Hedge Funds Repositioning for Growth

Fueled by geopolitical risks and market volatility exacerbated by the sharp rise in inflation, monetary policy tightening and falling equity prices, hedge funds incurred slight losses in 2022. However, they still outperformed the broader market. The industry is also facing a number of technological/operational challenges and acute cost pressures, which it needs to overcome. This is prompting managers to seek support from external technology and managed service providers to help navigate these challenges.

A Mixed Market With Some Clear Winners

Markets have been extraordinarily volatile, sparked by a series of inter-related geopolitical crises (i.e., the war in Ukraine, China tensions, supply chain shocks, etc.) and macroeconomic headwinds. These include, but are not limited to soaring inflation, rising interest rates, a steep decline in equities, volatility and uncertainty in the cryptocurrency world, and disappointing global economic growth.

Although hedge funds have had negative returns in aggregate - with the HFRI Fund Weighted Composite Index down 4.2% in 2022 - the industry has outperformed the broader public markets.1 Within the asset class, some hedge fund strategies – including macro – have posted excellent returns. For instance, the HFRI Macro (Total) Index was up 9.2% last year,2 in contrast to hedge funds running equity and event-driven strategies, both of which suffered losses in 2022.

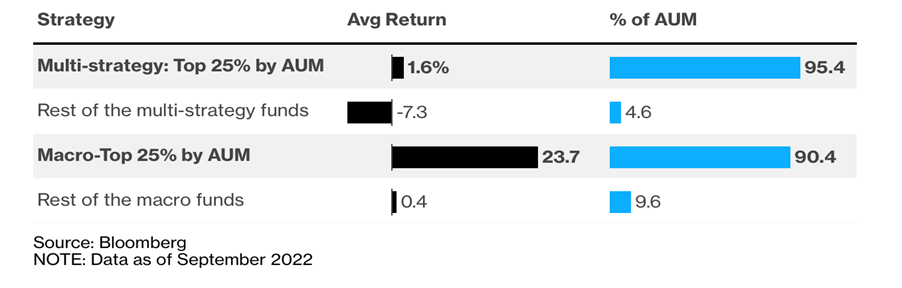

Furthermore, Bloomberg analysis shows that large macro and multi-strategy hedge funds have delivered better client returns over the last 12 months compared to some of their smaller peers (See table below). 3

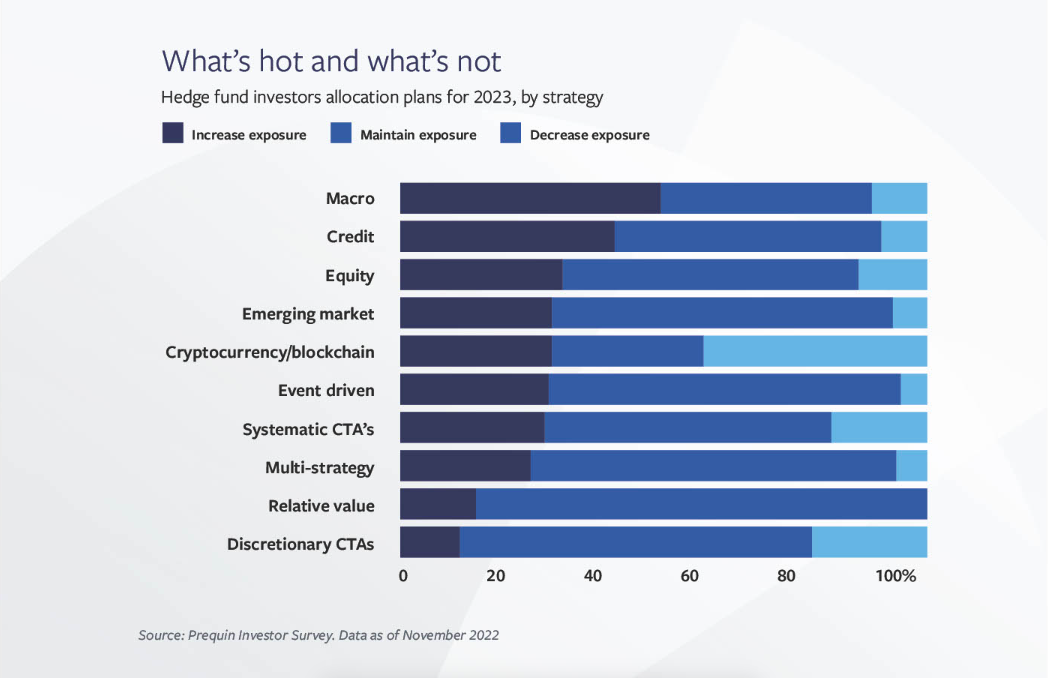

With such compelling returns, it is no surprise that investor appetite for macro strategies is surging (See table below).4 This comes as hedge funds continue to attract decent amounts of capital, with $44 billion flowing into the asset class during the final quarter of 2022, bringing the industry's total AUM (assets under management) to $3.83 trillion. 5

According to EY, hedge funds are the most popular alternative asset management strategy, accounting for 32% of allocations, putting them ahead of private equity and venture capital.6 This comes as many investors look to diversify their exposures and obtain non-correlated returns.

At the same time, other institutions have reached their maximum risk thresholds in terms of how much money they can allocate to private market strategies, an asset class which has experienced exponential growth over the last decade. This, in turn, forces those investors to reconsider hedge funds.

Hedge Funds Feel the Operational Challenge

Despite the increasing allocations into hedge funds, the industry is under pressure. Asset managers generally face many rising costs, and hedge funds are certainly no exception.

Regulation – particularly in the US – is taking a significant toll on hedge funds. So what is happening? The U. S. Securities and Exchange Commission (SEC) is imposing more demanding reporting standards on large hedge funds following extensive revisions to the Form PF, a regulatory filing that managers must submit quarterly or annually, depending on their AUM. Other proposals by the SEC to make certain market participants register as broker-dealers or government securities dealers also risk impacting hedge funds, in what some have warned could lead to firms incurring higher costs and added regulatory requirements.

Meanwhile, hedge funds in the EU are dealing with potential changes to the Alternative Investment Fund Managers Directive (AIFMD) and tighter ESG (environmental, social, governance) rules under the Sustainable Financial Disclosure Regulation (SFDR).

Simultaneously, institutional investors also insist that managers provide them with more in-depth and time-sensitive reporting. This is forcing firms to invest heavily in their internal systems to generate reports seamlessly and quickly for end clients.

These challenges come at a sensitive time for hedge funds, not least because many firms face spiraling costs elsewhere, exacerbated by wage inflation, talent shortages and client pressure on fees. Amid this challenging operating environment, hedge funds are looking for more ways to obtain business-wide efficiencies.

Leveraging the Right Technology Partner

Technology is an enabler for alternative managers, as it can help them obtain company-wide synergies. Increasingly, macro hedge funds are looking for tools to integrate order, portfolio and risk management into a single platform, which helps firms work off the same data set and reduce operational risks and costs. Managed services, when coupled with the right technology, are becoming an integral part of hedge fund operations enabling them to focus on alpha generation.

Hedge funds are also embracing innovative technology, including artificial intelligence (AI), as firms look to digest and analyze increasingly vast troves of data. According to Broadridge's 2023 Buy-Side Digital Transformation study, 81% of hedge funds said AI is now significantly changing the way they work. Through the use of AI, managers can train applications to transform data into novel trading strategies and/or automate processes that previously required user intervention.

Adding automation alongside AI potentially shifts the roles and responsibilities of staff within a hedge fund to focus more time on adjusting parameters and monitoring the performance of systems rather than making real-time decisions themselves. While many managers have indicated an interest in pursuing this type of technology, hindrances such as old and inflexible systems along with a lack of in-house technical talent still need to be addressed. We expect to see our clients accelerate their investment in AI and automation over the next several years.

Through a thoughtful and intelligent approach to technology and operations, hedge funds can augment their performance and obtain operational synergies.

References

1 Hedge Fund Research – January 20, 2023 – Hedge fund capital rises to conclude volatile 2022 as managers position for risk, uncertainty in 2023

2 Hedge Fund Research – January 20, 2023 – Hedge fund capital rises to conclude volatile 2022 as managers position for risk, uncertainty in 2023

3 Bloomberg – December 19, 2022 – Bigger was better in 2022: Global hedge fund industry sees split

4 Bloomberg – December 19, 2022 – Bigger was better in 2022: Global hedge fund industry sees split

5 Hedge Fund Research – January 20, 2023 – Hedge fund capital rises to conclude volatile 2022 as managers position for risk, uncertainty in 2023

6 Hedgeweek – December 1, 2022 -Investors sticking with hedge funds to protect assets, say EY

Product Spotlight

One multi-asset platform with integrated order, portfolio and risk management.

See moreContact Us about what’s next for you

Contact UsLet’s talk about what’s next for you

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Thank you.

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |