Rockall,

a Broadridge Business

Are You Collateral Blind?

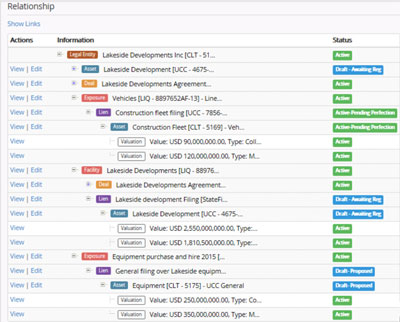

To navigate risk, banks need to know the details of the collateral held against its loans. Most banks lack a data model that exposes collateral data in a way that reveals every nuance and connection. The trouble is, anything less than this inevitably results in an inadequate understanding of the broader loan book – and the true extent of credit risk at play.

Indicators of collateral blindness:

Collateral blindness affects most banks, often without them realizing it, in three common ways:

- Insufficient credit detail. Collateral data and the workflow tasks associated with putting a loan in place may not be actively managed, making assured completion of the loan process impossible. Loan perfection is at risk and these banks are in danger of incurring avoidable losses. Even when correctly initiated, collateral is not always maintained – resulting in inaccurate or missing valuation updates, insurance cover and environmental status reports.

- Lack of visibility into what’s not there. Gaps, missing links, undocumented loan increases and out-of-date valuations go unreported, or worse, unnoticed. These banks struggle with data integrity, under-valued LGDs and significant costs associated with manually finding and fixing gaps and correcting data.

- All is not as it seems. A piece of collateral may secure more than one loan – or a guarantor could cover multiple exposures. Complex loans are not always systematically managed and flagged. These banks have a false sense of security. They could be exposed to unrecognized and unquantified risk and possibly fraud.

Treating collateral blindness

It makes simple business sense to get a firm grip over complex data, relationships and linkages held in the banking book and to manage it dynamically and with reference to the bank’s broader credit landscape.

By implementing an aggregation layer for banking book collateral, accurate and complete information can be put into the right hands. All stakeholders can be satisfied – from operations and business development to product portfolio management, compliance, capital adequacy, treasury and beyond.

Putting a lens on collateral data reveals quality and completeness in granular detail, helping to resolve information gaps and uncover credit risk. A data model that treats collateral in a holistic way and places it at the center of the credit ecosystem is the perfect lens to use for the correct perception of collateral and of the broader credit landscape.

Understanding your collateral challenges and overcoming them not only mitigates loss, but also gets you ready to capitalize on opportunity moving forward.

Contact Us

Welcome back, {firstName lastName}.

Not {firstName}? Clear the form.