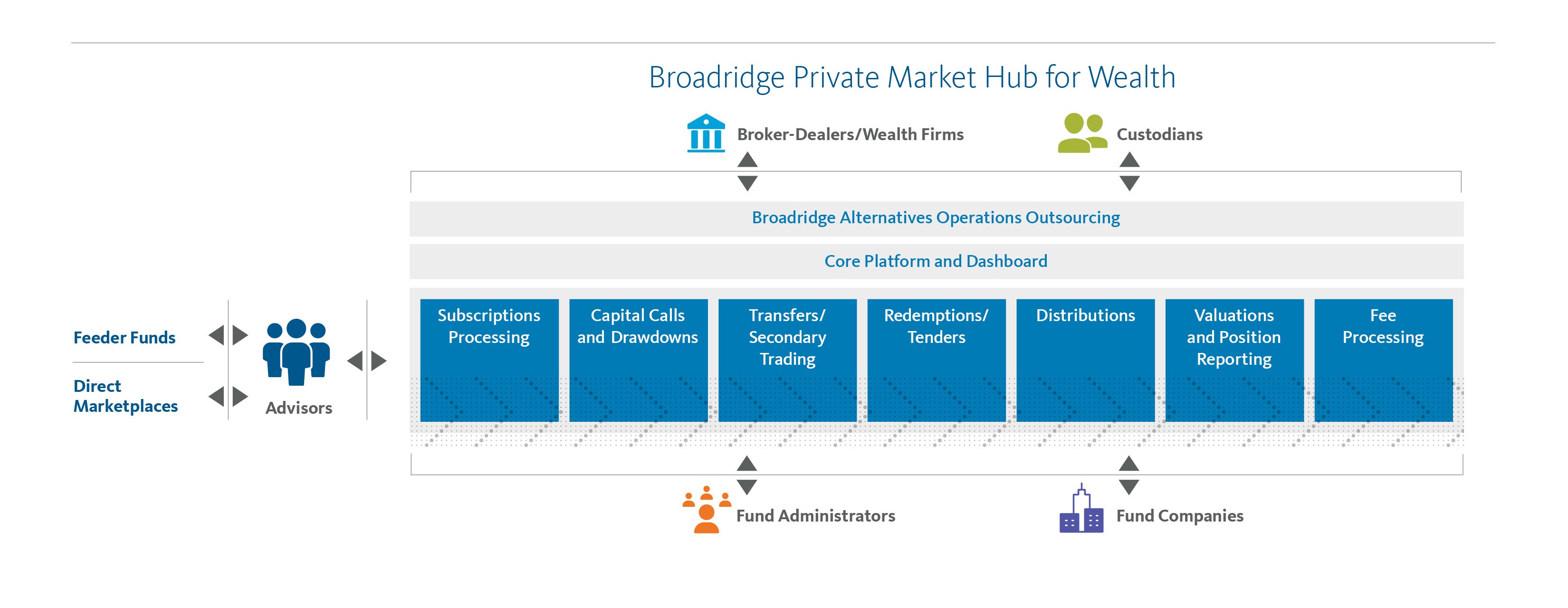

The alternative investment industry remains well behind the technology curve. Too many firms rely on outdated, unsecure legacy systems and labor-intensive processes that prevent them from growing their alternative investments book. That’s why we are introducing the Broadridge Private Market Hub for Wealth, a cloud-based end-to-end solution to automate workflows across the entire alternative investment lifecycle, including leveraging machine learning and natural language processing to parse unstructured data from funds and fund administrators.

Our solution sits at the intersection of wealth firms/custodians and funds/fund administrators. It standardizes data connectivity, aggregates transaction data and provides a centralized view of transaction flows. By enhancing connections between multiple industry participants across the value chain, we can help accelerate time to investment, reduce manual intervention, mitigate risk and more.

- Improve advisor and investor experiences

- Increase straight-through-processing

- Gain total visibility across the process

- Optimize operations for exponential growth

Private Market Hub for Wealth- Simplicity at every step

Cloud-Based Core Platform and Dynamic Dashboard

Automated, flexible and actionable

The core platform is an end-to-end workflow system, featuring a digital dashboard for real-time business intelligence reporting and transparency. A common data source for all stakeholders, Private Market Hub for Wealth is supported by a customizable and configurable rules engine with alerts, cross-validations and confirmations, enabling “four eyes” approvals, notifications and integrations with clients’ books and records for a consolidated view.

Automated Transaction Processing

Increased accuracy and transparency

The platform smoothly handles all types of transactions, from fund-initiated transactions such as capital calls or distributions, to investor-initiated transactions such as redemptions or tenders.

Modules for each transaction type provide user interfaces to capture the requests, communicate with the funds/fund administrators and process the transactions.

- Accept structured/unstructured fund distribution data from fund companies and administrators

- Automate reconciliation versus books and records

- Process individual investor account allocations

Valuation and Position Reporting

Greater compliance confidence

Broadridge manages the varying formats and quality of valuation, positions and activity, minimizing required manual intervention. The solution ingests all information into the shared workflow dashboard and database for easy retrieval of full historical valuation data. Machine-learning OCR eliminates the need for manual checks and balances of fund-specific valuation data.

Track Activity in Real Time

Improved advisor/investor experience

Customizable, built-in SLAs deliver a roles-based, single source of truth for all operational metrics. A shared dynamic dashboard gives your operations team access to one common data source

- Improve visibility and transparency

- Enable centralized view of transaction flows

- Mutualize operations costs through outsourcing

Put Intelligent Automation to Work

Increases efficiency and ensures security and accessibility

The solution also supports fund administrators/fund sponsors that do not send structured data. It scans PDFs and other unstructured data and digital materials with machine-learning OCR to extract and verify printed and handwritten text prior to accepting it for digital use.

- Reduce processing time

- Minimize errors

- Trigger custom notifications

- Create an audit trail

Contact Megan Flemming at +1 (646) 531 8464 or Megan.Flemming@broadridge.com.