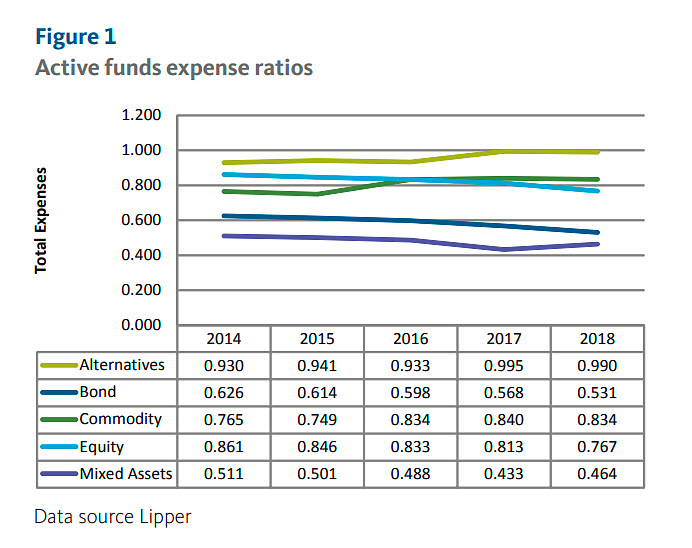

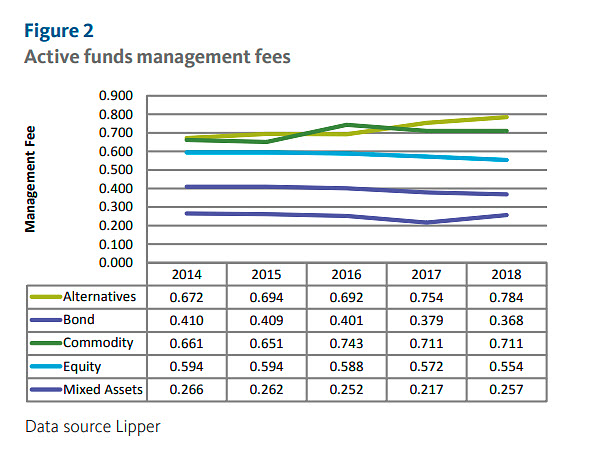

Over the past five years mutual fund expenses in the U.S. have trended downwards. While many factors have caused this trend, it is nearly impossible to identify a “primary” cause. Broadridge believes that it is important to give perspective on the many areas that are driving expenses down, especially for boards and management as part of the 15(c) process. Two of the common themes that are discussed for the impetus for lower expenses are related to downward pricing pressure from ETFs and passive products, and a shift in how investors purchase mutual fund shares, moving from retail load shares to institutional share classes, typically without sales loads, or 12b-1 fees.