当社販売担当者よりお問い合わせに関するEメールを差し上げます。

ご本人でない場合は、 フォームをクリアしてください。

営業担当者に対するお電話でのお問い合わせはこちら

販売担当者へのお問い合わせを受付けました。当社販売担当者より折返

しご連絡を差し上げます。

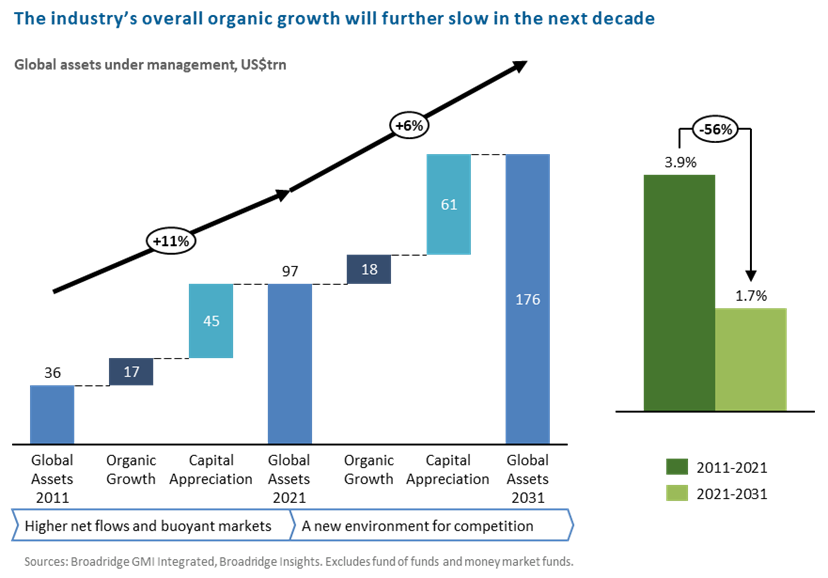

NEW YORK and LONDON, October 11, 2022 – Organic growth across the global asset management industry, measured on a total net asset flows basis, is expected to slow from a compound annual growth rate (CAGR) of 3.9% over the last decade to 1.7% from 2021 to 2031 as competition heats up between both challengers and incumbents alike, according to a newly released whitepaper, The New Competitive Calculus: Winning with Data-Driven Strategy by global Fintech and asset management advisory leader Broadridge Financial Solutions, Inc. (NYSE:BR).

Despite this, Broadridge forecasts that net asset inflows will still expand by a healthy US$18T over the next decade, helping to push total assets under management (AUM) to a record of more than USD$170T– unlocking exciting new avenues for growth and challenges to overcome for those that can adapt to change.

Competition, however, will be more fierce as growth slows. Broadridge’s research reveals three increasingly distinct classes of industry competitors, two of which - expanding incumbents and innovative challengers - dominate the industry’s organic growth. Already less than 100 asset management firms globally accounted for nearly 64% of the industry’s $14.4 trillion-plus in net new flows gathered since 2016, according to Broadridge’s research.

“Opportunities will be driven by different capabilities and clients – from institutions to individuals, and from the US and Europe towards Asia, especially China,” said Ben Phillips, head of Asset Management Global Advisory Services, Broadridge. “While secular changes manifest in different ways, there are still primary drivers that asset managers need to look out for to maximize their growth. The reality is that these changes are creating unmet needs, all of which are opportunities to innovate and reposition themselves for growth.”

Broadridge expects significant opportunities to be had aligning business strategies to meet shifting secular trends, many of which, if missed, will increasingly bifurcate the market between winners and losers.

The study predicts that individual investors will drive 69% of net flows in the coming decade significantly overtaking institutional investors, while private markets will shift from driving 16% of net flows between 2011 to 2021 to 32% of net flows between 2021 to 2031. In terms of regions, The New Competitive Calculus outlines net investment flows shifting from the US and Europe toward Asia Pacific, especially China. APAC will drive 42% of net flows between 2022 to 2031, from just 26% between 2012 to 2021.

As individual investors seek to use their portfolios to address a wider array of financial and non-financial objectives, thematic investing is expected to rise. One example is the momentum in ESG and impact-oriented investing, which will account for 27% of net flows during the next decade.

The above trends are dramatically changing the competitive forces facing asset managers today. Strong investment performance has long been regarded by the industry as the primary differentiator to win market share. However, with the shifts in opportunities identified in the whitepaper, performance is not enough to stand out. Today, competitive differentiation is being defined across four major dimensions:

Faster product innovation – Quick and effective innovation is key. Successful asset managers have adopted an innovation- and product-focused strategy where product development is a central role supported by data and propelled by a flexible distribution network.

Stronger distribution – Successful asset managers are set apart by their ability to scale. This means multiplying points of influence, strengthening relationships beyond value intermediaries, and building exclusive distribution relationships as a protected channel against rivals. A data-driven approach to segmentation helps maximize resource efficiencies and create leverage to better monetize distribution advantages.

More flexible delivery – Competitive asset managers have recognised the need to customise access for end-investors, becoming increasingly flexible with delivery models, especially for priority products and markets where such changes contribute to divisive market leadership. In determining which delivery models are worth pursuing, successful asset managers are focused on implementation cost, technologies that allow customization and portfolio personalization, and delivery capabilities that allow operational efficiency.

Better brand building – A competitive brand will set asset managers apart against the noise of new product capabilities and products, striking a balance between regional norms and global positioning. Strategic decisions include linking brand attributes to clear competitive advantages and embedding innovation and change as brand attributes.

Learn more about these trends shaping the global asset management industry from Broadridge’s whitepaper. Click here to access The New Competitive Calculus: Winning with Data-Driven Strategy.

About Broadridge

Broadridge Financial Solutions (NYSE: BR) is a global technology leader with the trusted expertise and transformative technology to help clients and the financial services industry operate, innovate, and grow. We power investing, governance, and communications for our clients – driving operational resiliency, elevating business performance, and transforming investor experiences.

Our technology and operations platforms process and generate over 7 billion communications per year and underpin the daily trading of more than $10 trillion of securities globally. A certified Great Place to Work®, Broadridge is part of the S&P 500® Index, employing over 14,000 associates in 21 countries.

For more information about us, please visit www.broadridge.com.

報道関係者 お問い合わせ先 :03-5425-7220, アシュトン・コンサルティング BroadridgeJapanPR@ashton.jp。