当社販売担当者よりお問い合わせに関するEメールを差し上げます。

ご本人でない場合は、 フォームをクリアしてください。

営業担当者に対するお電話でのお問い合わせはこちら

販売担当者へのお問い合わせを受付けました。当社販売担当者より折返

しご連絡を差し上げます。

DLT-powered intraday repo trades are quantifiably eliminating costs, reducing risks.

MARK WENDLAND

COO, DRW

Mark Wendland joined DRW as its Global Head of Treasury in 2019. Mark previously worked at Citadel, where he led the firm’s U.S. Operations, Global Fixed Income Finance, Counterparty Strategy and Relationship Management business units

Mark received his bachelor’s degree from Carroll College.

Distributed Ledger Technology (DLT) is helping banks, broker-dealers and other financial service firms unlock intraday liquidity that can save millions of dollars in costs. DLT-powered repo solutions are arriving on the scene at the perfect time for sell-side firms looking for ways to address rising funding costs that are putting margins under pressure.

Sell-side firms use repo transactions to access liquidity. Although repo is an important tool for cashflow management, it has some serious shortcomings. The most basic of these is a fundamental misalignment in timing. Sell-side firms use repo transactions to help avoid account deficits created by huge cash inflows and outflows over the course of a business day. Usually, those deficits exist for hours, or even just minutes. However, the current market structure was not built to facilitate trades of that short a time span. Using traditional securities processing infrastructure, it’s virtually impossible to execute and settle a trade on that compressed timeframe. In fact, it’s almost impossible to settle trades on the same day. As a result, firms are forced to pay for overnight repo transactions, when they really only need the liquidity for a much shorter period of time.

Even with those overnight transactions, the funding system is not efficient enough to cover all account deficits. Every day, the sell side pays millions of dollars in “daylight overdraft” fees to the U.S. Federal Reserve. That inefficiency didn’t rank as a top concern when interest rates were near zero and funding costs for banks and other financial service providers were low. But in today’s interest-rate environment, minimising operational and funding costs has become a strategic imperative.

Enter DLT. New platforms from Broadridge and other providers use DLT to provide the velocity, transparency and security needed for intraday repo transactions that are radically enhancing the efficiency of cashflow management. “With Broadridge’s DLT platform, you can receive money at 9 a.m. and return it at 11 a.m.,” says Michael Walsh, Head of Capital Markets IT and Operations in the Americas for Societe Generale, an early adopter of Broadridge’s Distributed Ledger Repo (DLR) solution.

In many ways, repo represents an ideal use case for DLT: it’s a market in which many bilateral transactions executed with manual processes create big operational costs and risks. “It’s the perfect environment for a DLT solution in that distributed ledger technology solves almost all of these issues by creating a perfectly standardised approach that everyone can operate in,” says Christian Rasmussen, Head of Group Treasury Investments and Execution, Americas, for UBS, one of the first users of the Broadridge DLR solution.

By enabling intraday repo, DLT-based solutions are transforming the way the industry accesses liquidity and manages cash flows, reducing exposure to operational and counterparty risks. “Intraday repo is an exciting development that unlocks a new avenue for more efficient risk management, which is something we think about a lot at DRW,” says Mark Wendland, COO of diversified trading firm DRW, another early user of the DLR platform. “This solution gives institutions more flexibility in their capital deployment intraday and access to new yield enhancing strategies.”

In this paper, we will examine the challenges and costs associated with cashflow management and intraday liquidity, discuss how intraday repo can help sell-side firms address these issues, and explain how DLT solutions are helping sell-side firms address or even eliminate these concerns by making intraday repo an accessible and viable mechanism for funding. We will also discuss how the buy side will benefit from the growth of intraday repo and look at how and when buy side firms are getting involved as cash providers. Throughout this report—as in this introduction— we will hear from actual users of Broadridge’s DLR platform, who will describe their experiences as early adopters of a DLT-based solution.

Intraday liquidity refers to funding that can be accessed at any point during the business day to process transactions. Over the course of a day, banks and broker dealers experience a consistent stream of cash inflows and outflows. Some of those cashflows—like securities settlement, the dollar legs of foreign exchange transactions, maturing loans or securities, and corporate actions—are predictable, meaning that firms have at least some idea of when they will occur. Other cashflows come up at a moment’s notice. Unpredictable cash flow events include margin calls from CCPs, new securities lending transactions, the cashflow impact of settlement failures, and the transfer of funds by clients using gross settlement mechanisms such as Fedwire.

Managing these rapid-fire inflows and outflows is not an exact science. At times throughout the day, the netting out of these flows creates account deficits. These deficits are usually brief, lasting hours or minutes. Although they are short in span, account deficits can be costly. The U.S. Federal Reserve covers account deficits—for a fee. If a bank is connected to Fedwire, the Federal Reserve guarantees to make payment with “daylight overdraft.” If daylight overdraft isn’t enough to cover a deficit or would be too expensive, firms are sometimes forced to place additional cash into the account to continue meeting the firm’s obligations, with knock-on effects for the calculations they maintain for their liquidity reserves.

“Although these costs appear minimal on a one-off basis, when multiplied across the thousands of transactions executed every year by a bank or broker, they represent significant expenditures,” says Paul Chiappetta, Vice President of Product Management and Business Development at Broadridge. Some firms spend a million or more dollars per year on daylight overdraft alone, not to mention the opportunity costs associated with the lost yields on additional capital that has to be applied to meet excess intraday funding needs.

There are also risks. At many firms, intraday funding is still managed on Excel spreadsheets—a manual and inefficient process that introduces the risk of human error. As we will see in the next section of this report, the strategies firms use to meet their intraday funding requirements also expose them to significant amounts of counterparty risk.

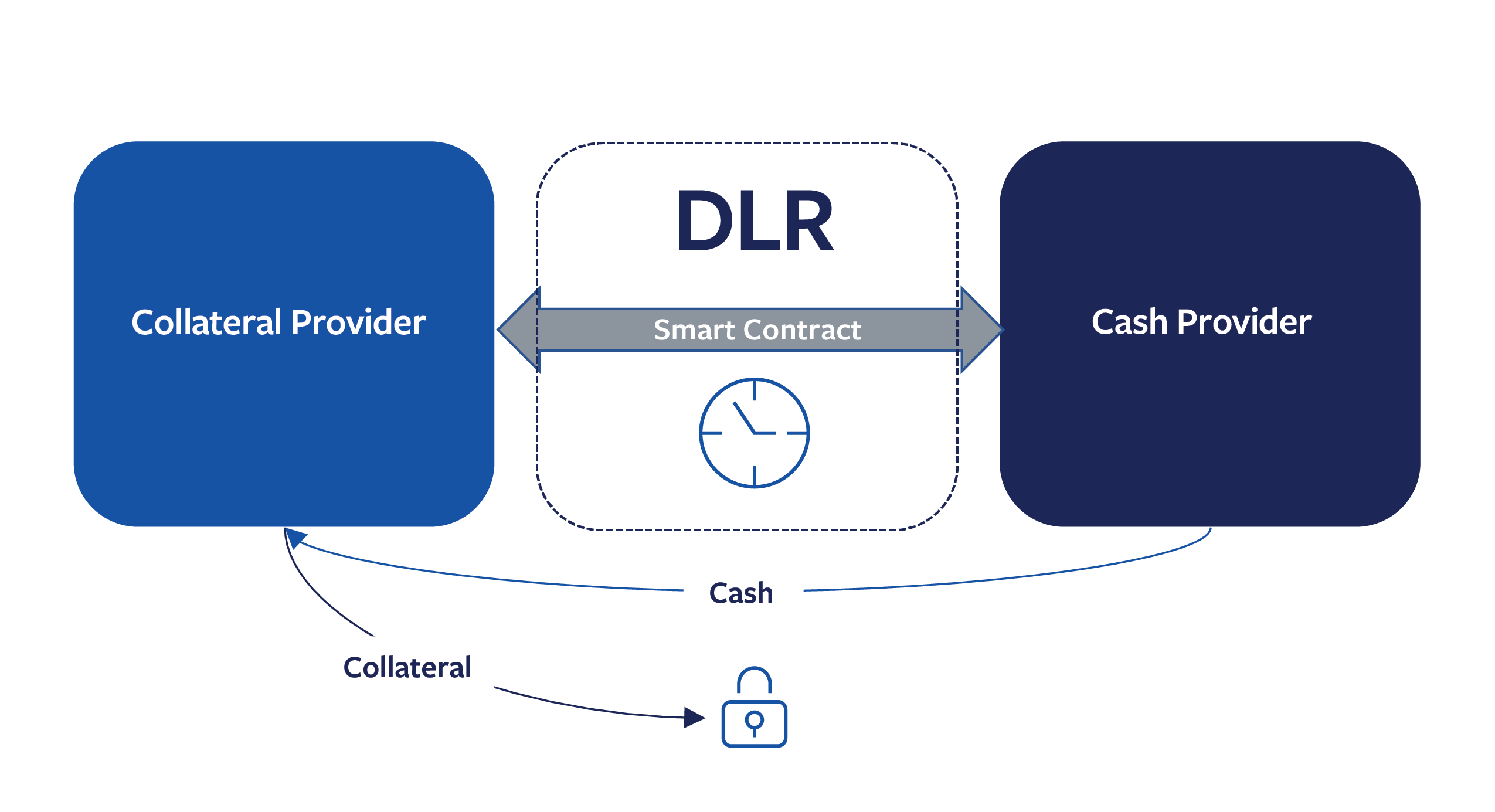

Repo is one of the main tools banks and broker-dealers use to access intraday liquidity and manage cashflows. A repo is a sale of securities along with an agreement to repurchase the securities at a specified price on a later date. In many ways, a repo transaction functions like a secured loan. The lender loans cash to a borrower and receives the borrower’s securities as collateral. The proceeds of the initial securities sale can be thought of as the principal amount of the loan, and the excess paid by the cash borrower to repurchase the securities corresponds to the interest paid on the loan, also known as the repo rate.

Repo has many applications, including matched book trading, firm funding, and asset sourcing. For banks and broker-dealers, repo plays an especially important role in liquidity. Repo trades help market participants fund accounts, prevent or minimise deficits and avoid daylight overdrafts.

However, repo transactions have one major drawback: banks and broker-dealers are often stuck paying the cost of overnight interest to cover account deficits that may only last minutes. Although funds lent against high-quality collateral such as treasuries can be delivered almost instantly, processing and settling a repo trade takes time. As a result, almost all repo activity takes the form of overnight trades.

A 2021 survey by the New York Fed concluded that a majority of “overnight” trades are actually executed in the early morning. Almost two-thirds of Treasury FICC DVP repo volume analysed in that study was completed between 7:00 a.m. (when the market opened) and 8:30 a.m. In Overnight Treasury GCF, 62% was completed by 8:30 a.m. For both markets, around 90% of trading was completed by midday.

Why are banks and broker dealers paying for overnight funding for transactions that occur so early in the day? According to the Fed report: “The factor that market participants most consistently cite is the start of daylight overdraft fees assessed by clearing banks at 8:30 a.m. to dealers that have not funded their clearing accounts. These fees are particularly meaningful for smaller, independent broker-dealers, that raise a substantial portion of their funding in interdealer repo. Thus, smaller dealers make every effort to fund as early as possible.”

The upshot: Banks and broker-dealers are spending millions of dollars for overnight funding that they don’t really need.

PAUL CHIAPPETTA

Product Management and Business Development, Broadridge

Paul Chiappetta joined Broadridge’s Capital Markets Digital Innovation team June 2022.

Prior to that Paul was Americas COO for ALM Group Treasury at UBS, where he drove the regions Distributed Ledger Repo activities. With over 20 years in the industry, Paul has experience working across back, middle, and front office positions

The obvious solution to the problem of excess spending on overnight repo is an easy mechanism for intraday funding. Sometimes called micro-funding or repo-by-the-minute, intraday repo is a standard repo trade with both the start and end leg settling on the same settlement date. This type of trade can be done for any interval from minutes to hours, with the cash lender receiving a fee for their principal investment rather than a standard repo rate. This fee can be calculated either as a set amount for a specified period of time as agreed at the outset of the trade or determined dynamically by applying a rate for every minute the loan is open.

Intraday repo provides flexibility in funding, giving a bank or dealer the option to fund themselves for an hour or two to cover liquidity spikes that may occur throughout the day, and mitigating daylight overdraft charges and other financial impacts caused by such fluctuation. “

In an ideal world, banks and broker-dealers could use intraday repo to manage their cash flows and collateral proactively on a minute-by-minute basis throughout the day,” says Broadridge’s Paul Chiappetta. “But that’s not possible with traditional market structure, which is simply not designed to accommodate the operational demands of same-day settlement or transactions that last only one or two hours.” As a result, intraday repo trades have been mostly limited to certain central bank transactions— until now.

“In an ideal world, banks and broker-dealers could use intraday repo to manage their cash flows and collateral proactively on a minute-by-minute basis throughout the day.”

Two major changes set the stage for the birth and potentially rapid growth of intraday repo as a funding tool. Most recently, the current spike in interest rates gave broker-dealers and banks a strong incentive to find a cheaper source of intraday liquidity. For many firms, inefficiencies in cash and collateral management didn’t register as especially important priorities when interest rates were near zero. The situation is much different with today’s dramatically higher rates pushing up funding costs.

Thanks to an equally important change in technology, firms in search of better and cheaper alternatives now have a viable option. Even if sell-side firms had been motivated to employ intraday repo at any point over the past decade, they likely would have been disappointed. The existing infrastructure couldn’t accommodate same-day trade settlement, and the technology needed to upgrade existing systems and processes didn’t exist. “Until now, the main thing slowing down the settlement cycle has been people,” says UBS’s Christian Rasmussen. “Any amount of manual input into a settlement process has the potential to introduce delays and errors.”

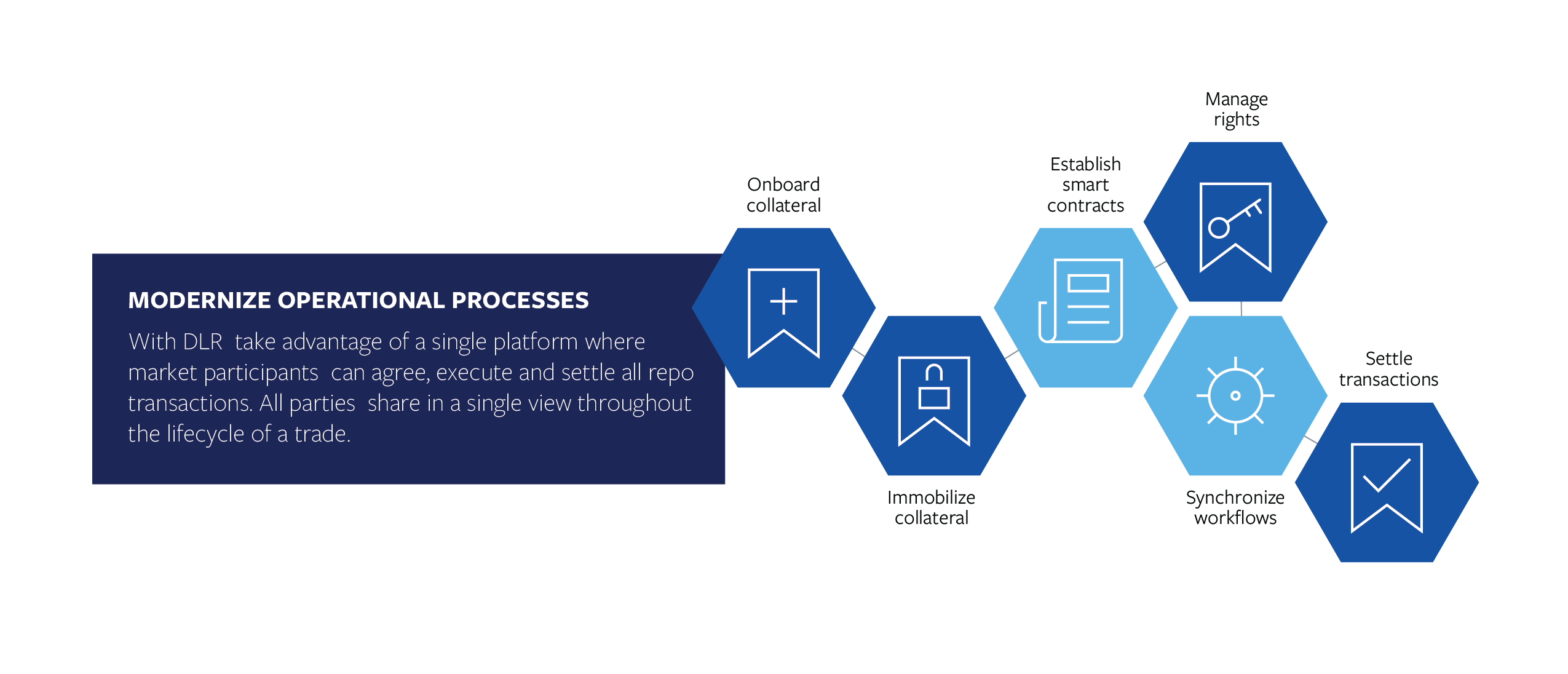

The emergence of distributed ledger technology has the potential to transform the way banks and broker-dealers access liquidity. DLT provides the velocity required for bilateral counterparties to instantaneously agree, execute, and settle an intraday repo transaction. In a DLT environment, collateral does not need to be physically transferred. Instead, the underlying security is immobilised, with ownership maintained through smart contracts utilising a Digital Representation of Security (DRS). The smart contract methodology employed by solutions like Broadridge’s DLR platform streamlines the process by creating a mutualised workflow allowing both the cash lender and securities borrower to see the entire lifecycle of the trade in real-time. The DLT platform connects the existing settlement infrastructure with a DRS . Both parties can monitor cash and securities and track the fee accrual throughout the duration of the trade, ensuring accurate settlement at a precise, predetermined time.

Solutions like DLR integrate with front-end systems used by banks and broker-dealers, allowing intraday repo transactions to seamlessly flow into existing daily firm financing and position management workflows. Users can enter intraday repo transactions manually, or trades can be fed into the front-end system via automated trade feeds, simultaneously updating positions in real-time and passing the trade details to the DLT platform for settlement and processing. Interest is calculated from a fee entered on the trade.

Societe Generale’s Michael Walsh compares the adoption of the DLR platform to his firm’s decision 12 years ago to outsource operations to an external vendor, in this case Broadridge. At the time, many people inside and outside the firm were skeptical about taking such a huge step based on what was then still considered an emerging technology strategy. But with both the outsourced operations and the move to DLR, the process ended up being a smooth transition that dramatically enhanced efficiency while slashing internal costs. “Today we have clients calling us and saying DLR sounds too good to be true,” says Michael Walsh. “But it really is that good.”

MICHAEL WALSH

Head of Capital Markets IT and Operations in the Americas, Societe Generale

Michael Walsh oversees teams in the United States, Canada, and Brazil.

Michael previously worked at Drexel Burnham Lambert, Robert Flemings Inc., Lehman Brothers, Deutsche Bank and Commerzbank in various IT/Operational / managerial roles. He also has worked for National Association of Securities Dealers (NASD), as a Director of Product Development. During his career he had overseas assignments in London, Hong Kong, and Frankfurt.

He holds a bachelor’s degree in Organisational Management from Lehman College. He has also received a Certificate of Merit from Wharton School of Business for his participation in a three-year program sponsored by the Securities Industry Association. Michael has also successfully obtained five regulatory licenses during his career.

Michael Walsh oversees teams in the United States, Canada, and Brazil.

How do DLR users benefit from the switch to a DLT-based repo system? From the perspective of Josh Prokopiak, Director and COO at Societe Generale, the most immediate benefit is risk mitigation. “At the most basic level, moving repo trades to a distributed ledger shortens time to settle, reducing counterparty risk,” he says.

DRW’s Mark Wendland says, “For too long, the technological barriers have put limitations on the ability to maximise the use of capital. The DLR platform allows for the proper technological infrastructure we’ve strongly advocated to be put in place for many years.”

In repo, DLT-powered solutions eliminate most of the manual operational requirements in the traditional process, speeding settlement and lower costs significantly. Because fee and interest payments on intraday trades cover an interval shorter than the minimum overnight term, costs are much lower than the standard repo rate currently entered on non-intraday overnight, term, and open repo transactions. “In a DLT environment, a significant percentage of operational costs will go away,” says UBS’s Christian Rasmussen says.

For Societe Generale, moving the business off Excel and onto DLT has eliminated the need for spreadsheets and manual input, while also taking out almost a million dollars in annual costs. “The fact that everything is on the distributed ledger makes it so much easier,” says Michael Walsh. “If the broker-dealer is short $10 million and the bank is long $10 million, in one account you can just net out to zero.”

In the past, the firm was spending an average of thousands of dollars every day on daylight overdraft. After moving to the distributed ledger, Walsh estimates that daylight overdraft charges are now zero in “four out of five days.” Those savings will increase over time. “As we become more efficient, more of that money will stay in treasury earning interest,” he says.

Christian Rasmussen agrees. “If you move to a true DLT platform where assets and cash are tokenised, you can come to universal, instant settlement, and the costs of warehousing cash dissipate and go away,” he says. “This is the Shangri La the market wants to achieve for managing collateral and cash.”

JOSHUA PROKOPIAK

Director and COO, Societe Generale

Joshua joined Societe Generale in 2004 in the Derivative and Financial Product group as their COO. He performed similar roles within the Special Situations and Fixed Income groups before being appointed Head of FIC COO team for the Americas in 2017.

Prior to joining Societe Generale, Joshua worked at Goldman Sachs, Lehman Brothers and Prudential Securities in various accounting and managerial roles. He holds a bachelor’s degree in Finance from Pace University.

At Societe Generale, Josh Prokopiak and Michael Walsh believe DLT has the potential to transform financial markets over the next five years. “We’re bullish on the technology,” says Walsh. “It’s working in many industries outside banking to great success.”

For these professionals, repo represented an ideal early use case for DLT, and DLR was an important opportunity to get involved early. “This was a chance for us to get our feet wet and help guide the direction [of DLT evolution],” Josh Prokopiak says. The firm’s plan was to adopt the DLR solution internally, get compliance comfortable with the technology, gain experience doing business in the new environment, and then gradually begin rolling out the DLT offering to clients.

For Societe Generale, intercompany trades among the company’s three business units make up about 40% of all transaction volume. That business would be the proving ground for DLT’s ability to reduce costs and risks by creating efficiencies on the back end. Implementing the DLR solution enabled the firm to centralise all its activities in a single Bank of New York account. “We always wanted to be a leader in DLT,” said Michael Walsh. “With Broadridge, we jumped into the pool.”

Of course, as with any new technology, early adopters faced challenges. One of the biggest: getting approval from legal. “The repo market is out on the frontier with this technology, and it is setting precedent. As a result, market participants need to create generalised legal documentation to operate more seamlessly,” says UBS’s Christian Rasmussen.

Another initial hurdle is getting all the components of a large organisation aligned to integrate the new technology. “This an innovation that will benefit operations, compliance, risk and a whole host of other functions in an organisation. To win the cooperation of all these groups you have to really take the time to explain what’s at stake, and what’s the value add,” Christian Rasmussen says.

That’s where working with a large vendor like Broadridge can pay dividends, Rasmussen says. “A big firm like Broadridge already has a high touchpoint across the industry, and across most individual firms,” he explains. “Because they already have lots of systems embedded in the organisation, they can be instrumental in communicating value and process.”

Josh Prokopiak says Societe Generale partnered closely with Broadridge to implement the DLR solution. For more than a year, the firms held joint weekly steering committee meetings to discuss issues, work through any snags, and understand the impact on workflows. These steering meetings were supplemented with daily operational meetings in which the firms addressed immediate issues. Societe Generale has now executed thousands of transactions on the DLR platform to date without a single major issue.

CHRISTIAN RASMUSSEN

Head of Investment and Execution America’s

Christian Rasmussen is a senior Global Finance Leader at UBS with expertise in Treasury Services, Fixed Income Secured financing solutions and Assets and Liabilities management. He is adept at developing strategies to maximise managing a balance sheet, including interest rate risk, structural foreign exchange risk and collateral risk, as well as the risks associated with liquidity and funding portfolios. In 2021 he assumed his current role as Head of Group Treasury Investments & Execution America’s. This role encompasses the regional liquidity portfolios, all secured and unsecured funding in the region, and IRRBB activities within BUSA. Christian has been a leading member in driving the enhanced regulatory standards for UBS Americas. He is currently the business lead for LIBOR transition in the America’s, as well as sitting on the ARRC Market Structure and Paced Transition working group.

UBS’s Christian Rasmussen says it makes sense that the sell side would be the leader in adopting a DLT solution for repo, which he describes as a critical function for banks and dealers, but a “fringe transaction” for many other players. “Buy-side firms are cost conscious,” he says. “They won’t spend money to be leaders, but once they see an opportunity in broad activity, they will jump in.”

Indeed, as DLR and other DLT-based solutions takes root among sell-side firms, they are beginning to attract the attention of securities lenders from the buy side who see a revenue opportunity.

It is that enticement to the buy side that could transform short-term funding markets, potentially saving banks, broker-dealers and other market participants millions. Societe Generale’s Josh Prokopiak says one of his firm’s large clients already approached his team and said it wanted to be involved in the DLT initiative. The Societe Generale sales team and front office think other clients would be interested in intraday repo as well. “There is growing interest,” Prokopiak says. “The only question is: when will it take off?”

As firms like Societe Generale, UBS and DRW utilise the DLR solution for intraday trading, they are working through issues that will have to be addressed before they roll a DLT platform out to clients at scale. Among the issues they are now addressing are fee schedules, legal documentation, and the overall business case and revenue potential for clients.

At the present time, DLT platforms are experiencing increased adoption by sell-side firms, and the earliest buy-side adopters will begin investigating the yield potential of intraday repo. This gradual adoption of the DLT could shift into overdrive if a liquidity crisis takes hold. A lack of funding on the street could cause a spike in demand for intraday funding.

In terms of significant obstacles that could slow this evolution, UBS’s Christian Rasmussen adding, “You’re operating within the standard marketplace, with standard documentation. It’s just the digitisation that’s different.”

Intraday repo has arrived. By applying DLT technology to the repo market, Broadridge and other providers have equipped banks, broker-dealers and other financial service firms with an invaluable source of intraday liquidity. Intraday repo transactions powered by DLT-based solutions will eliminate most daylight overdraft fees, reduce other operational costs, and minimise counterparty risk. The ability to easily access funds for minutes or hours over the course of a business day will radically enhance efficiency in cashflow management, creating new opportunities for sell-side firms to optimise their deployment of cash and collateral. The financial service firms now adopting DLT solutions in repo are gaining the experience and creating the internal policies and infrastructure required for broader use of the technology. As more assets and cash are tokenised across the industry, it will be easier for firms to adopt other DLT-based solutions. As UBS’s Christian Rasmussen concludes, “Things are speeding up.”

Our representatives and specialists are ready with the solutions you need to advance your business.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |

Your sales rep submission has been received. One of our sales representatives will contact you soon.

Want to speak with a sales representative?

| Table Heading | |

|---|---|

| +1 800 353 0103 | North America |

| +442075513000 | EMEA |

| +65 6438 1144 | APAC |