If you are a holder and/or issuer of LIBOR-linked securities extending beyond the end of 2021 the time to prepare is now and should be an urgent priority not only to evidence support for the transition but also build internal expertise required to compete in the post LIBOR marketplace.

“The U.S. financial industry must accelerate efforts to move away from the scandalplagued LIBOR reference interest rate… The Federal Reserve will expect to see an appropriate level of preparedness at the banks it supervises.” - Federal Reserve Vice Chairman for Supervision Randal Quarles, Reuters April 10, 2019

Focus on Alternatives

As it is unclear if LIBOR will be permanently discontinued by the end of 2021 firms must plan for multiple LIBOR potential cessation scenarios including for LIBOR continuing in some post2021 form. This uncertainty is also aggravated by the existence of multiple alternative RFR rate schemes set to replace LIBOR in 2021. Unfortunately, the composition of LIBOR diverges from these RFRs rates creating several upfront complications:

- Not all RFRs reflect a degree of bank credit risk

- RFRs are daily backward-looking secured or unsecured overnight rates versus LIBOR which is a forward-looking term rate with a range of maturities

- There is no simple equivalency conversion (such as LIBOR = SOFR + spread %)

- Forward looking term representations for the RFRs have yet to be published

- Firms must carefully factor tenor and other considerations in contract negotiations

- Switching will impact pricing and valuations schemes as alternative RFRs may fragment quotation and trading

- Operational impacts to accrual calculations and rate maintenance need to be resolved

- Potential asset-liability mismatch risk between borrowing and lending activities as bank funding would no longer include much unsecured interbank lending and the setting prices on LIBOR will no longer provide a “natural hedge”

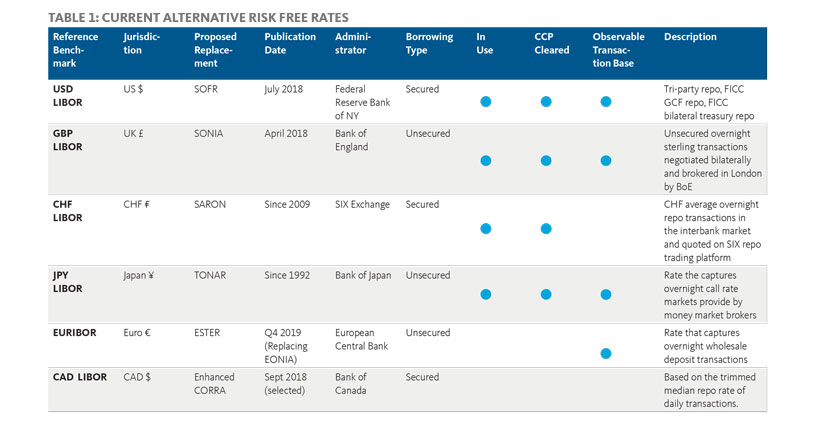

Despite the inferred complications these RFR rates (Table 1) are deemed advantageous over LIBOR as they are based on observable transactions within liquid markets and across multiple financial services sectors. The replacements must also comply with key standards and guidance from governing bodies (e.g. ARRC, IOSCO Principles for Financial Benchmarks, FRB).

Market Adoption Timeline

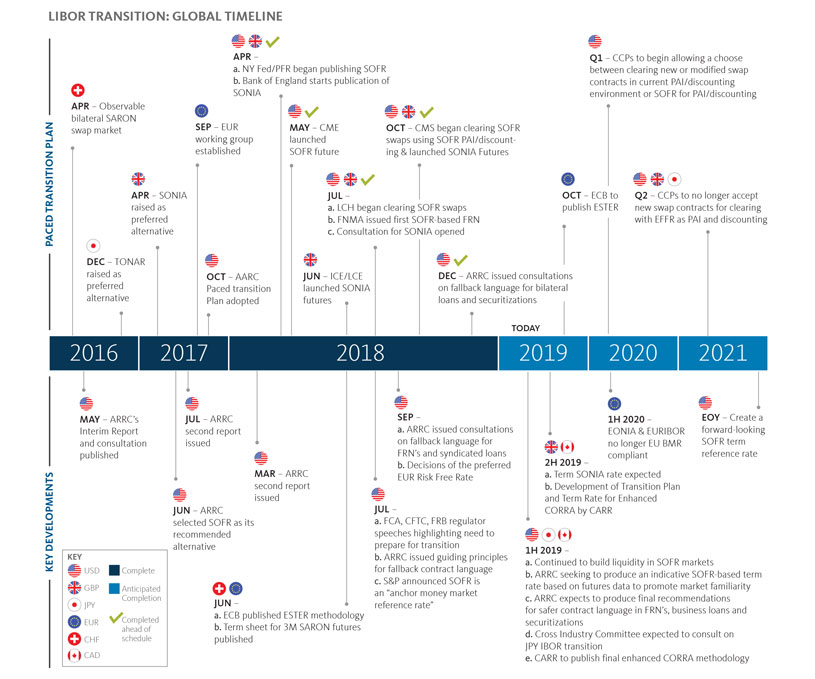

Various international governing bodies are overseeing the development of the alternative reference rates and have published RFR development schedules to aid the marketplace with transition planning and facilitate a smooth and orderly progression until the end of 2021 (Exhibit 1).

The primary goal for these administrators is to encourage voluntary adoption rather than mandate a transition from LIBOR. They are also tasked with considering industry best practices related to contract design and building a baseline level of liquidity for products utilizing alternative RFR rates. This promotion of trading volume is viewed as the path to provide enough market liquidity to support pricing across the yield curve and make the transition from LIBOR by 2021 more feasible.

Industry Implications

This transition is more than a simple “search-and-replace” exercise. There are fundamental challenges and impacts across the enterprise that need to be considered during implementation planning.

Trading/Pricing

Benchmark rate term structures – Will require sufficient trading to build liquidity in futures and swap contracts to provide longer dated exposures and price transparency across the term structure.

Cross-currency basis risk/Credit spread – Firms will need to determine how to best minimize basis risk and develop approaches for managing cross-currency basis risk for varying RFR rates.

Hedging/Hedge accounting – Continued need to monitor and align new and legacy benchmark interest rates between hedging instruments (e.g., swap) and hedged items (e.g., debt issued) to meet requirements for valuation and effectiveness testing.

Valuation, model and risk management – LIBOR has been the proxy rate used for valuation, risk modeling, and a discount factor for prepayment schedules. This means a wide range of financial and risk models will need to be redeveloped, recalibrated and revalidated using the agreed adopted RFR rate regime. Given the lack of historical time series data for RFRs firms will need to build an inventory of all pricing, valuation and risk models that are LIBOR dependent and rank order the models for redevelopment.

Replacement timing – The US and UK have settled on an RFR alternative, but other major currencies are still working on theirs. This would shift the market away from an international unsecured standard resulting in challenges in cross-currency swap markets since instead of using the similar rate for both legs of a foreign currency (FX) swap, trades may need different rates for each leg (e.g., USD at secured SOFR swapped for GBP at unsecured SONIA).

Legal/Contracts

Client outreach, repapering, and negotiating contracts – For contracts maturing beyond 2021, firms may need to renegotiate with their borrowers and counterparties to transition the base rate from LIBOR. Unlike derivatives contracts, cash products for corporate and retail end users have limited contract standardization, or industry protocol most likely forcing firms to identify the affected contracts, digitize them, extract the relevant terms, and update each contract through bilateral or multilateral negotiations.

Fallback provisions – Firms will need to update the language in existing contracts to cover the discontinuation of LIBOR with an RFR or other agreed replacement to address the risk of LIBOR discontinuation before 2021.

- Credit – Impacts to valuation if fallback provisions are triggered that may require credit spread premiums to support pricing considerations between new and legacy transactions

- Derivatives – updating of ISDA masters and CSAs to reflect the permanent discontinuance of the LIBOR benchmark

- Corporate lending – Parties to agreements need to consider building flexibility to amend interest rate determination provisions potentially lowering standards for amendment approvals such as consent of the borrower and majority lenders

- Debt/Floating rate securities – Issuers/trustees need to consider how a replacement rate could affect note holder interests and the potential impact on payments arising from discontinuance or replacement

- Transition period – Continued publication of LIBOR despite reduced liquidity may render a fallback rate usage contractually prohibited requiring additional workarounds

Regulatory

Financial disclosures – The SEC will expect registrants to provide disclosures about the effects of the LIBOR replacement activity that is deemed material to areas such as liquidity, debt covenant compliance, and hedge accounting. Companies with outstanding floating rate notes based on LIBOR may also need to report the events that trigger the substitution and/or disclose the types of backstop arrangements in place if LIBOR is no longer quoted.

No legal or regulatory mandate – The timetable to transition from LIBOR to RFRs is not set out in legislation, even though regulators have stated their intentions clearly and repeatedly. The consequence of this lack of legislative underpinning is that different (regulated) firms could reasonably take different views as to what actions need to be taken and by when. Furthermore, unregulated counterparties are not directly subject to any regulatory pressure to renegotiate LIBOR-linked contracts and therefore may be slow or reluctant to engage.

Infrastructure/Operational

System infrastructure – The transition to a new rate could mean a number of strategic, business and technological changes to administrators, financial institutions and end-users triggering potentially costly changes in internal and third-party pricing, accounting, and risk management models and systems.

Tax Implications – Considerations if a change in interest calculations for debt instruments would constitute a “significant modification” of the debt, resulting in tax consequences for the issuer and holder of the debt and possible re-characterization for tax purposes.

Next Steps

After establishing an enterprise level governance and program management structure most firms will need to assess, quantify and document the risks and impacts to broad areas such as accounting, liquidity, pricing, margin/collateral, and treasury. This is required to construct a plan that effectively transitions from an unsecured LIBOR-linked products, to corresponding RFR based rate products in a controlled manner. Operational front-to-back changes must also assess and collate corresponding changes required for a firm’s infrastructure, and vendor partners.

Planning considerations should include:

- Enterprise wide analysis, by line of business, function, and geography

- Use of a centralized program management structure from the outset

- Identified necessary stakeholder groups required to conduct the assessments, set methodology, determine impact, and identify next steps (e.g., legal, finance, controllers, risk managers, treasury, business/product owner, communications, audit, operations, and systems)

- Objective assessment of functional strengths and weaknesses and then consider hiring experienced vendors to support the transition team to fill internal gaps, bolster existing teams and thereby minimize staff burn-out

- Ring fencing subject matter experts and solicit their concerns (e.g. traders for secured versus unsecured risk, operations for margin and collateral impact)

Initial Assessment Workstreams

Contract gathering and analysis – Identification and review of all contracts that reference LIBOR that could trigger the reset or use of LIBOR as a benchmark.

System infrastructure review – Enterprise review of trading, clearance and settlement, and reference data systems to evaluate what changes may be required to support RFRs. Review valuation systems where LIBOR is used as a rate in financial models in constructing curves for fair-value valuations. Review internal and external reporting systems.

Operations impact review – Subject matter specialist led gap analysis and impact assessments of the front to back operational processes within your business.

Regulatory, compliance and accounting assessments – Companies with outstanding floating rate notes based on LIBOR may need to report the events that trigger the substitution of the rate and the implementation of a new rate, and/or disclose the types of backstop arrangements in place if LIBOR is no longer quoted.

Communications – There is a need to assess and develop a communication plan to cover the scope of external communications required with clients and investors throughout the transition.

Engage with our team of experienced professionals who work across accounting, risk, operations, treasury, compliance and other functions with the top financial services companies around the world. We can assist with the assessment of the impact to the organization of LIBOR replacement and then develop a timeline and plan for change that covers the multi-dimensional organizational changes required while highlighting potential growth and enhancement areas.

Finally, we can work with cross-functional teams within organizations to implement these plans with the goal of a controlled and smooth transition to a new benchmark rate, with minimal business cost and business disruptions.