EXECUTIVE SUMMARY

In September 2017, Broadridge, in collaboration with Aite Group, published a whitepaper entitled “Shareholder Rights Directive: Advancing to a State of Readiness”, which examined the broad themes of the updated Shareholder Rights Directive (the Directive) and the challenges and opportunities that it presented for the investor communications industry.

On September 3rd 2018, the European Commission (Commission) published its much anticipated Implementing Regulation 2018/1212 (the Regulation) in regard to the Directive that was passed into law in June 2017. In this white paper Broadridge examines this secondary legislation and the new requirements, impacts and implications on participants in the shareholder communications chain.

SEPTEMBER 3RD, 2020 – THE COUNTDOWN HAS BEGUN

The deadline for EU member states’ transposition of the Regulation into local national law is September 3rd, 2020.

The Regulation contains three key themes:

- Shareholder identification

- Agenda distribution and voting by intermediaries

- Vote confirmation

Within these themes it clarifies definitions, standardised communication formats, minimum data requirements and deadlines to be complied with by issuers and intermediaries in corporate events and in shareholder identification processes.

THERE ARE SEVERAL AREAS OF CLARIFICATION THAT ARE PARTICULARLY NOTABLE:

- A new mechanism to exchange shareholder information will be required in every European Union (EU)/European Economic Area (EEA) market

- All intermediaries, irrespective of their role in the chain, must facilitate shareholder rights

- The definition of “without delay” in relation to the requirement for intermediaries to pass on any votes received to the next intermediary or issuer (or issuer agent) – intermediaries and their service providers will no longer be able to hold onto votes

- The EC has chosen not to mandate the use of specific message standards or technologies, making it possible for many different protocols to be implemented by individual member states

With greater clarity over how the Directive must be implemented, member states will now start planning for implementation into their own national law. However, the Regulation still leaves areas of flexibility on approach which brings with it the risk of diverging implementation across markets. Timing is therefore critical and intermediaries and industry practitioners operating within a member state have a limited window of opportunity to lobby, either directly or through their professional bodies, to help shape implementation. While difficult to influence all member states to adopt the same direction, inaction during this critical window could result in a missed opportunity for local and pan-European shareholder communication intermediaries to help drive harmonisation of processes across Europe.

Intermediaries also now have enough clarity to start evaluating their own product offering - new requirements, including significantly more stringent processing deadlines and new processes such as shareholder identification, must be factored into their asset servicing capabilities and product development plans, either through in-house investments or through their outsourced investor communications specialist partner.

The Regulation

BACKGROUND

In order to gain a thorough understanding of the practical implications of some of the SRD’s goals, the Commission called for experienced industry practitioners to join a 12-person technical expert group. This group was tasked with assisting and advising the Commission as it drafted the Implementing Regulation.

The resulting draft regulation, the product of refinement following regular meetings with the expert group between September 2017 and February 2018, was subject to a public consultation in April 2018. 56 responses were submitted before the consultation deadline, which gives a good indication of the level of interest from market participants.

From the very start of this process, the Commission’s intent was to respect the varying securities holdings structures across member states. This was an important point given that the Commission’s mandate from the European Parliament did not extend to prescribing change to laws at national level. This is something that is left to member states to determine for themselves as they implement the Regulation into their applicable national laws.

While supporting the use of ISO standards in general, the Commission has stopped short of advocating any particular standard or technology. The obligation is on each member state to determine technology protocols, communication formats and message standards, with intermediaries and practitioners having the opportunity to influence the outcome through consultation and lobbying.

With this in mind, the approach that the Commission has taken to promote and encourage standardisation is to set minimum requirements, both in terms of the process flows and the specific data points and formats of information to be exchanged within the shareholder communication chain. The Regulation also sets “deadlines to be complied with,” namely specific processing timeframes for the key flows in relation to shareholder identification, transmission of information and facilitation of exercise of shareholders’ rights.

Table A: SRD deadlines to be complied with

| Process |

Deadline to be

complied with |

By whom |

- Initial event announcement

|

- Made available to intermediaries on the same business day as the legal announcement

|

|

- Onward processing of the event announcement

|

- The same business day as received (if received after 4pm, by 10am the next day)

|

|

- Shareholder action (instruction)

|

- Without delay (transmit once relevant processing is completed)

|

|

- Shareholder action deadline

|

- No earlier than 3 business days prior to the issuer deadline or record date

|

|

|

|

- Immediately following receipt of a shareholder action (instruction)

|

|

- Post-meeting vote cast confirmation

|

- Within 15 business days of the meeting or the request, whichever comes later

|

|

- Shareholder identity disclosure request

|

- The same business day as received (if received after 4pm, by 10am the next day)

|

- Issuer, All Intermediaries

|

- Shareholder identity response

|

- Business day following the receipt of the request or the request record date, whichever comes later*

|

|

*Where the disclosure request has been received in a machine-readable format and the record date is no longer than 7 business days in the past. In either of these instances the response should be sent ‘without delay’

SRD TIMELINE

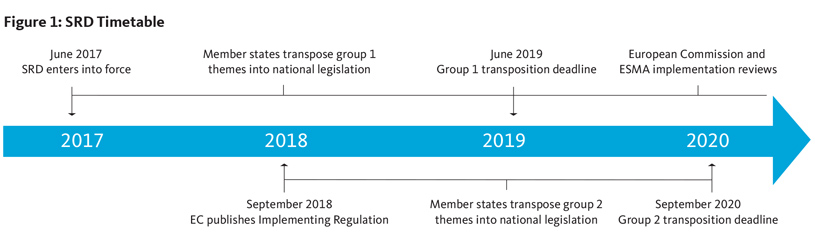

The deadline for transposition into national law of the group 1 themes of the Directive is June 10th 2019. The deadline for the group 2 themes, which are the subject of the Regulation, is September 3rd, 2020.

Member states will likely start to consult on national implementing acts in early 2019. Some states are likely to implement legislation earlier than the September 2020 deadline; others may miss that deadline and incur a fine from the EU.

PUBLIC CONSULTATION

A total of 56 entities responded to the consultation, from a range of industry segments, with varying degrees of depth of response; from simple paragraphs expressing concern or support for specific areas, to lengthy documents suggesting alternative options.

The key themes that emerged during the consultation stage were:

- The lack of definition of ‘shareholder’ - concern was expressed that the different definitions of shareholder across the EU (ranging from beneficial owner to custodian nominee) would mean that some of the transparency and harmonisation objectives of the Directive would not be achieved.

- Record date timing - a potentially missed opportunity to address some of the reconciliation challenges created as a result of the record date being very close to the meeting (after the voting deadline date) in some member states.

- Deadlines - intermediaries raised concern over deadlines, highlighting that in some cases it would be extremely challenging to remain compliant as they did not sufficiently allow for some of the more complex processing requirements in some markets. Particular concern was expressed regarding the last intermediary deadline being three days or less before the market deadline - as the last intermediary could be one of many in a long chain of intermediaries.

- Standards - some responses indicated disappointment that existing standards (specifically the ISO 20022 proxy message suite) were not mandated, making the task of working to a common communication mechanism across all member states much more challenging.

Table B: Classification of respondents to consultation on the draft regulation

| Entity type |

Number of respondents |

|

|

|

|

|

|

|

|

|

|

|

|

- Central Securities Depository

|

|

- Proxy Voting Service Provider

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DEFINITIONS

As the discussions at the expert group meetings delved into more detail, it became clear that while the existing SRD definitions would not be changed, some new definitions would be required. For example, the term ‘intermediary’ which was itself introduced as a new definition in the SRD amended text, needed to be defined further to take account of specific areas of responsibility of different actors in the intermediary chain. As such, the concept of first and last intermediaries was added, as was ‘issuer CSD’. The definition of ‘issuer’ was also expanded to include a third party working on behalf of the issuer, for example a registrar.

This focus on all intermediaries, irrespective of their specific role in the chain, means that facilitating shareholder rights (and specifically proxy voting) needs to be at the forefront of their product offering and can no longer be considered as a ‘nice to have’ or passive service.

Table C: Key regulation definitions

|

| Term |

Definition |

|

|

- ‘issuer’ means a company which has its registered office in a Member State and the shares of which are admitted to trading on a regulated market situated or operating within a Member State or a third party nominated by such a company for the tasks set out in this Regulation

|

|

|

- ‘issuer CSD’ means the central securities depository which provides the core service as defined in points 1 or 2 of Section A of the Annex to Regulation (EU) No 909/2014 of the European Parliament and of the Council with respect to the shares traded on a regulated market

|

|

|

- ‘intermediary’ means a person as defined in point (d) of Article 2 of Directive 2007/36/EC and third country intermediary within the meaning of Article 3e of Directive 2007/36/EC

|

|

|

- ‘first intermediary’ means the ‘issuer CSD’ or other intermediary nominated by the issuer, which maintains the share records of the issuer by book-entry at top tier level with respect to the shares traded on a regulated market, or holds those shares at top tier level on behalf of the shareholders of the issuer. The first intermediary can also act in the role of last intermediary

|

|

|

- ‘last intermediary’ means any intermediary that provides the securities accounts in the chain of intermediaries for the shareholder

|

APPROACH TO STANDARDISATION AND TECHNOLOGY

Standardisation of approach across member states is a key factor in reducing processing complexity and achieving pan-European harmonisation. The Commission recognised this and encouraged the use of ISO standards in general; however, they have stopped short of mandating any specific standard.

It would appear that the Commission felt that mandating an existing standard such as the ISO 20022 proxy voting message format could be deemed contrary to the open and collaborative approach to standardisation discussions in capital markets.

Moreover, any new standards that may emerge in the future could require modification of the Directive or Regulation if a single existing standard was mandated, however relevant it might be today. The Commission has taken the same approach with technology, whether existing or emerging.

A consequence of this approach is that there is a very real risk of divergence of implementation across member states, which may introduce new challenges for market participants. The responsibility is now on member states and intermediaries to work together to determine and implement the requirements of the Regulation in a harmonised way. Time is of the essence for intermediaries and other industry practitioners to start discussions and lobbying efforts to guide member states towards efficient and harmonised corporate governance processes.

SHAREHOLDER IDENTIFICATION

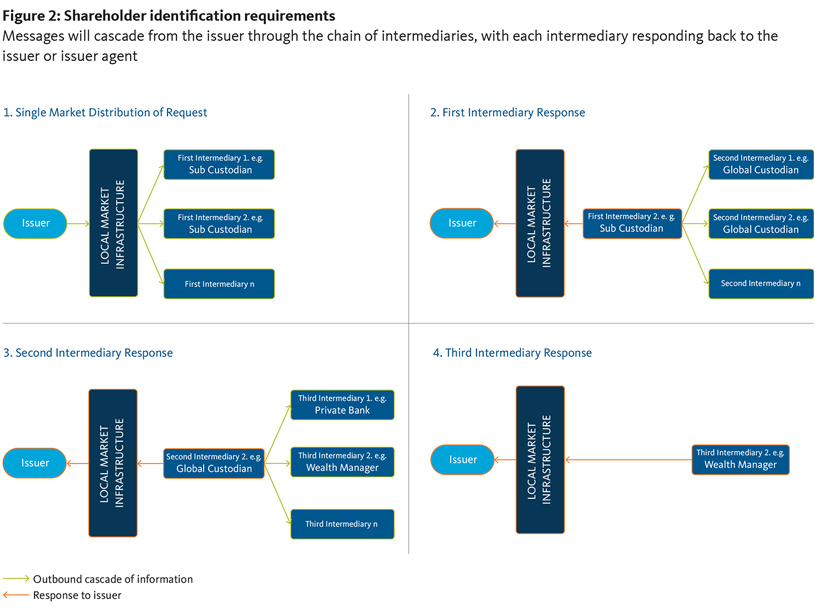

In order to uphold the issuer’s right, under the Directive, to have visibility into the ownership structure of their shares, each member state must now determine the most appropriate mechanism for issuers to receive and reconcile this data from multiple intermediaries in the shareholder communications chain.

According to a report published in April 2017 by ESMA (European Securities and Markets Authority), while a shareholder identification mechanism exists in 14 EU member states today, both the process and any deadlines to be complied with varied markedly, indicating a clear need for issuers and intermediaries to work to a more harmonised process across member states.

The Regulation introduces significant changes in shareholder identification rules. The general process for the exchange of information has been defined. This includes deadlines to be complied with, general guidance on standardisation and processing rules, and the content of messages. However, large gaps still remain, in particular there is no defined messaging structure, nor is there any definition or guidance on communication structure.

Two messages have been defined, the Request to disclose information regarding shareholder identity and the Response to a request to disclose information regarding shareholder identity. The Requesting message must be cascaded from the issuer through the chain of intermediaries, with each intermediary forwarding the request on to the next intermediary in the chain. Each intermediary must then send the Responding message back to the issuer or issuer agent. Each intermediary must work on strict deadlines. There is some variance for time zone and time of day, but generally the forwarding and responding processes must take place within one business day.

Intermediaries are required additionally to verify that a disclosure notice sent by a third party nominated by the issuer does originate from the issuer. This can be challenging due to the large extent to which third party providers are used today.

This information exchange continues to be bound by GDPR, so data protection remains a key concern.

There is the potential for intermediaries to be required to connect with up to 30 different local message communication platforms - each EU/EEA market could establish their own local market platform with different message standards and communication protocols. In addition, intermediaries will need to manage the verification of issuer shareholder identification requests and the cascading of messages in a timely fashion to ensure compliance. This problem lends itself to consolidated technology solutions across member states.

TRANSMISSION OF THE MEETING NOTICE

While the proxy voting service offered by intermediaries has developed significantly over the last decade or more, there are still some intermediaries that do not offer a meeting notification service. Unless their client has opted out of receiving meeting notifications and other shareholder communications, the Regulation now requires that they offer such a service.

Under the Act, issuers must provide to intermediaries notification of the meeting and the agenda no later than on the same business day on which it announces the event. Intermediaries in turn must transmit the receiving information to the next intermediary in the chain without delay and no later than by the close of the same business day as it received the information (or by 10am on the following day if received after 4pm).

Within these timescales, intermediaries will still be required to analyse meeting information, and where necessary translate the meeting information. In order to ensure that these service levels are met and also comply with the Regulation, intermediaries must examine their existing capabilities. Investment in systems and / or specialist outsourcing options may be required to help meet compliance requirements.

VOTING AND VOTE CONFIRMATION

As part of upholding the issuers’ right to greater transparency under the Directive, the Regulation requires intermediaries to pass on any votes received to the next intermediary (or issuer/issuer agent) ‘without delay’. Currently, intermediaries often hold on to shareholder vote instructions until close to the voting deadline before passing them onwards to the next intermediary. This practice is followed to manage costs by reducing the level of effort in share positions reconciliation and the volume of message traffic that would otherwise have to be done if vote instructions were passed on upon receipt. While no time-based deadline is specified in the same way as other requirements of the Regulation, the term ‘without delay’ effectively prevents intermediaries from continuing this practice.

This represents a significant shift in approach for intermediaries and therefore it is important to review not just technology and message flow changes to support this requirement, but also the operational impact and increased costs.

Implemented in the right way, this change could bring benefits by shifting much of the last minute reconciliation activity up in the timeline, allowing more time for investigating issues or discrepancies.

For many years, investors have been voicing their concerns around the lack of transparency through the chain, largely as a result of sporadic or missing vote confirmation. Confirmation of the receipt of a voting instruction is something that does happen today, with most electronic voting mechanisms or messaging networks having the ability to acknowledge successful receipt. The Regulation now mandates this practice, comprehensively and for all participants, and also includes the requirement to do so without delay. This should not have a significant impact on intermediaries with an advanced and well-established service offering; however, some will now need to ensure that this capability is in place.

Post-meeting confirmation of votes cast is a much more challenging subject and is something that has been tackled by a variety of industry bodies and other groups over the years without much success. Issuers or their agents will be required, upon request, to issue a confirmation of votes cast and counted, either within 15 days of the meeting concluding, or within 15 days of the receipt of the request, whichever comes later. The Regulation defines the minimum set of data that should be included in such a confirmation, which should provide far more granularity than is available in confirmations today.

Arguably there are some less well understood reconciliation complexities that could be introduced with the level of granularity that the Commission is mandating. The ability to process this complex data back through the intermediary chain and facilitate reconciliation of the share positions and the voting direction is a new concept that will need to be assimilated by the industry.

Mandating the provision of post-meeting vote confirmation removes much of the transparency concern that has led to some of the prior unsuccessful industry initiatives to address the issue. While in general terms this can be seen as a positive development for investors, post meeting vote confirmation presents a processing challenge for issuers (or their agents) and intermediaries, introducing the potential for more reconciliation complexity.

CONCLUSION

Our September 2017 white paper concluded that the SRD is a driving force for greater transparency in corporate governance and improved shareholder engagement. The Regulation remains in keeping with these goals.

The Regulation has moved to address many of the inadequacies of the meeting notification and voting process through the intermediary chain. There remains, however, some scope for implementation divergence by member states. Intermediaries should act now to ensure that they are part of implementation discussions. Lobbying for a harmonised approach, either directly or through their professional associations, will be critical to ensure the most efficient processes are implemented.

Custodians and other intermediaries should examine their own product offering to identify areas where change will be needed to ensure their own compliance with the Regulation. Existing processes will need to evolve to incorporate some of the new timing requirements, and new processes and data flows will need to be factored in to their offering.

Clear opportunities exist for forward-looking, well prepared firms to develop and manage solutions for the industry.