当社販売担当者よりお問い合わせに関するEメールを差し上げます。

ご本人でない場合は、 フォームをクリアしてください。

営業担当者に対するお電話でのお問い合わせはこちら

販売担当者へのお問い合わせを受付けました。当社販売担当者より折返

しご連絡を差し上げます。

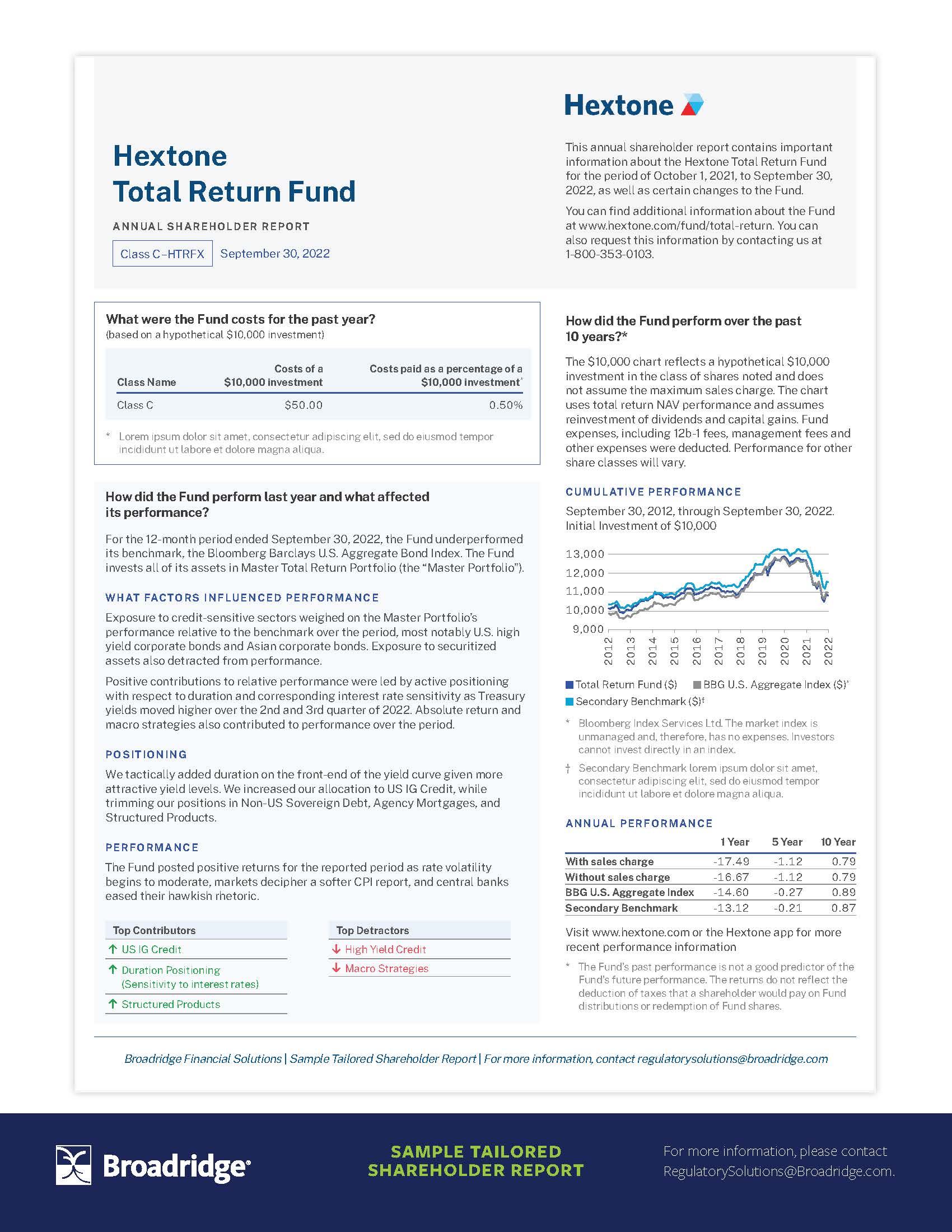

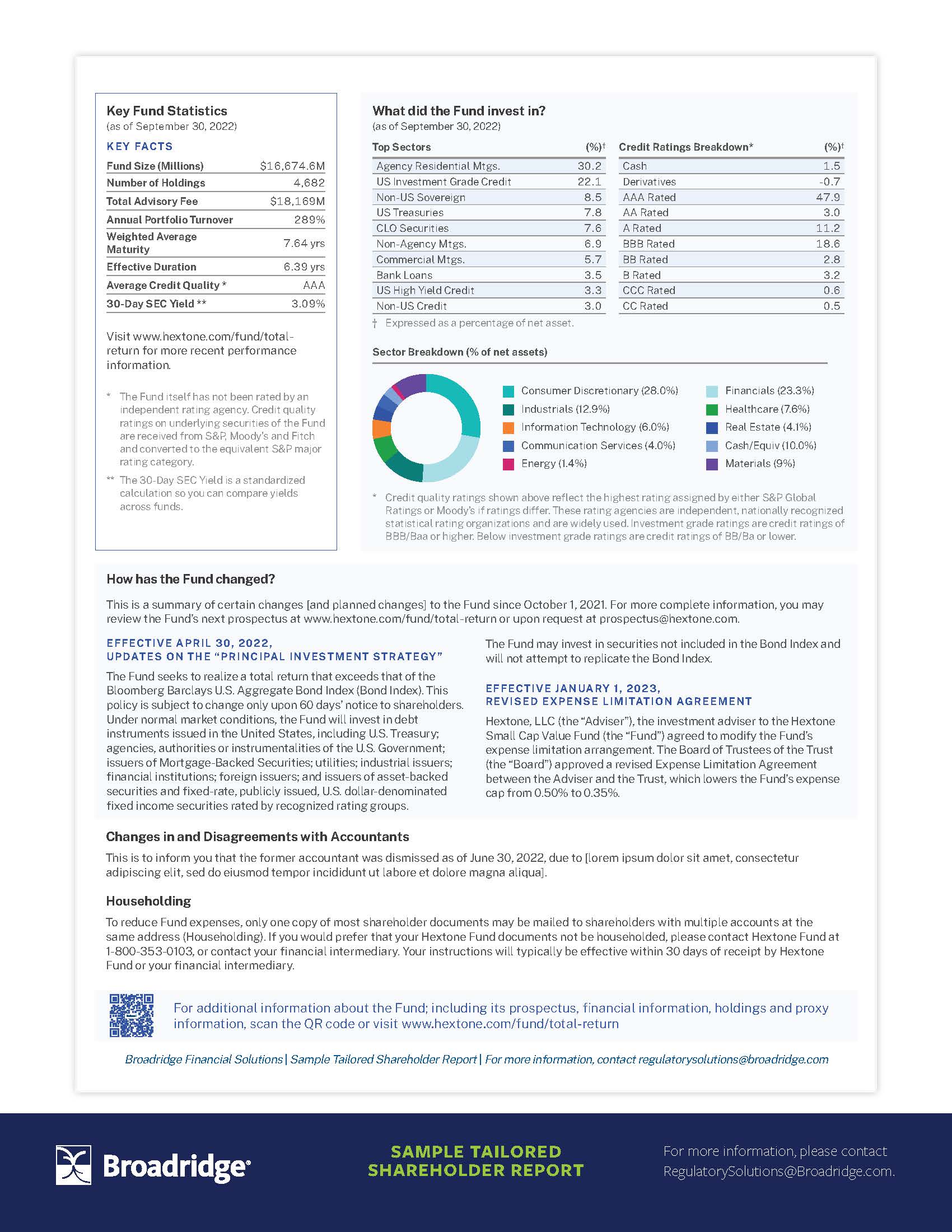

NEW YORK – March 1, 2023 – To better help companies comply with the SEC’s Tailored Shareholder Reports rule, global Fintech leader, Broadridge Financial Solutions, Inc. (NYSE:BR), has developed a new, technology-enabled template and end-to-end process solution for fund companies and fund administrators. This new digital template greatly simplifies the steps involved in creating and providing the SEC’s new Tailored Shareholder Reports.

“The digital template we’ve created is good for fund investors and compliant with the rules and is just one part of the end-to-end solution which provides the scale and automation companies are seeking,” said Michael Tae, Broadridge President of Mutual Fund and Retirement Solutions. “Our end-to-end solution for funds and fund administrators offers iXBRL tagging, SEC-compliant layered web hosting, and comprehensive SEC filings, along with a personalized communication experience for fund investors that efficiently combines and delivers Tailored Reports just for the funds and share classes they hold within their accounts. Our solution will drive added savings on paper and postage for companies and new savings, as well, by encouraging more investors to receive all of their fund information electronically.”

The technology-backed template, with its report composition component, will automate a multi-step process, resulting in new efficiencies for complying with the SEC rule. The rule requires mutual funds and ETFs to provide concise, user-friendly reports to investors beginning July 24, 2024 for each share class of every fund. For fund companies, with large numbers of funds and share classes, this involves creating thousands of individual reports.

Driving Digitization and Enabling Automation

Broadridge is working with fund companies and fund administrators to employ digitization, automation and operational process improvements that produce better investor communications in the most cost-effective way possible. Within each fund firm many groups are involved in the process, from the Treasurer’s office, to operations, legal, marketing, and venders making automation essential.

The topics and sequence that the SEC requires for these reports were identified, but a sample format was not provided. To help industry executives, Broadridge created a template that allows for digital inputs and is concise, engaging and visually clear while meeting the SEC requirements.

To see the template: https://www.broadridge.com/_assets/pdf/broadridge-sample-tailored-shareholder-report.pdf

Broadridge has also created FAQs on Tailor Shareholder Reports to address many of the questions industry executives have raised in industry forums regarding the new rules.

About Broadridge

Broadridge Financial Solutions (NYSE: BR) is a global technology leader with the trusted expertise and transformative technology to help clients and the financial services industry operate, innovate, and grow. We power investing, governance, and communications for our clients – driving operational resiliency, elevating business performance, and transforming investor experiences.

Our technology and operations platforms process and generate over 7 billion communications per year and underpin the daily trading of more than $10 trillion of securities globally. A certified Great Place to Work®, Broadridge is part of the S&P 500® Index, employing over 14,000 associates in 21 countries.

For more information about us, please visit www.broadridge.com.

報道関係者 お問い合わせ先 :03-5425-7220, アシュトン・コンサルティング BroadridgeJapanPR@ashton.jp。