Lipper Classifications and Morningstar Categories

Since Broadridge’s acquisition of the Morningstar 15(c) business, one of the most frequently asked questions has been what will the changes mean to how my fund ranks within reports. For most boards and fund companies we work with changes, if any, to rankings will be dependent on which classification system is utilized. Broadridge is now able to offer clients the opportunity to utilize either Lipper or Morningstar classifications and data. While the underlying data between the two firms is relatively similar and will have little if any impact on rankings our research does indicate that there may be more significant changes to a fund’s ranking based on the choice of which classification system to use, Lipper or Morningstar.

One, The Other, or Both?

Fund directors may be faced with the choice of using Lipper classifications or Morningstar categories in the 15(c) reports for funds they oversee. This document highlights the basic similarities and differences between the two systems for classifying mutual funds. It is not meant to recommend one system over the other; in fact, we anticipate that some clients will use one system for a set of their funds and the other system for the rest.

Basic Similarities

Both Lipper classifications and Morningstar categories consider a fund’s declared objectives, but are ultimately independent of fund names (“Capital Growth”), industry nomenclature (“Total Return”), or other declarations of style (“this is a ‘conservative’ fund…”). The two systems are universal — covering all funds, including open-end, variable annuity portfolios, and exchange-traded funds (ETFs) — and exclusive: a fund can be in only one group. (Note that Morningstar has a separate system for closed-end funds and Lipper has some unique classifications for both insurance and closed-end funds.)

For diversified equity funds, both firms parse portfolio holdings to determine style (value, core, or blend) and market capitalization (large-cap, mid-cap, and small-cap). Additionally for US diversified equity products Lipper has both multi-cap and equity income) groupings. Portfolio holdings are also used to determine if a fund is broadly grouped as US/domestic; international/foreign; or global/world. Morningstar also relies on a similar portfolio analysis to categorize multi asset and allocation funds, as well as specialized equity funds.

Lipper, on the other hand, employs a qualitative analysis of a fund’s prospectus for specialized equity funds and fixed income funds. To determine average credit quality and duration, Morningstar currently relies on survey data voluntarily provided – or not – by the fund manager, but plans to parse bond portfolios by analyzing individual holdings, as it does now with equity funds. Lipper determines sector concentrations, average credit quality, and maturity (rather than duration) from the fund’s prospectus.

Both Lipper and Morningstar group funds based on their holdings for the past three years. Lipper assigns a higher weighting to more recent portfolios; Morningstar equally weights each portfolio. The two systems are largely automated, though there is some oversight by investment analysts, and fund managers may appeal their assignments. Finally, both Lipper and Morningstar have ratings — Lipper Leaders and the Morningstar star rating — as well as benchmarks, based on their respective systems.

Basic Differences

As noted, both Lipper and Morningstar group funds based on their holdings for the past three years. Lipper assigns a higher weighting to more recent portfolios; Morningstar equally weights each portfolio. Morningstar categories are tied to a schematic, the style box for equity, fixed-income, and more recently, alternative funds; Lipper does not have such a schematic. Morningstar’s system is the basis of both retrospective (‘star’) ratings, and forward-looking (‘medalist’) ratings; Lipper has only retrospective ratings. One element of the Lipper Leaders rating is cost; price is an element of the Morningstar medalist ratings, but not the star rating. The Morningstar categories are integrated into the firm’s own asset allocation models; Lipper classifications may be used for asset allocation, but the firm itself does not offer asset allocation. Last, Morningstar offers qualitative commentary based on its category system; Lipper does not itself analyze funds based on its classification system.

Table 1

US Equity—Open End

| Lipper Classification | Morningstar Equivalent? |

|---|---|

| Equity Income | N/A |

| Equity Leverage | N/A |

| Large-Cap Core | Large Blend |

| Large-Cap Growth | Large Growth |

| Large-Cap Value | Large Value |

| Mid-Cap Core | Mid-Cap Blend |

| Mid-Cap Growth | Mid-Cap Growth |

| Mid-Cap Value | Mid-Cap Value |

| Multi-Cap Core | N/A |

| Multi-Cap Growth | N/A |

| Multi-Cap Value | N/A |

| Small-Cap Core | Small Blend |

| Small-Cap Growth | Small Growth |

| Small-Cap Value | Small Value |

| S&P 500 Index | N/A |

Table 2

Non-US Equity—Open End

| Lipper Classification | Morningstar Equivalent? |

|---|---|

| China Region | China Region |

| Emerging Markets | Diversified Emerging Markets |

| European Region | Europe Stock |

| India Region | India Equity |

| International Equity Income | N/A |

| International Large-Cap Core | Foreign Large Blend |

| International Large-Cap Growth | Foreign Large Growth |

| International Large-Cap Value | Foreign Large Value |

| International Small/Mid-Cap Core | Foreign Small/Mid Blend |

| International Small/Mid-Cap Growth | Foreign Small/Mid Growth |

| International Small/Mid-Cap Value | Foreign Small/Mid Value |

| International Multi-Cap Core | N/A |

| International Multi-Cap Growth | N/A |

| International Multi-Cap Value | N/A |

| Japan | Japan Stock |

| Latin American | Latin America Stock |

| Pacific ex-Japan | Pacific/Asia ex-Japan Stock |

| Pacific Region | Diversified Pacific/Asia |

Table 3

Global Equity—Open End

| Lipper Classification | Morningstar Equivalent? |

|---|---|

| Global Equity Income | N/A |

| Global Large-Cap Core | N/A |

| Global Large-Cap Growth | N/A |

| Global Large-Cap Value | N/A |

| Global Multi-Cap Core | N/A |

| Global Multi-Cap Growth | N/A |

| Global Multi-Cap Value | N/A |

| Global Small/Mid-Cap Equity | World Small/Mid Stock |

| N/A | World Stock Large Cap |

Differences by Broad Asset Class: Equity

Both Lipper and Morningstar divide equity funds into three basic groups: Domestic/US; international/foreign; and global/world (see Tables 1-3). Both have three market-capitalization based ‘rows,’ large, medium, and small, and three style-based ‘columns,’ value, core/blend, and growth. Most significantly, for each group, Lipper has an equity income classification; Morningstar does not. And, for each of the style-based columns, Lipper has a multi-cap classification; Morningstar has only single market capitalization categories. Lipper maintains these style-based ‘columns’ in its global classifications; Morningstar has a single world large stock category.

For regional equity funds, Lipper and Morningstar have virtually identical groupings, though the members of each grouping do not overlap entirely. Specifically, the two firms have groupings for Pacific/Asia, Asia ex-Japan, China, India, Emerging Markets, Latin America, and Europe.

For equity (as opposed to commodity) energy and natural resources funds, Lipper has three classifications whereas Morningstar has two. For equity sector funds, the two firms again overlap almost entirely, with groupings for funds that focus on MLPs, industrials, precious metal miners and producers, communications stocks, and utilities.

In three areas Lipper has both a global and a domestic classification whereas Morningstar has but a single category: financial services, technology, and healthcare. Lipper separates consumer goods and consumer services funds; Morningstar divides between consumer defensive and consumer cyclical funds. Both firms have a grouping for infrastructure funds. Lastly, Lipper has three real estate classifications: US, International, and Global, Morningstar combines the latter two under one category Global Real Estate.

Differences by Broad Asset Class: Taxable Fixed Income

For core or “agg” bond funds (see Table 4), Lipper has three sector-based and one duration bond classifications: core, core plus, flexible, and general (‘General’ corresponds to long-term). Morningstar has four duration-based categories: ultra-short, short, intermediate, and long. Lipper duration bands are based on average maturity: <3 years = short; >3 and <5 =short/intermediate; >5 and <10 = intermediate; and >10 = general (long). Morningstar duration bands are calculated relative to the duration of the Morningstar Core Bond Index (MCBI): <25% = ultrashort; >25 and <50% =short; >75 and <125% = intermediate; and >125% = long.

For US government bond funds, Lipper has two Treasury bond classifications, short and general (long). Morningstar groups Treasury-focused funds under its government categories. Lipper has distinct GNMA and US Mortgage classifications; Morningstar groups these funds in their respective government bond categories. Lipper has four government bond classification types: short, short/intermediate, intermediate, and general (long). Morningstar has three government bond category types: short, intermediate, and long. Both Lipper and Morningstar have an inflation protected bond grouping. Neither firm has a distinct grouping for non-US inflation-linked bond funds, or for real return funds.

For corporate debt, Lipper breaks investment-grade corporate debt funds into two classifications, Corporate Debt A-Rated and Corporate Debt BBB-Rated. Morningstar has a single corporate bond category. Lipper has a Loan Participation classification; Morningstar has a Bank Loan category. Lipper has a High Yield [corporate] bond classification, Morningstar has a High Yield Bond category. And, Lipper has a Convertible Securities classification which overlaps with the Morningstar Convertibles category. Lipper does not have a distinct grouping for preferred stock funds; Morningstar does.

Table 4

Taxable Fixed Income—Open End

| Lipper Classification | Morningstar Equivalent? |

|---|---|

| Core Bond | N/A |

| Core Plus Bond | N/A |

| Convertible Securities | Convertibles |

| Corporate Debt Funds- A Rated | N/A |

| Corporate Debt Funds- BBB Rated | N/A |

| Emerging Markets Hard Currency Debt | Emerging Markets Bond |

| Emerging Markets Local Currency Debt | Emerging Markets Local Currency |

| Flexible Income | N/A |

| General Bond | Long-Term Bond |

| General US Government | Long Government |

| General US Treasury | N/A |

| Global Income | N/A |

| GNMA | N/A |

| High Yield | High Yield Bond |

| Inflation Protected Bond | Inflation Protected Bond |

| Intermediate US Government | Intermediate Government |

| International Income | N/A |

| Loan Participation | Bank Loan |

| Multi-Sector Income | Multisector Bond |

| Short-Intermediate USGovernment | N/A |

| Short US Government | Short Government |

| Short US Treasury | N/A |

| Specialty Fixed Income | N/A |

| US Mortgage | N/A |

Lipper divides emerging markets bond funds into two classifications, Emerging Markets Local Currency Debt and Emerging Markets Hard Currency Debt; Morningstar makes a similar distinction with separate Emerging Markets Local Currency and Emerging Markets Bond categories.

Lipper divides funds focused on non-US bond funds into two classifications, International Income and Global Income; Morningstar has a single category for non-US bond funds, World Bond. Finally, Lipper has a distinct Specialty Fixed Income classification; Morningstar has no corresponding category.

Differences by Broad Asset Class: Municipal Bond

Both Lipper and Morningstar use the same duration bands for taxable and tax-free funds (Table 4). Lipper has non-duration based single-state classifications for seven states: MD, MA, MN, NJ, OH, PA, and VA; Morningstar has non-duration based single-state categories for five of those seven, but not MD and VA.

Lipper has three duration-based classifications for California municipal funds: short/intermediate, intermediate, and general [long]. Morningstar puts short-duration California funds into the Muni Single State category, but does have California Intermediate and California Long categories. Lipper has two duration-based classifications for New York municipal funds: short/intermediate and general [long]. Morningstar puts short-duration New York funds into the Muni Single State category, but does have New York Intermediate and New York Long categories.

Lipper has three duration-based classifications for “other” states: short/intermediate, intermediate, and general [long]; Morningstar has three categories for “other” states: short, intermediate, and long.

Lastly, Lipper has a High Yield Municipal Debt classification and Morningstar has a corresponding High Yield Muni category.

Differences by Broad Asset Class: Alternatives

For equity-based alternative funds, Lipper has an Alternative Equity Market Neutral classification which corresponds to the Morningstar Market Neutral category, and Lipper has an Alternative Long-Short Equity classification which corresponds to the Morningstar Long-Short Equity category. Lipper has a Dedicated Short Bias classification which corresponds to the Morningstar Bear Market category. And, for fixed-income based alternative funds, Lipper has an Alternative Credit Focus classification which is comparable to two Morningstar categories, Long-Short Credit and Nontraditional Bond.

As for hedge fund strategies, Lipper has two ‘single strategy’ classifications, Alternative Event Driven and Alternative Global Macro, for which there are no corresponding Morningstar categories. Lipper does have an Alternative Multi-Strategy classification, which corresponds to the Morningstar Multialternative category.

For commodity funds (those investing directly in the commodity, as opposed to funds that invest in firms that mine or cultivate the commodity), Lipper has a Managed Futures classification which corresponds to the Morningstar Managed Futures category; Lipper has a General Commodities classification, which corresponds to the Morningstar Commodities - Broad Basket category, and Lipper has three specialized commodity classifications for which there are Morningstar equivalents: Agriculture Commodities / Commodities – Agriculture; Energy Commodities / Commodities – Energy; and Commodities Precious Metals / Commodities – Precious Metals. Lastly, Lipper has a Commodities Specialty classification for which there is no Morningstar equivalent.

Lipper has two broad-based classifications, Absolute Return and Alternative Active Extension, for which there is not an equivalent Morningstar category. Lipper has an Alternative Currency classification which corresponds to the Morningstar Multicurrency category.

Morningstar has a series of ‘trading’ categories for which there are no equivalent Lipper classifications: Trading – Inverse Commodities, Trading – Leveraged Commodities, Trading – Inverse Debt, Trading – Leveraged Debt, Trading – Leveraged Equity, Trading – Miscellaneous. Finally, Morningstar has a category, Options-Based, for which there is no equivalent Lipper classification.

Allocation and Mixed-Asset Funds: Risk-Based

The Lipper classification system and the Morningstar category systems for target risk funds have some overlap, but are considerably different. Lipper’s classifications and Morningstar’s categories are based on equity percentage as a proxy for risk (expected volatility); what varies in this regard are the equity bands.

Lipper locates funds intended to provide income to already-retired investors within its risk-based allocation series under the heading “Today” as well as in a separate grouping for retirement income investors. Morningstar, in contrast, does not have a separate ‘income’ (or ultraconservative) category, and locates retirement income funds at the front end of its target-date series. The total number of funds within each series varies; Morningstar has approximately 40% more funds within its five categories than Lipper does within its five classifications, excluding retirement income. Lastly, Lipper has several multi-asset classifications, such as Flexible Portfolio, for which there is no Morningstar equivalent.

Allocation and Mixed-Asset Funds: Target Date

The Lipper target-date classifications and the Morningstar target-date categories are very similar, if not identical. For both, groupings are based on vintage date (objective) rather than underlying holdings or asset allocation. For both, groups corresponding to five-year ‘vintages,’ beginning in 2010 with five year-increments thereafter.

Morningstar has a separate category for funds that have already reached their vintage date (2000-2010); Lipper puts some of these funds in its 2010 classification and treats others as retirement income. Another difference is that Lipper’s classifications end at 2055+, whereas Morningstar’s final category is 2060+.

How Much Overlap Is There Between The Two Systems?

The answer, frankly, is that it depends. In some cases, our research has found overlap as high as 90%, whether going from Lipper to Morningstar or Morningstar to Lipper. In other instances, even where one might expect a high degree of overlap (because both firms have the same grouping), it is on the order of 30-40%, again going from one to the other. Moreover, overlap rates vary by product type with rates generally being higher among ETFs, which are newer, most often index-tracking, and have narrowly defined strategies than among open-end funds, which are predominantly actively-managed and have broader investment mandates.

It is important to note that both systems are dynamic: Morningstar’s category system is prone to expand and contract based on the number of funds in a category, as a certain minimum is necessary to construct a bell curve to generate the star rating. In addition, Morningstar’s system, in our view, is predicated on distinct differences in expected returns, which would be modeled in an asset allocation. On the other hand, Lipper’s system has a smaller minimum size for each classification, and thus can separate more quickly into additional classifications and maintain existing classifications longer. Then, too, Lipper’s system is, in our opinion, also more responsive to declared objectives as well as marketing and sales distinctions. Lastly, we would say that neither system is fully evolved in its treatment of alternative investments.

Examples

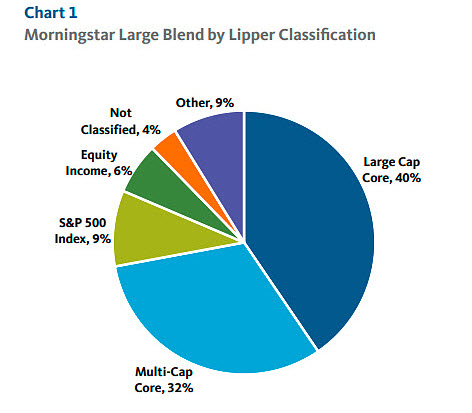

Chart 1

Morningstar Large Blend by Lipper Classification

While one might expect to see a high degree of overlap between the Morningstar Large Blend category and the Lipper Large Cap Core classification (see Chart 1), the figure is arguably only 49%: 40% of funds are in fact in the same grouping, and 9% are S&P 500 index funds, which Morningstar groups as Large Blend index funds.

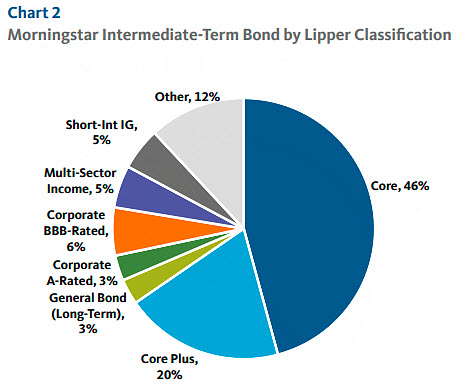

Chart 2

Morningstar Intermediate-Term Bond by Lipper Classification

The relatively low overlap between the Morningstar intermediate-term bond category (see Chart 2) and the Lipper core bond classification is more immediately understandable: Morningstar does not distinguish between ‘core’ bond funds, those whose holdings largely correspond to the kinds of bonds in the Bloomberg Barclays US Aggregate Bond Index, and ‘core plus’ funds, which hold those securities as well as significant portions of high yield, non-US dollar, as well as municipal bonds and TIPs.

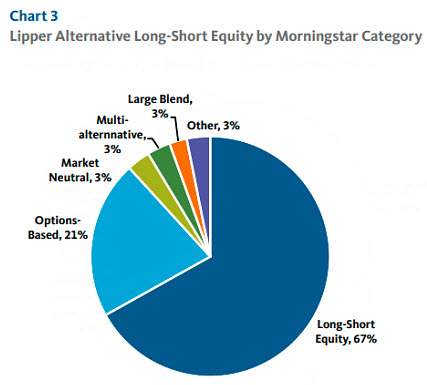

Chart 3

Lipper Alternative Long-Short Equity by Morningstar Category

Lipper, on the other hand, makes this distinction and in addition has two separate corporate bond classifications. Morningstar has a single corporate bond category, but applies different thresholds to separate funds that hold primarily corporate issues as well as securitized and government bonds.

Perhaps surprisingly, alternative fund groupings can be more consistent than basic equity and fixed income ones (see Chart 3). For example, two funds of the funds that Lipper classifies as long-short equity are also categorized by Morningstar under the same name. In this instance, however, Morningstar has a distinct grouping, options based, for which there is no Lipper equivalent.

What About Expenses?

As noted, a switch from Lipper classifications to Morningstar categories will affect not only performance rankings but also expense rankings, as the constituents of the denominator in any x/y ranking, where x is the subject fund, and y is the set of its peers, will vary. It is also important to note that the use of Morningstar or Lipper data may also affect expense rankings as follows:

- For net expenses, derived from the annual report, the figures from the two firms should be identical. However, Morningstar does and Lipper does not collect semi-annual expense data, which, in an era of price cuts, can mean that a comparison universe from Morningstar contains more recent and hence lower net expenses, which would make a given subject fund’s rankings lower (worse).

- Lipper has, in our opinion, a more consistent separation between 12b-1 fees, non-12b-1 distribution fees, and related shareholder costs, such as transfer agency fees. In the current “clean share” environment, boards may need to pay particular attention to charges that could be construed as “distribution in guise.” Morningstar’s recent addition of ‘bundled,’ ‘semi-bundled,’ and ‘unbundled’ service fee arrangements may address some of these concerns.

Takeaways

Directors should be aware that the choice of Lipper classifications or Morningstar categories for a series of funds is exclusive: the two cannot be combined in any way. However, the use of one system does not preclude the use of data or rankings from the other.

Boards first need to consider the effects of a change on other parts of the organization, beyond 15(c). For example:

- Lipper classifications and Morningstar categories are used to sell and market funds, to gauge the performance (and pay) of portfolio managers, and to communicate results to shareholders. Will the new reports be more (or less) consistent with the standards used by these other parties?

- How are the Lipper classifications and Morningstar categories — and the ratings and rankings derived from them — used by gatekeepers and fiduciaries to determine which funds are even available to investors via a particular distribution channel? Will a switch help (or hinder) the board’s ability to understand why funds are (or are not) on a particular brokerage platform, supermarket, or qualified plan menu?

- Last, as with any change, boards should be wary of how a shift — particularly one that improves the expense or performance ranking of a fund — is viewed by compliance staff. Broadridge can present the potential costs and benefits of a change, help boards document their rationale, and “lock in” a process that will be credible because it is consistent.

Contact Us

Welcome back, {firstName lastName}.

Not {firstName}? Clear the form.