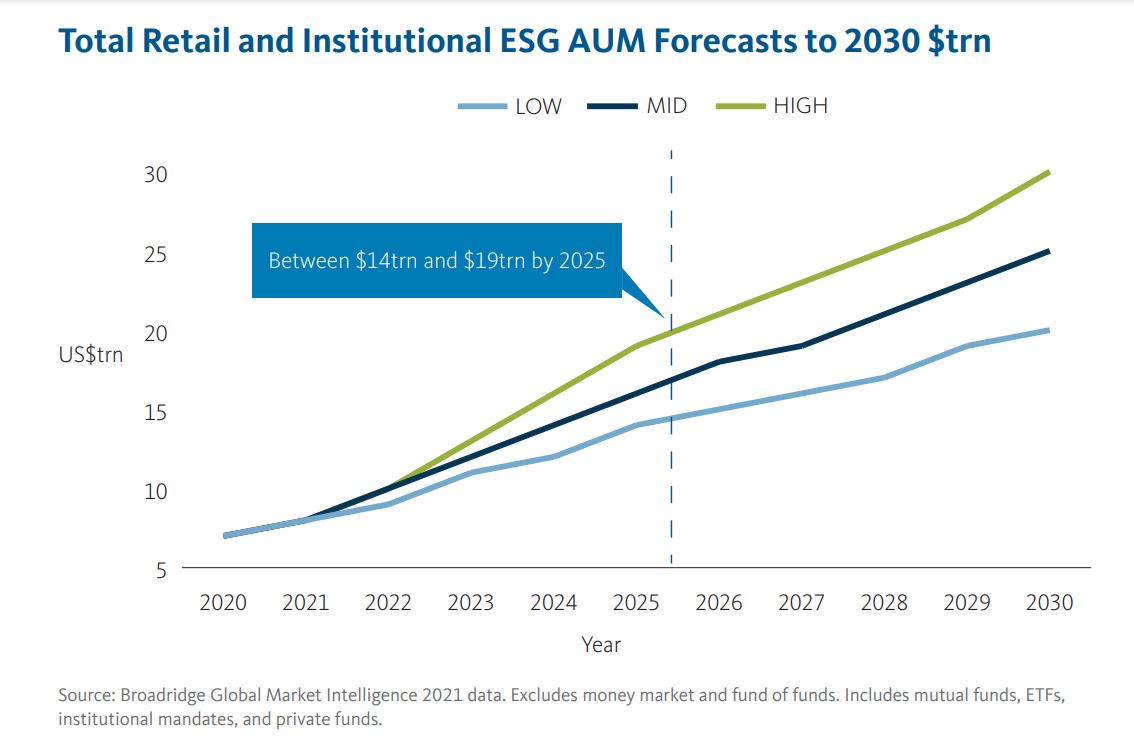

Today’s retail and institutional investors are driven to find companies that are committed to sustainability. Issuers demonstrating dedication to operating in a sustainable and socially responsible manner are primed to attract long-term investment from the growing pool of professionally managed ESG assets, notwithstanding short-term market fluctuations.

Given the powerful undercurrents supporting ESG investing, assets could grow to $14-19 trillion by 2025, and potentially $20-30 trillion by the end of this decade.

Corporate issuers continue to:

- Map out goals with set targets and evaluate how they will be achieved

- Disclose and report on ESG factors that demonstrates oversight of non-financial risks and opportunities

- Ensure that sustainability is integrated into corporate strategy and organizational culture.

Of course, results can only ever be as good as the inputs that drive them. Accurate and timely data is the foundational bedrock on which successful corporate strategy is built. With good ESG data as a core component, leaders can identify areas prime for improvement while building on current success stories. ESG reporting sends a powerful signal that leadership is dedicated to long-term success. Having the best available data is the most effective and straightforward way to stay focused on what matters – be it for your business, the world, or both.