Background and Current Status

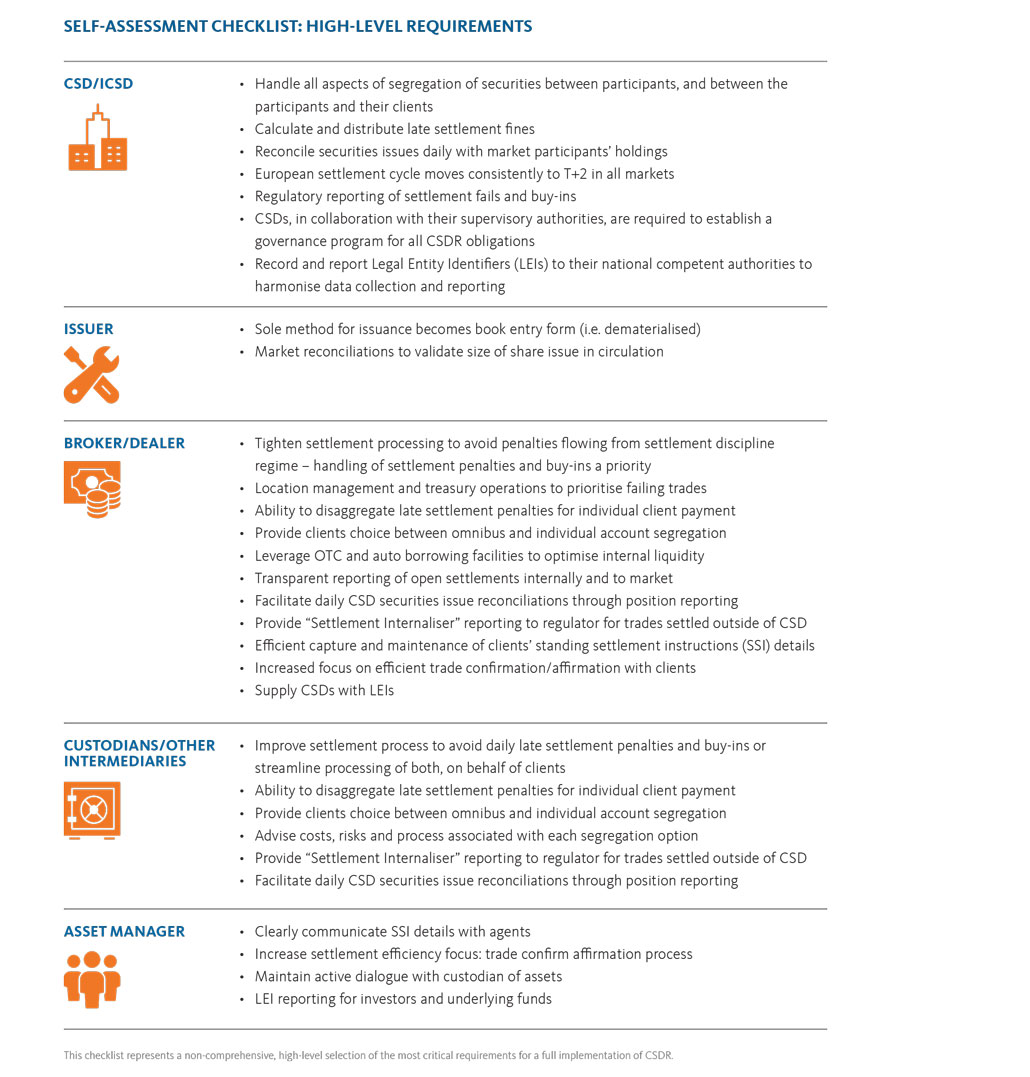

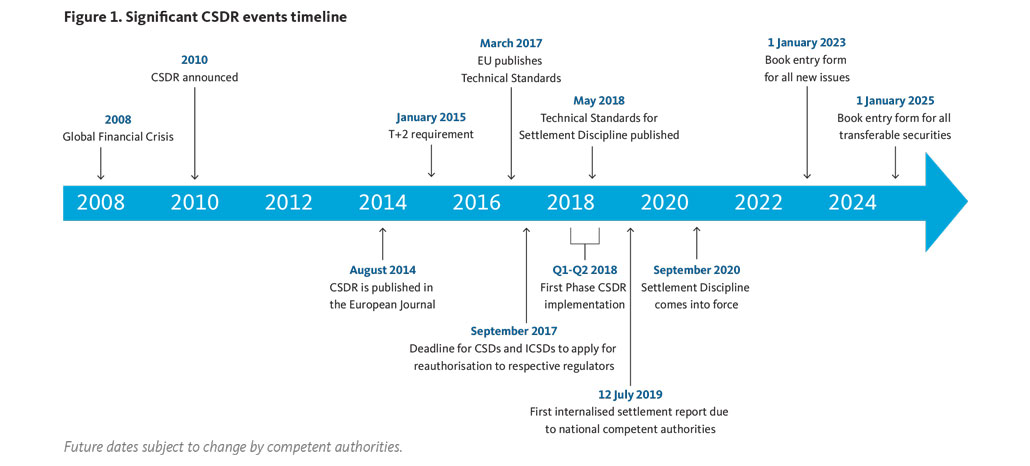

CSDR was published in the Official Journal of the European Union in August 2014 and is gradually entering into force. The regulation applies to EU CSDs (and ICSDs), issuers that issue securities in EU CSDs, participants and indirect participants at CSDs, and banks offering banking services to EU CSDs.

The principal way that compliance with CSDR will be enforced is through authorisation of CSDs (by the home member state Competent Authority), a process which began in the first half of 2018.

The European Commission is overseeing CSDR with the Technical Standards (ITS & RTS) being defined by the European Securities and Markets Authority (ESMA) in cooperation with the European System of Central Banks (ESCB).

How the Responsibilities are Mapped

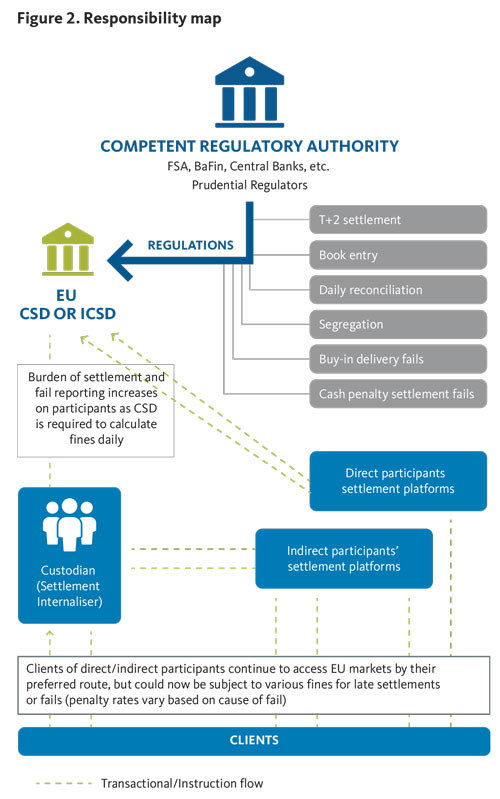

An overriding priority for CSDR is to harmonise the different rules applicable, and establish a level playing field among European securities depositories. Another imperative is to increase the safety of assets and improve operational efficiency of securities settlement, leveraging enhanced infrastructure and more robust, consistent discipline measures that will encourage timely settlement.

The principal means by which European regulators aim to achieve this is by insisting that CSDs and ICSDs ascribe to a single set of rules that are consistent across the EU 27 markets.

With Target2 for Securities we have already seen the transition of settlement cycles to a T+2 settlement regime, and a move to dematerialisation that brings us to nearly 100% book entry form for securities.

Under CSDR, CSDs will now additionally be bound by regulation to perform a daily reconciliation of securities balances, with support and data from market participants. They are also required to maintain the segregation of client assets throughout the settlement and safekeeping process.

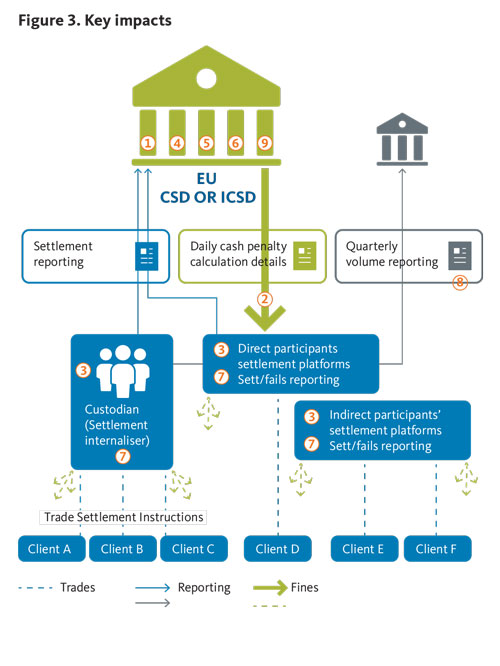

As such, CSDR aims to enforce a more rigorous process and calculation of cash penalties for any settlement fails. Reporting such fails will impact all participants in the transaction process and enforce buy-ins for participants’ delivery fails. This is a significant change, as many markets have never applied such disciplines from a regulatory mandate.

Key Impacts and Application of the Rules

Responsibilities of the CSD and Participants

- All European CSDs are required to complete settlement for all on-exchange trades 2 days following transaction date (T+2)

- Cash penalty on settlement fails: CSD will levy a daily cash penalty, on banks and financial institutions that use their services, for each settlement instruction that fails to settle by the intended settlement date, with reporting of settlement fails on an annual basis from CSD to the Competent Authority

- Mandatory buy-in for delivery failure for any financial instrument within a set period of the settlement date. The buy-in is executed by the participants (by the CCP for CCP-cleared transactions, or executed at the trading level with the trading party for non CCP-cleared transactions)

- CSD to complete a daily reconciliation to verify records with participants, and provide to participants

- CSD to enable segregation of securities between participants, and participants and their clients, and offer omnibus and individual client segregation

- With the daily reconciliation obligation for CSDs (see 4 above) participants will invariably be involved in this process - although this is not a part of the regulatory requirement - to ensure their records for the number of securities held in each security issue matches with information received from the CSD on a daily basis

- CSDs’ participants must be able to offer their clients at least the choice between omnibus segregation and individual client segregation, and to inform them of the costs, level of protection and risks associated with each option

- Settlement agents, intermediaries and custodians will be required to report aggregated volume and value of all security transactions settled outside of a CSD (i.e. off-exchange) on a quarterly basis to the Competent Authority

- Issuance of transferable securities by EU issuers is required to be represented in book entry form (i.e. dematerialised)

Implications for Market Participants

The Principal Rule Changes with CSDR

The new regulations imposed by CSDR carry clear implications for the wider securities industry in Europe, and will mandate changes in a number of the steps in the process lifecycle. The detail below aims to explain some of the practical effects of those changes:

Most European markets have gone through processes to largely remove physically held and traded securities since the 1980s. The new legislation mandates book entry form, with the target of moving fully away from physical certificates to electronic book keeping (dematerialisation) - or where paper securities are held in a vault and not circulated (immobilisation). Any issuer established in the EU that issues, or has issued, transferable securities which are admitted to trading or traded on trading venues, is required to arrange for such securities to be represented in book entry form.

The goals of efficiency, consistency across markets and risk reduction are all addressed by the CSDR requirement for T+2 settlement for all European CSDs. Completing settlements for all on-exchange trades two days following their transaction date brings all CSDs on to a harmonised model for finalising the settlement cycle (this requirement was fulfilled when Spain migrated in September 2016).

Some of the biggest changes under CSDR have primary impacts beyond the CSDs themselves, to institutional market players and custodians. These changes involve the settlement process. Chief amongst these is a newly restyled settlement discipline regime, which targets timely and efficient settlement in two steps – through the introduction of cash penalties, and by implementing a mandatory buy-in procedure.

Cash penalties and mandatory buy-ins are components of a settlement discipline regime to address and prevent settlement failures, with the aim of encouraging the timely settlement of transactions by all participants (including indirect participants) at a CSD, monitoring settlement fails and providing regular reporting to the respective regulators. This will apply as a single model across the EU. CSDs can also suspend customers that consistently fail to deliver securities, or impose limitations on such customers.

Daily reconciliation: To ensure and validate the integrity of issues in the market, CSDs will be expected to take appropriate reconciliation measures, on a daily basis, that verify the number of securities making up an issue submitted to the CSD is equal to the sum of securities recorded on the securities accounts of the market participants. This action will fall upon both the CSDs and market participants to complete, as participants will need to provide the CSD with all information required to ensure the integrity of an issue, and work with the CSD to solve any reconciliation breaks.

CSDs will also be required to enable the full segregation of securities between participants, and between participants and their clients. They must offer both omnibus and individual client segregation. Requirements placed on CSDs are:

- Enable the segregation of securities for one participant from securities of another participant

- Enable a participant to segregate their securities from the securities of that participant’s clients

- Enable a participant to hold in one securities account the securities of different clients of the participant (“Omnibus Client Segregation”)

- Enable a participant to segregate the securities of any of the participant’s clients (“Individual Client Segregation”)

For market participants the segregation requirement is:

- Offer clients the choice between omnibus and individual client segregation, and

- Advise costs and risks associated with each option

Risks and Issues - How Can the Market Prepare?