Many firms have realized that one-day, or same-day, settlement leaves little room for manual processes and reconciliations. They must adopt straight-through processing (STP) and automate any remaining manual processes. However, this can create settlement and counterparty risks, increases funding and fail charges, and results in failures to meet regulatory reporting requirements.

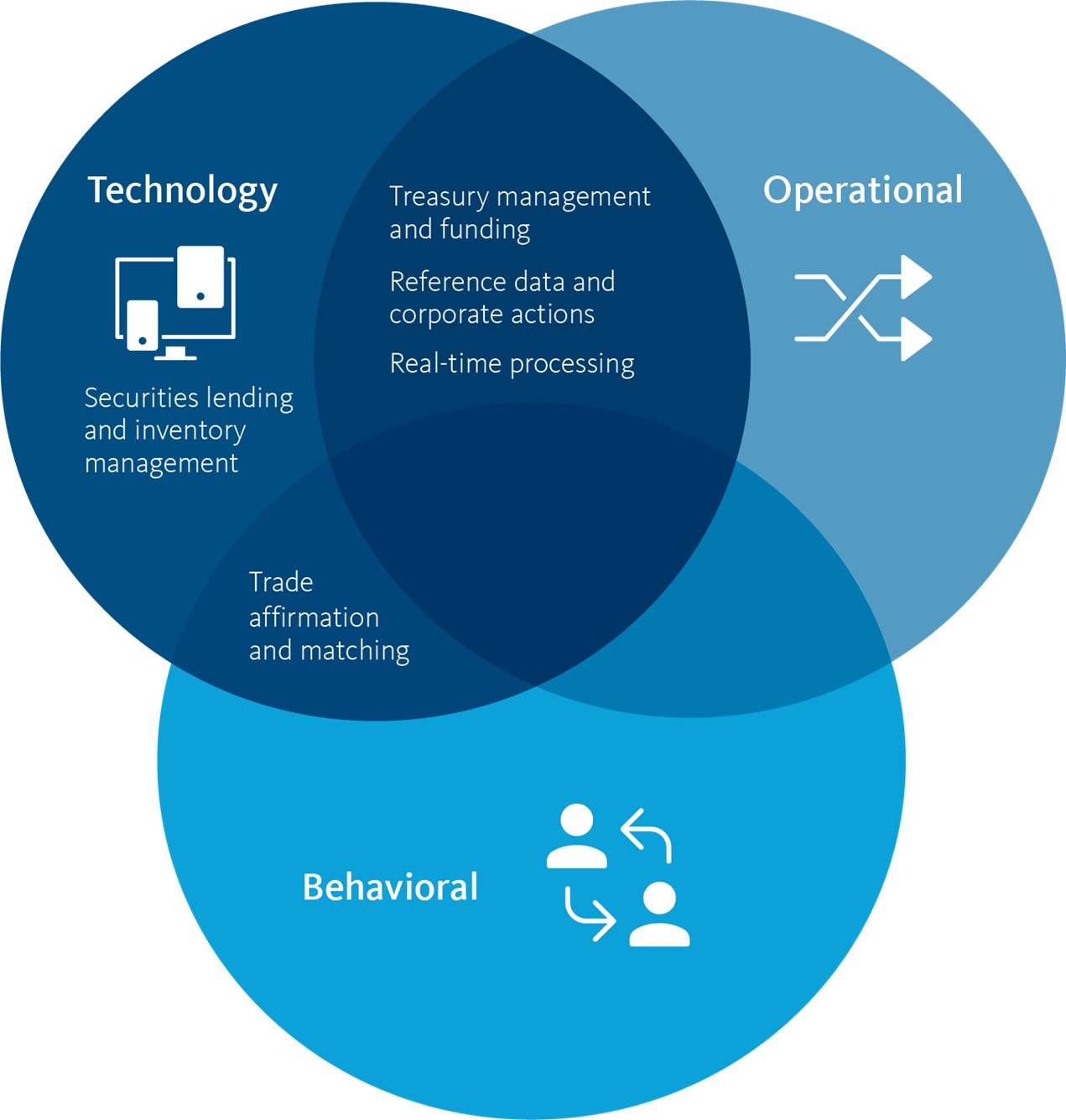

Accelerated settlement has impacts across the trade lifecycle requiring Technology, Behavioral, and Operational changes across sell-side and buy-side firms.

- Trade affirmation and matching (Technology and Behavioral): The trade capture and allocations process needs to be standardized and automated to ensure break resolution on trade date and to reduce unaffirmed trades for continuous net settlement. Some buy-side firms continue to send in allocations manually and will need to change their behaviors to adopt systemic communication of allocations and send them in on the trade date.

- Treasury management and funding (Technology and Operational): As the National Securities Clearing Corporation (NSCC) deadlines move up, funding will have to be continually monitored and estimated until settlement. Firms will need to implement real-time views of cash and securities positions and update operational processes.

- Securities lending and inventory management (Technology): It is increasingly important for firms to get a consolidated, real-time view of their global positions to help optimize global inventory, identify lending opportunities, and reduce borrowing needs. Securities lending also has revenue impacts for firms.

- Reference data and corporate actions (Technology and Operational): Firms need to invest in common sources of reference data and corporate actions to streamline internal processing and minimize breaks across the front, middle, and back office.

- Real-time processing (Technology and Operational): With batch timings shrinking and the possible move to same-day settlement, firms have to invest in real-time global processing capabilities for finance and accounting, clearance and settlements, and stock record. Operational processes need to be aligned with updated workflows to take advantage of real-time processing.

To prepare, firms need to look beyond tactical changes and start investing in a technology platform that streamlines the front-to-back trade lifecycle, enables global real-time processing, and consolidates key business capabilities across asset classes. This investment will not only position firms to meet the needs of an accelerated settlement cycle, but also will reduce trade settlement risk, improve capital and collateral utilization, and grow top-line revenue by enabling those firms to expand into new business lines and geographies as quickly as market and competitive conditions require.

Getting to the Root of the Problem

Currently, firms employ multiple systems to process trades across different asset classes and geographies. Many of these systems are large, monolithic products that are not capable of extending key functional capabilities to new asset classes, geographies, and business lines. As those firms’ businesses grow, the underlying system complexity grows in an exponential manner. This can create redundancy of both systems and people, as well as reconciliation overheads, fragmented workflows, manual processes, and the inability to get a consolidated view of the business — all of which reduce efficiency and drive costs higher.

In addition to duplicating flows and processes, these siloed systems also have disparate ways of executing the same function. For instance, product controllers deal with different P&L calculations performed by multiple systems for the same asset and must reconcile and explain the differences. Silos also increase a firm’s change costs due to the time and effort required to update multiple systems to meet regulatory and industry change.

In response, many firms try to deploy a common user interface or implement a common data layer to gain a consolidated view of the business. However, these strategies do not address the underlying complexity of multiple trade processing platforms, and firms are no closer to the global real-time environment necessary to support accelerated settlements.

Transforming the Trade Settlement Platform, One Module at a Time

As we prepare for T+1, we have an opportunity to future-proof our product and technology investments and address the challenges of an eventual move to same-day, real-time, or intraday settlements. However, firms have become weary of large-scale transformations and often lack both the appetite to take on the risk of disrupting ongoing operations, and the budget to see them to completion.

The good news is that, for those firms not wanting to pursue a ‘big bang’ transformation, they can still move toward a future-focused post-trade platform by taking a more evolutionary path.

By adopting a modular approach, firms can migrate to a post-trade technology platform that consolidates transaction processing across asset classes and geographies and delivers incremental ROI each step of the way, rather than having to wait months — or perhaps even years — to realize the value of their investments.

Take position management as an example. Instead of managing positions separately across multiple systems — e.g., for U.S. fixed income, U.S. equities, and international equities — firms can implement a position management module that takes in transactions from multiple settlement engines and maintains a real-time global position view across assets and geographies. Eventually, this position manager can evolve from an aggregator to an actual consolidated stock record that drives regulatory reporting, client reporting, possession and control, tax reporting, and more.

This evolution also delivers business benefits, including opportunities to optimize positions across depots and different lines of business, reduced borrowing requirements, and improved collateral and risk management functions. The standalone consolidated position management module also can be easily extended to support new lines of business, making it easier for firms to leverage capabilities for future growth.

Over time, the consolidated module approach reduces change-the-bank costs by isolating and minimizing the need to update multiple platforms, and makes it easier to extend the same capability into new asset classes and markets.

A modular approach is inherently customizable, allowing a firm to begin its evolution to a consolidated platform based on its unique business strategy and current technology infrastructure. For instance, a firm that has challenges with product control and financial reporting across different systems can begin its transformation with a financial and accounting module that streamlines P&L and key books and records functions. Another firm might prioritize the global consolidation of a particular asset class to streamline booking models and post-trade processing workflows.

Applying this modular approach across the trade life cycle — from trade capture, to accounting and finance, to clearance and settlement — creates a pathway to decommission siloed systems while incurring incremental benefits along the way. A modular platform that leverages a common data model and a standardized UI and workflow framework to simplify the processing architecture also lets firms quickly deploy new technologies like distributed ledger technology (DLT) and artificial intelligence (AI) with less risk and at a lower cost.

A Roadmap to Transformation

Every firm will have a unique roadmap to preparing for T+1, but all firms can benefit from taking this opportunity to reassess their investment strategies as a whole. Modernizing technology will require firms to rethink their post-trade platform in its entirety, rather than continuing to dedicate resources toward stopgap solutions that prop up legacy platforms and architectures.