Some firms in the marketplace have limited activity in sponsored repo and other firms that received approvals for Category 1 (U.S. banks) in the first wave of sponsored repo uptake are expanding and seeking approvals for Category 2 (dealers, non-U.S. banks, prime brokers) from Fixed Income Clearing Corporation (FICC). Firms have sought assistance from Broadridge to prepare business cases to support entering the sponsored repo marketplace. One of the due diligence areas for sponsored repos that firms are spending more time on in recent months is understanding risk and exposure.

WHY IS FOCUS ON SPONSORED REPO RISK INCREASING?

In establishing and growing a sponsored repo book of business, firms need to assess the costs of the management and maintenance of the program. As part of validating their business cases to either launch or expand sponsored repo activity, they need to:

- Determine market appetite/IOIs from their client base.

- Prioritize fit, launch and demand across their lines of business.

- Examine sponsored repo as a fit for their book of business(es) or goals to drive growth.

- Review and adjust the accounting treatment and risk tolerances/policies to optimize integration of sponsored repo into their business.

Broadridge have assisted clients on all facets of due diligence but in recent months, questions on risk scenarios have become more prevalent than any other aspect of establishing or growing sponsored repo – so why? While each firm’s nuances for establishing sponsored repo are unique, there are four key trends that are causing recent focus on risk monitoring, exposure and policy-setting:

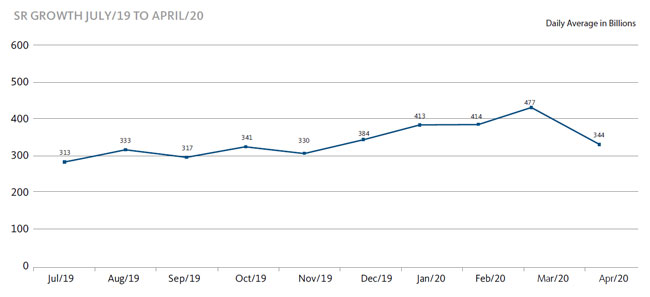

Risk Scrutiny Prioritization Driven by Size of Exposure: Any deal type that increases the weight of a firm’s book of business generally is put under a more intense microscope for exposure as it grows, as the risk scrutiny often is commensurate with size. Given sponsored repo trading has increased substantially across the industry in the last year, it stands to reason the domino effect of individual firm’s risk watch dogs keeping an eye on its growth in their portfolios and monitoring the associated risk tolerances is a natural offshoot of this growth.

Covid-Driven Market Volatility: As Covid has unfolded, it has introduced near unprecedented volatility in global markets. The pandemic has created a liquidity crisis globally and regulators are introducing relief programs, such as Federal Reserve Bank (FRB) in the U.S., in an effort to avert severe economic downturn. Risk teams are responding to the liquidity and other market risk factors that have surfaced since March by adapting their policies and tolerances. Given one of the attractive features of sponsored repo is the liquidity relief it offers Sponsored Members, it is not surprising deals have jumped noticeably since March and risk teams will be following this increased exposure in these volatile times even more closely.

Bracing for the Longer-Term Ramifications of Covid: In addition to the sudden economic downturn and the virtual shutdown of many industries globally to quell the spread of the pandemic, firms are planning for the longer-term economic effects that could result in a recession or even a depressiontype event. Re-calibrating adequate planning for longer term cash flow and liquidity needs is paramount. Firms with asset management liability obligations (such as pension and insurance) will be adjusting their holdings and examining exposure to ensure they can whether the economic storm. As sponsored members in a sponsored repo deal scenario, they will be reaching out to their street-side counterparts who are FICC Sponsoring Members to collaborate on mutually beneficial strategies.

Regulatory Scrutiny on all Deal Structures Increasing: As the world is navigating the current disruption caused by Covid in financial markets and all other facets of life, it is still dealing with policies being put in place to avert a repeat of the 2008 subprime crisis. Recent additions to the regulatory pile such as SFTR and CSDR have pushed the envelope of not only looking for reports on what was done, but also looking for how it was done.

These new ‘traceability’ obligations are not sponsored repo specific but are impactful for them and many other aspects of securities financing. When adopting new deal types, firms must look at the end-to-end workflows for such deals to ensure they can achieve adequate reportability and an audit trail with no gaps across their own firm and across third parties in the deal. If one ‘leg’ of a trade is in EMEA, it should be explored for SFTR reporting obligations, so firms with both Category 1 and Category 2 FICC approvals for sponsored repo should examine their books of business for reporting obligations.

WHY DOES SPONSORED REPO PRESENT NEW TWISTS IN DEAL MONITORING?

To understand risk a firm has in a sponsored repo deal, they must have clarity on the role they play for the deal to occur. Sponsored repo enables FICC members to offer access to some of the privileges they have to their clients. The ‘Sponsoring Member’ is the underlying FICC member. The ‘Sponsored Member’ is a limited purpose member of FICC.

Sponsored repo is very similar to repo and for firms experienced in repo, this new sponsored repo workflow and risk mechanics will be easier to digest than firms who are repo trade novices. Sponsored repo is a form of repo substitution, with Sponsoring Members moving away from balance sheet intensive repo trades to something that’s striving to be more efficient and allowing the capital gained in the process to be redeployed towards other uses.

Using a golf club membership as an analogy for FICC membership, we have outlined in plain language how sponsored repo works between Sponsored and Sponsoring Members. If FICC were a golf club and a firm were a member of that club with Category 1 and/or 2 approvals, they can bring non-members to play a round of golf based on certain parameters. However, if the guest (Sponsored Member) of a member (Sponsoring Member) hits someone with a golf ball, the member is liable not the guest. The same concept applies to sponsored repo risk and the liability chain.

“Sponsored repo deals create a different risk lens under which sponsoring members need to monitor their underlying clients and FICC exposure”

Understanding the liability obligations starts to unfold why sponsored repo risk analysis is different, as the FICC Sponsoring Member is both sides of the risk trade/equation. It also starts to explain why early adopters of sponsored repo may have less risk concerns than later adopters.

Using the golf analogy and liability scenario, your first choice to invite to your club are your colleagues who are good golfers. However, as you expand the number of tee times you have, you need more friends to take for a round of golf and you start to look at your friends who may present more of a risk on the golf course. As the risk ratio increases, the scrutiny of inviting that player to the game changes.

To increase the challenges of negotiating with good golfers for tee times and expanding your rounds with colleagues, other members are looking to entice the same good golfers to play in their rounds as well. Similarly, with sponsored repo: as its adoption in the industry expands, finding quality Sponsored Member deals with an acceptable risk/reward ratio for FICC members will be more challenging. This background on how sponsored repo deals work helps bring clarity on the risk and liability considerations of these types of deals.

TOP 5 EXPOSURE QUESTIONS ASKED ON SPONSORED REPO

In trying to wrap their heads around the liability, many firms have reached out to understand the deal flow mechanics and timing of exposure for sponsored repo. The questions equally range between the logistics of the deal/structure and the ‘what if’ scenarios if a deal falls through or other challenges Impede normal-course completion.

Below are the top five risk/exposure query discussions Broadridge are asked by clients looking to advance the ball on establishing or expanding their sponsored repo business:

1. When a sponsored repo deal is done, the Sponsoring Member IS both sides of the trade – one side on behalf of their book, the other on behalf of their client. Unlike most transactions on the street where you are waiting to confirm and settle with the other party, the Sponsoring Member when setting up the open leg is also setting up the close leg to send back to themselves. The Sponsoring Member has the responsibility for both sides of the trade with FICC on behalf of their client (the Sponsored Member). This concept, while relatively simple, has caused some confusion as folks wrap their heads around facing off against themselves on sponsored repo deals.

2. There is no latency/gap in the time between execution and confirmation – the entire process happens in a few seconds. Together with the confusion on the premise that the Sponsoring Member is both sides of the trade, the concept of lack of latency between both sides of the deal seems equally hard to grasp as first introduction for many firms. Given the Sponsoring Member is facing off against themselves on behalf of the Sponsored Member for a deal, completion is near instantaneous since the Sponsoring Member is initiating and completing both sides of the deal. It is an important concept for risk teams to understand, the gap between execution and settlement is generally where firms identify they have the most risk if the deal does not settle. Where both sides are executed simultaneously (as in sponsored repo deals), the risk factors are greatly diminished in the equation.

3. FICC does not ‘face’ the Sponsored Member - FICC will always ‘face’ the Sponsoring Member for all delivery versus payment (DVP) transactions regarding the FICC Sponsored Member account. Sponsoring Members must provide a guarantee to FICC with respect to all obligations of its Sponsored Members and post additional capital into FICC’s clearing fund. All responsibility and liability for sponsored repo deals resides with the Sponsoring Member and any recourse FICC will have on both sides of any deal will be with the Sponsoring Member.

4. FICC will invoke the Sponsoring Member guaranty any issues created or raised by the Sponsored Member. For additional clarity, the Sponsoring Member may also have to post additional liquidity at FICC’s Capped Contingent Liquidity Facility (CCLF), as a liquidity buffer for each netting Sponsored Member. Liquidity adjustments may be needed to institutionally support a potential liquidity crisis of the clearinghouse represented by their trades as Sponsoring Members or on behalf of their clients, the Sponsored Members. The CCLF becomes an important barometer against a Sponsoring Member’s capacity to manage risk for the Sponsored Members they bring to the sponsored repo arena.

5. There is no easily discernable mechanism to differentiate between ‘legs’ of a deal for better risk management and settlement with Sponsored Members and risk buckets. Given sponsored repo deals must be executed in $50,000,000 tranches, an eight-figure trade has a lot of pieces, many of them hard to identify from each other for each client or across the book of business. Sorting out the pieces for settlement and allocation can be tricky. To help reduce possible challenges, Broadridge strongly recommends sponsored repo firms engaging in high volumes in their lines of business (i.e., broker dealer, prime brokerage, bank) establish as much delineation between deals, clients and books of business as feasible to ease the matching challenges in facing off against FICC.

Establishing policies and procedures for risk and liability on sponsored repo represent new challenges for many firms until they understand the nature of these types of deals. The other area firms wrestle on managing and monitoring risk for sponsored repo is intra-day updates and calculations. Many firms are turning to technology to assist in this regard, which is covered in the next section. Just before moving to that discussion and for further reader clarity on sponsored repo risk, below are the FICC guidelines from their website and readily available materials for all firms looking to established sponsored repo:

- FICC’s risk management of the arrangement occurs primarily at the Sponsoring Member level.

- All applications for Sponsoring Membership are decided on by FICC Management and the FICC Board of Directors

- While the Sponsored Members are principally liable to FICC for their securities and funds-only settlement obligations, the Sponsoring Member is required to provide a guaranty to FICC with respect to all obligations of its Sponsored Members, so that if a Sponsored Member does not satisfy any of its obligations to FICC, FICC can invoke the Sponsoring Member’s guaranty

- Liquidity needs created by activity in the Sponsoring Member Omnibus Account will be considered when calculating the Sponsoring Member’s CCLF requirement (subject to regulatory approval).

“Sponsored repo is a form of repo substitution, so firms that are novices to repo will struggle more with adoption than seasoned repo desks”

EXPEDITING INTRA-DAY RISK EXPOSURE: TECHNOLOGY TO THE RESCUE

Measuring risk for many firms is a multi-faceted function. From a high-level operational view regarding trade risk, the approach can be bucketed into three common execution practices.

The dedicated risk function and team in a firm are generally well equipped with robust tools and vetted/reconciled/scrubbed data to run consolidated risk reporting overnight. These groups are looking at many facets of risk, adherence to policies and guidelines and enterprise-wide exposure in addition to monitoring and do forensics while examining next day/rolling/ historic basis risk tolerances. They will be looking at not only the individual deals on an end-of-day basis, but also looking for endto-end enterprise wide risk and how it may have shifted or need to be shifted as business parameters change.

While they provide risk reports to many folks in the firm, most individuals outside the risk department do not have access to these tools directly for ad hoc or specific ‘what-if’ intra-day or real-time risk modelling and they must seek other means to achieve some of their risk calculations. This represents the other end of the risk pendulum that require risk tools with a different lens – the front office.

Traders, deal makers and market makers need to adjust to market parameters and stay within internal risk policies on a real-time basis, which is a very different challenge. Having a real-time cohesive risk view is an ever increasing ‘must have’ tool for the front office in an era where deal complexity is increasing, regulatory scrutiny tightening and expedited turn around on decision-making essential.

Trying to determine start of day positions for holdings, cash and risk tolerances has plagued the industry for years. Every year, the ability to have a ‘start of day’ view and strategy before the market opens has increasingly becomes a factor in competitiveness. Those who can assess their opportunities early in the day, have capacity for ‘what if’ analytics, real-time updates and transparency into their books of business during the day, have an advantage over those firms and desks that scramble to know where they stand in order to complete deals and remain onsite from a risk tolerance perspective.

Access to intra-day risk data repositories for analytics is moving up as a priority for many firms as a strong hybrid solution option to provide more resources access to risk calculations. Extracts from vetted/cleansed/reconciled book of record data in a more accessible environment to manipulate information for custom intra-day risk report needs alleviates the demand and keeps the cost of risk tools in check for the folks who must have them. These types of roles occur in front, middle, back office functions in addition to regulatory, client reporting and other areas requiring a work bench to run risk calculations intra-day

Moving some risk analysis upfront in the food chain of the deal intra-day is continuing to be best practice for effective deal making and prudent risk management. Front office technology with imbedded risk tools, ability to explore depth of market for opportunities and to perform ‘what-if’ scenarios continues to be sought after by firms looking to remain competitive. The uniqueness of the sponsored repo risk profile is another notch in the business case approval chain to justify the expense and demonstrate the value proposition of the investment.

KEY FUNCTIONS TO BE AWARE OF IN MONITORING SPONSORED REPO RISK

While monitoring credit limits at the desks on a real-time basis at the parent, client and relationships level are becoming the norm for front office risk management, there are some nuances specific to sponsored repo firms should consider when examining modifications to their internal and client-facing risk policies and procedures. While this is not an exhaustive list, they are risk views that have a heightened priority as a result of sponsored repo offerings.

FICC-Facing Risk Monitoring

- The Sponsoring Member is responsible to FICC for posting all of the Clearing Fund associated with the activity of the Sponsoring Member Omnibus Account, which is calculated twice daily on a gross basis (i.e., for Clearing Fund calculation purposes, each Sponsored Member’s trading activity is VaR margined separately and the sum of those total VaR charges is collected and held by FICC separate from the Clearing Fund posted by the Sponsoring Member for its proprietary activity).

- Liquidity needs created by activity in the Sponsoring Member Omnibus Account will be considered when calculating the Sponsoring Member’s CCLF requirements. Examining CCLF parameters and dynamics is helpful to understand the domino effect of sponsored repo activity to the member’s overall liquidity needs with FICC.

Client-Facing (Sponsored Member) Risk Monitoring

- Exposure to each client and types of collateral/substitution options for individual deals and book of business management ongoing.

- Monitoring client exposure risk vs. size/type of deals in place with each client to maintain weighing of risk tolerances for the book of business per client.

- Firms must consider that the risk for each sponsored repo deal and the exposure to the underlying Sponsored Member needs to be examine and adjusted with market conditions and material changes to both Sponsored and Sponsoring Members firms.

CONCLUSION

- Sponsored repo does not show any signs of diminishing in popularity. It is an attractive way for sell-side clients to re-engage their buy-side clients (especially pension and insurance) While offering increased balance sheet optimization and capital efficiencies for Sponsoring Members. As well, during the Covid-driven liquidity crisis, sponsored repo has served as an attractive tool for Sponsoring Members in reducing liquidity risks and exposure.

- The appeal to Sponsored Members is equally compelling, all of which indicates this deal type will continue to grow for the foreseeable future. As this book of business grows in firms and the markets uncertainly of Covid prevails, the need to understand the unique risk profile it yields and the need for tools to adequately monitor deal and end-to-end book of business risk will increase in stride.

- It is the understanding of these risk exposure’s and the nature of sponsored repo deals that will aid Sponsoring Member firms in achieving approvals for launch and business case expansion faster. In addition, understanding the risk profile and the role they play with their clients, the Sponsored Members, and with FICC will also help firms explain these deals to their prospects for growing the book of business.

- Given sponsored repo has grown substantially in the last year and shows no signs of slowing down, firms will continue to strive to understand risk exposure and make investments in platforms to manage all facets of sponsored repo including back office, trading and risk tools to bring adequate monitoring and expedite deal making and deal capturing capabilities.