当社販売担当者よりお問い合わせに関するEメールを差し上げます。

ご本人でない場合は、 フォームをクリアしてください。

営業担当者に対するお電話でのお問い合わせはこちら

販売担当者へのお問い合わせを受付けました。当社販売担当者より折返

しご連絡を差し上げます。

NEW YORK, May 15, 2023 – Three major investor trends are playing out in the asset management industry, according to the latest edition of the U.S. Investor Study from global Fintech leader, Broadridge Financial Solutions (NYSE: BR). The democratization of investing among all generations and investible asset levels, the evolution of the next-generation investor and the decline of active mutual funds are trends causing an urgent need for the fund industry and wealth managers to adjust their products and invest in new data, analytics and digital capabilities in order to address these changes.

Broadridge’s landmark U.S. Investor Study draws on detailed analysis of billions of investor data points, made possible by its critical role at the center of a communications network linking thousands of brokers, tens of thousands of funds, and more than 100 million individual investors. As a result, the Study provides a powerful lens for asset managers and financial advisors alike to better understand the powerful trends driving the investment landscape.

“Personalization is becoming one of the industry’s most disruptive trends that will have a profound impact on asset management product and distribution strategies,” said Dan Cwenar, head of Broadridge Data and Analytics. “A deeper understanding of the end investor, especially those self-directing their assets, creates an opportunity for advisors to develop a more personalized experience for investors.”

The Democratization of Investing and the Rise of the Young Investor

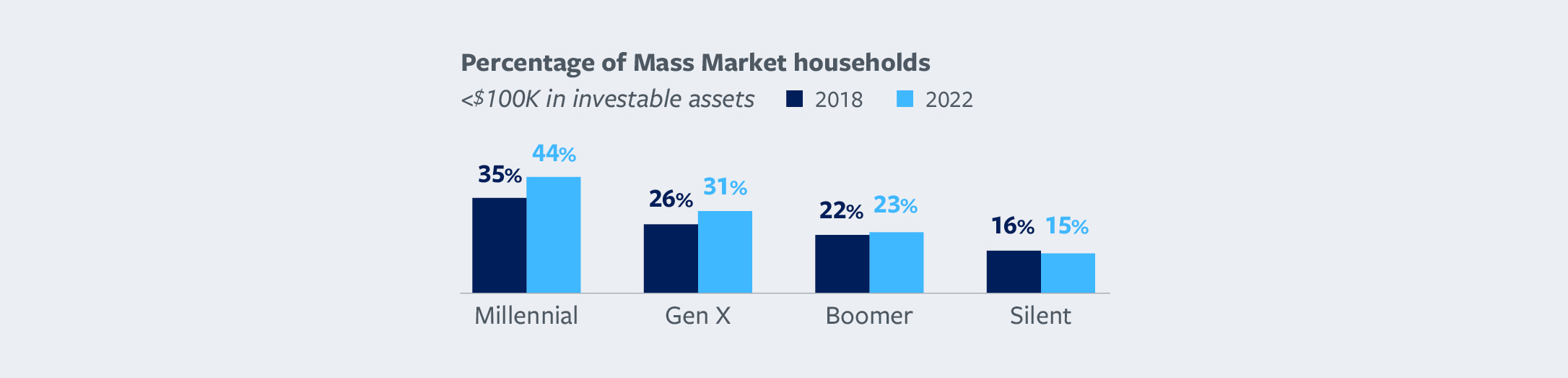

The investor population has changed significantly over the last four years as new investors enter the market. There is a surge in younger investors and an increase in Mass Market investor households (less than $100K in liquid investable assets) across Millennial, Gen X, and Boomer generations. The percentage of investor households with less than $3.5K in investments rose among both Millennials and Gen-X generations.

The Next Wave of Investors

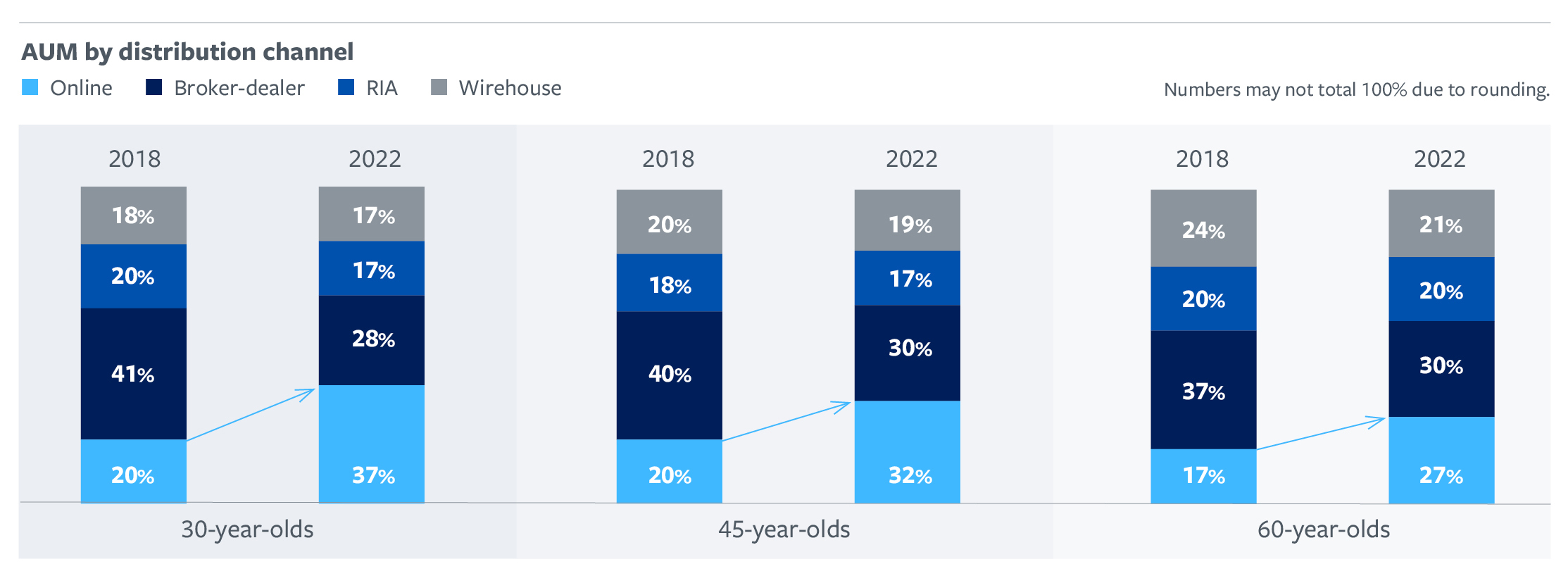

Additionally, across age groups, more investors now use the online discount channel compared to four years ago. The number of investors using other channels remained relatively steady. A significantly higher percentage of assets is now concentrated in the online channel, while broker-dealer, RIA and wirehouse declined. As investors of all ages, particularly younger investors, flock to the online discount channel, it is increasingly important for asset managers and advisors to find ways to engage with and educate them.

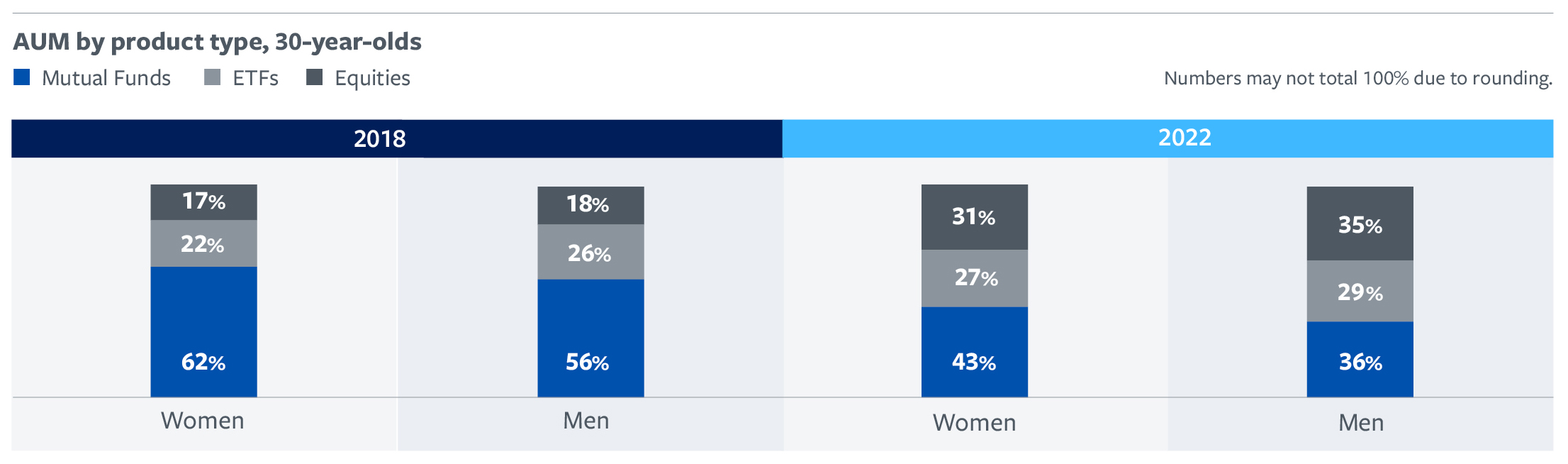

A spotlight on 30-year-old investors reveals women held a higher percentage of their invested assets in mutual funds, compared to their male counterparts, who held a higher percentage of their assets in ETFs and equities, though both have moved to a more balanced mix among these products.

Narrowing differences among 30-year-olds by gender were also seen in median AUM, reliance on the online channel and weighted average fund risk score.

Decline in Active Mutual Funds, while ETFs and Equities Rose

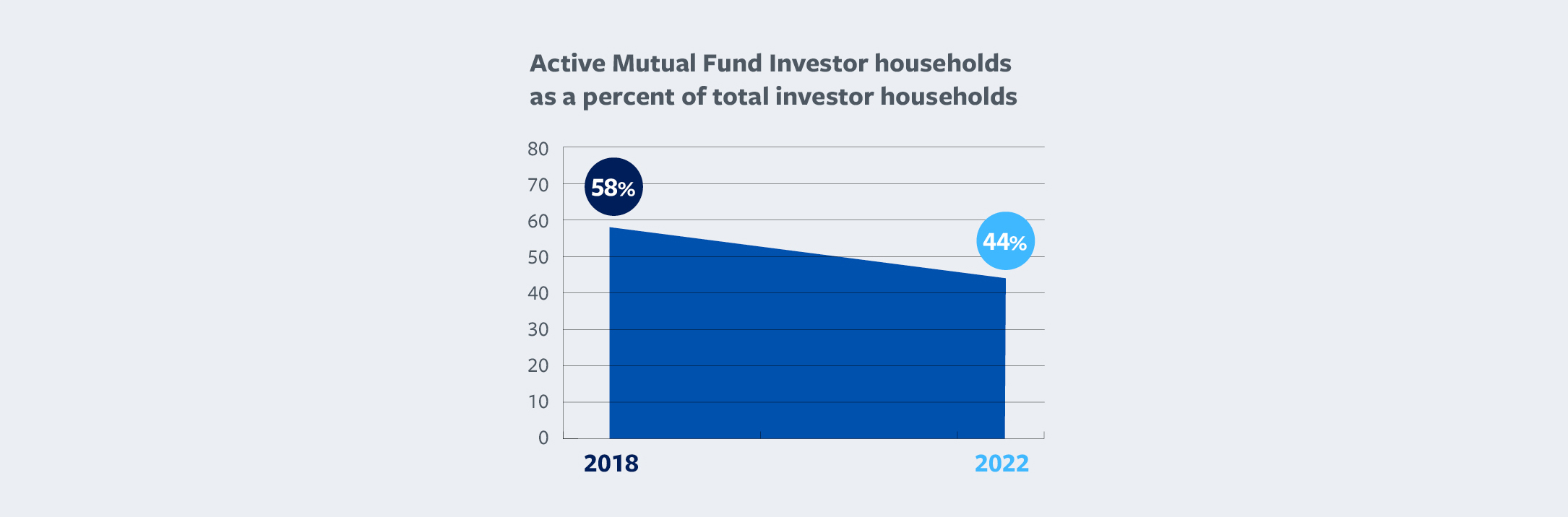

Assets for mutual funds, a product that was once the mainstay of investor portfolios, declined across every generation and wealth segment in the past four years, while ETFs and equities gained.

“Active Mutual Fund Investor” households, those with more than one-half of their assets in active mutual funds, accounted for 44% of households in 2022, a steep 14% decline from four years ago. These households are more likely to be lower earners (less than $100k income) and heavy users of the broker-dealer channel.

Broadridge’s U.S. Investor Study is one of numerous proprietary reports enabled by Broadridge’s Data and Analytics capabilities. Firms use Broadridge’s data-driven insights to better understand where their best opportunities are and how to capitalize on them, and ensure they have their resources aligned against the right clients and customers. The critical perspective firms gain enable them to make better, more informed strategic decisions about their businesses.

To view Broadridge’s newest U.S. Investor Study, click here.

Study Methodology

To create this study, Broadridge analyzed de-identified share ownership data derived from Broadridge’s proprietary business processes consisting of tens of millions of retail investor households and billions of data points to achieve a unique level of insight into holdings invested through financial intermediaries (broker-dealers, online, RIAs, wirehouses). Broadridge analyzed exchange-traded funds (ETFs), closed-end funds, open-end mutual funds and U.S. equities held in taxable accounts and IRAs for the years ending 2018, 2019, 2020, 2021 and 2022.

About Broadridge

Broadridge Financial Solutions (NYSE: BR) is a global technology leader with the trusted expertise and transformative technology to help clients and the financial services industry operate, innovate, and grow. We power investing, governance, and communications for our clients – driving operational resiliency, elevating business performance, and transforming investor experiences.

Our technology and operations platforms process and generate over 7 billion communications per year and underpin the daily trading of more than $10 trillion of securities globally. A certified Great Place to Work®, Broadridge is part of the S&P 500® Index, employing over 14,000 associates in 21 countries.

For more information about us, please visit www.broadridge.com.

報道関係者 お問い合わせ先 :03-5425-7220, アシュトン・コンサルティング BroadridgeJapanPR@ashton.jp。