As the investment industry reinvents itself for a digitally-connected world, wealth advisors must also radically reimagine and retool their businesses. Unfortunately, many have not moved quickly enough — or at all — to make the necessary changes, putting their future market position at risk.

In this paper, Broadridge and ESI ThoughtLab provide a roadmap and business case for wealth advisors looking to both realign and digitally transform their practices.

Topics in this white paper include:

- An industry in flux — The convergence of economic, demographic and technological shifts has turned the investment industry upside down. These shifts will have major implications for wealth advisors, who will need to adapt to the changing expectations of their clients to thrive — and even survive — in the tumultuous times ahead.

- Are advisors prepared? — Many investment advisors and their firms are struggling to keep up with the dizzying speed of change. ESI ThoughtLab’s research shows that a significant number of them are not well prepared in many crucial areas, such as holistic goal planning and fintech solutions.

- The next-generation advisor — To stay relevant in a fastdigitalizing marketplace, wealth advisors will need to rethink their roles and how they drive value to investors, finding innovative ways to combine high-tech capabilities with high-touch personal service. Doing this successfully will require a new breed of advisor that is bionic, data-enabled, client-focused, holistic and 24/7.

- Driving transformation with technology — For wealth advisors, technology is both a disruptor and a panacea. Digitalization is raising investor expectations for low-cost, frictionless service, but at the same time providing forward-looking advisors with new ways to meet client needs, make decisions and drive business.

- The ROI of digital innovation — Although getting up to speed on technology can be challenging, the payback can be significant. Wealth advisory firms that move too slowly not only will miss out on these benefits, but they will pay a “laggard penalty” in the form of poorer performance.

- Six key calls to action — Based on ESI ThoughtLab’s research and input from Broadridge experts, we have framed six calls to action to help investment advisors adapt to new market realities:

- Consider your niche and where you add value.

- Be digital first, but not digital only.

- Make the client your North Star.

- Become data-driven.

- Harness advanced technology.

- Consider a team approach.

An Industry in Flux

The convergence of economic, demographic and technological shifts has turned the investment industry upside down. These shifts will have major implications for wealth advisors, who will need to adapt to the changing expectations of their clients to thrive — and even survive — in the tumultuous times ahead.

ESI ThoughtLab research shows how these forces are coming together to transform the wealth management industry (see Figure 1.1). Investment advisors expect the global integration of financial markets (41%) — enabled by smart technology (35%) — and the rise of emerging markets (38%) to rewrite the playbook for their firms over the next five years.

As investors around the world embrace virtual communication and smarter technology, advisors will have the ability to serve clients not only outside their immediate local areas, but worldwide — including those in emerging markets. Moreover, investors across wealth levels are increasingly international, holding assets in more than one country. For their advisors, that means greater concerns about global economic and financial volatility (33%) and greater exposure to tax, regulatory and compliance complexity (23%).

“The trend is definitely going that way,” says Kevin Darlington, Vice President of Product Management for Broadridge Advisor Solutions. “There are fewer and fewer geographic limitations on the clients that advisors can work with.” Steve Scruton, President of Broadridge Advisor Solutions, agrees. “My own advisor is a great example,” he says. “About 50% of his business is outside the U.S. now.”

DEMOGRAPHICS

Another driver is demographic change, which includes not only greater investor diversity — net worth rose for non-white families at more than double the rate for white families between 2013 and 20161 — but the rise of Millennials, who are expected to inherit $30-40 trillion over the next 15 years. According to the latest U.S. Census figures, Millennials are the most racially diverse generation in U.S. history: 44% are non-white.

“The Millennial population is so large that their wants, needs and desires are ultimately going to be representative of everyone.”

William Fayerweather

Vice President of Strategy,

Broadridge Advisor Solutions

While it may be many years before most Millennials accumulate or inherit significant wealth, they are increasingly important to investment providers (21%), not only because they represent the future of the industry, but also due to their strong influence over the attitudes and expectations of older generations.

The influence of Millennials has helped to drive the most crucial change for investment advisors: the inexorable shift toward digitalization. Investors across generations and wealth levels look to manage their money in the same way they now shop, socialize, communicate and learn – by using a range of digital tools, social media and mobile apps.

As a result, investors are expecting much more from advisors and their firms: they now want the same 24/7 seamless customer experience from investment providers that they are receiving from Silicon Valley. This includes reaching their advisors by mobile, email and text and having online access to full, up-to-date account information (see Figure 1.2).

“We as consumers have a lower tolerance now for a poor user experience,” says Darlington. “Wealth management firms need to make it as easy for me to navigate their services and handle transactions as I can shop on Amazon or search on Google.”

However, ESI ThoughtLab research shows that investors also increasingly seek “high-touch,” personalized advice that considers their broader life goals (see Figure 1.2). “Regardless of how old investors are — whether in their 20s or in their 60s or 70s — they still want a financial life coach, someone to help bounce ideas off and talk about strategy,” says William Fayerweather, Vice President of Strategy for Broadridge Advisor Solutions.

ARE ADVISORS PREPARED?

These developments have huge implications for investment advisors and their firms, many of which are struggling to keep up with the speed of change.

“The majority of advisors are not really prepared, partly because of their age and where they are in their careers. They simply haven’t been operating their businesses with a digital mindset.”

Steve Scruton

President, Broadridge Advisor Solutions

ESI ThoughtLab’s research corroborates this view. Our survey of 250 wealth advisors shows that a significant number of them are not well prepared in many crucial areas. These include shifting from commission to fee-based services (48%), adding low-cost smart beta products (43%) and providing more holistic goalplanning advice (43%) (see Figure 1.3).

More than a quarter are still not prepared to offer what most investors now consider a basic requirement: anytime, any-device access to their account information and crosschannel communications with advisors. If advisors don’t meet these shifting investor expectations, they risk losing out to competitors, including fintechs, which 35% of advisors see as a rising threat. “Investment advisors have so much more competition,” says Scruton. “It’s other industries. It’s insurance companies that are getting into the space. It’s robo-advisors.”

The Next-Generation Advisor

To stay relevant in a fast-digitalizing marketplace, wealth advisors will need to rethink their roles and how they drive value to investors. Successful investment managers in the future will become “bionic” advisors — finding efficient and innovative ways to marry high-tech capabilities with high-touch personal service.

Darlington says that the key is combining the best of humans and technology. “To be honest, I’m a little skeptical of the digital-only value proposition — investors often need to talk to a human advisor.”

Rather than compete with technology, next-generation advisors will embrace it to do what they do best — understand their customers, build empathy and trust plus meet their individual needs, particularly in times of personal change and market volatility. To do this successfully will require a new breed of advisor.

Next-generation advisors will need to cultivate these five key attributes to thrive in the next wave of digital disruption:

- BIONIC

- DATA-ENABLED

- LASER-FOCUSED ON CLIENTS

- HOLISTIC

- 24/7

1. BIONIC

Next-generation (next-gen) advisors will excel at using technology to enhance every aspect of their businesses, from targeting, attracting and on-boarding new clients to engaging, servicing and upselling existing ones. This will boost advisor productivity — a necessity in an industry where margins are under pressure and advisors need to find new ways to streamline costs and expand their customer bases.

That could be tough for an advisor with 200 clients on the books. “Without technology, it’s impossible to service that many clients and stay in touch when new opportunities arise,” says Scruton. “However, advisors can service a large client base much more effectively with the support of technology, since it frees up time to focus on the areas where they add the most value.”

In learning to make the best use of technology, most wealth managers build technology solutions onto their existing personal approach. Instead, they should start by assuming that the business started out digital and then add the elements that need to be personal.

In this way, investment advisors can truly rethink their approach for a digital marketplace and strike the optimal balance between high-touch and high-tech solutions. ESI ThoughtLab’s research shows that by 2022, for many investment activities, advisors will set a more even balance between the roles of humans and machines (see Figure 2.1).

For example, artificial intelligence (AI) is already replacing humans in high-frequency trading and some aspects of portfolio management, such as automated portfolio rebalancing. Machines also have the upper hand in quickly analyzing news feeds and social media, processing earnings statements and trading on these market developments instantaneously.

However, AI will be unable to replicate all aspects of human intelligence needed for handling investment tasks, such as assessing market turning points, anticipating political events or managing client relationships. “Machines aren’t good at interpreting nuances,” says Fayerweather. “They can’t tell what kind of relationship you have with a client, or whether a particular LinkedIn update merits a phone call or email.”

Scruton believes that technology will change the role of advisors, but not eliminate it. “Their human experience and industry expertise will still be vital,” he says. “But their work will focus less on generating commissions and more on providing clients with the best communications and the best possible advice.”

And while machines can automate some of the more routine client servicing tasks — such as sending out communications to clients — it can’t offer the personal hand-holding that clients seek in times of turmoil. “Advisors really earn their fees in the worst moments — maybe by talking you off a ledge when a 2008 happens,” says Fayerweather.

Darlington thinks that technology, paradoxically, helps advisors to be better humans. “If existing clients see you as even more on top of things, then they refer friends and give you more assets. Those kinds of clients stay with you; and amazingly, completely objective investment performance starts to take a back seat.”

2. DATA-ENABLED

Data is the lifeblood of the next-generation advisor. Tomorrow’s successful advisor will leverage a wide variety of internal and external data to put together a 360-degree picture of their clients and prospective clients. This data will include full use of financial information on clients held across the enterprise, as well as demographic, psychographic, behavioral and social media data from external sources (see Figure 2.2). From real estate and vehicle ownership to information on career changes and life events, advisors will harness data to help in client targeting, marketing and personalized servicing.

“Statistics and data will drive the action,” says Scruton. “An advisor will come into the office and get notifications on a mobile device about social media posts or life events of their customers — such as the birth of a child. So, it might be a good time to suggest starting a college savings fund or increasing retirement savings.”

He says that at the click of a button, the advisor can send out relevant content to that customer about a 529 college savings plan, for example. “Conveying such information at the right time and in the right way can make the difference between strengthening a relationship and losing a client.”

Similarly, Scruton says, if a client “likes” an article on social media about green investing, the advisor can follow up with communication about sustainable investment products. Not only can this use of social media open up a dialog with the client, but also with the client’s social media connections, creating new networking and sales possibilities. “Advisors should connect with clients on the technology platforms that suit each one,” says Scruton. “Smart firms will arm their advisors with streams of curated content that can be pushed to clients across these platforms."

As a result, says Scruton, advisors will have to step up their game. “Too many advisors today only discuss what’s up and what’s down in markets. In the future, that won’t cut it,” he says. “Advisors will have more data and technology at their fingertips and will be expected to use it to produce better, personalized communications that will help grow assets under management.”

Darlington adds that if advisors fully embrace the latest data tools, they can reduce the time to prepare for a quarterly meeting with a client from half a day to a few minutes. “The systems will tell them what they need to know about Jane Smith, when they last spoke to her, and what they should be discussing with her, including life events or goal changes that might necessitate a recalibration of her investments,” he says. “That doesn’t mean that they should be less thoughtful about the approach — in fact, the technology gives advisors more time to think."

3. LASER-FOCUSED ON CLIENTS

Leveraging technology and data will help wealth managers become more laser-focused on clients — another essential attribute of next-gen advisors. By using data for microsegmentation, advisors can better target their marketing and client interactions.

This is where AI comes most into play, helping advisors generate sales leads and business development opportunities. AI software can scrape dozens of marketing, demographic, psychographic, public record and credit databases. It can then analyze the data to identify consumers with the right profile for a particular advisor.

“At its core, technology is taking what advisors would normally do when they had half the clients they have now — going to networking groups, joining clubs, asking for referrals — and automating it,” says Fayerweather.

Once advisors have these leads, they can use AI-powered software for content marketing. Such tools can help advisors, plan, create, optimize, personalize and promote content, and push out the material most appropriate to each prospect. As an added benefit, these tools can allow advisors to measure the results more effectively.

Perhaps most importantly, micro-segmentation allows advisors to better focus their efforts. As technology makes geographic location less important, more advisors are looking to specialize, finding a niche where their skills, experience and interests are a good match to a particular type of client — like women managing small businesses or technology entrepreneurs. By segmenting clients into servicing categories, Scruton believes that advisors will be able to pay more attention to their highest-value clients and have more time to find new ones.

Darlington likens micro-segmentation to using a camera zoom lens. “It’s like trying to describe something from a distance,” he says. “I might be able to tell from 1000 feet away that it’s a group of people. Only as I get closer can I say whether it’s a mixture of men and women or young and old or different ethnicities. The more pieces of information I get, the closer I get to fully understanding and identifying each client segment.”

He adds that coupled with the increasing ability of advisors to work with clients remotely, micro-segmentation is making it possible for advisors to specialize in what he calls micro-niches. “With geographic limitations less of a factor these days, advisors can choose from a much wider pool,” he says. “That means they inherently can have a much deeper focus on a more nuanced niche. That’s an interesting dynamic.”

An advisor might end up working mostly with doctors, lawyers, tech startup executives with stock options to divest or even middle-aged divorcees. “It’s a very solid form of prospecting,” says Darlington. “You can get a much more revealing view of your client base. What does your practice actually look like, above and beyond their simple net worth and their age? In addition to demographics, you can see that they vote this way, join these kinds of social organizations and so on.”

Fayerweather agrees that next-gen advisors will use these tools to gain a deeper understanding of their clients. “Advisors will be able to figure out their niches and focus on the people that they can serve better,” he says. “They may not all need to look the same; maybe it’s a financial objective or goals that they have in common. Determining what you’re really good at and communicating that to a customer will help you gain trust faster.”

At times, this may mean passing on some clients — which requires a new type of mentality, says Fayerweather. “Both the narrower focus on prospecting and the discipline to be able to turn away people that aren’t ideally suited for your practice will build credibility and pay dividends, both in the short term and the long term,” he says.

“With fewer geographic limitations and greater ability to micro-segment, advisors can more readily focus on specialized client niches.”

Kevin Darlington

Vice President of Product Management,

Broadridge Advisor Solutions

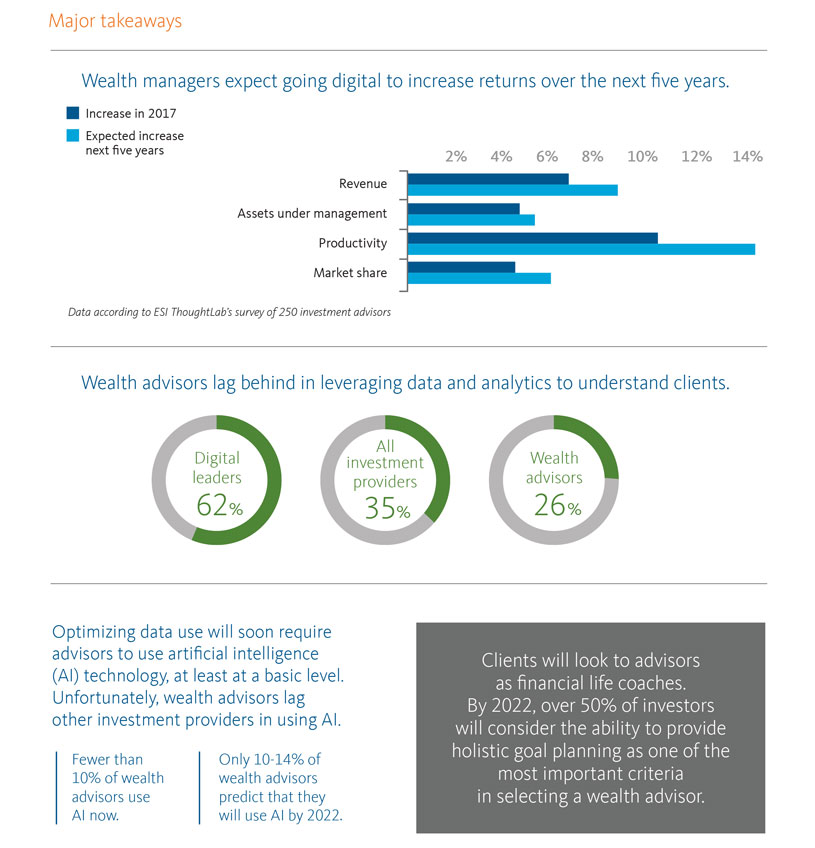

4. HOLISTIC

As technology simplifies routine investment tasks, clients will look to advisors as financial life coaches that can provide personalized and specialized support geared to their broader financial needs. ESI ThoughtLab’s research shows that by 2022, 50% of investors will consider the ability to provide holistic goal planning as the most important criterion in selecting a wealth advisor (see Figure 2.3).

“Tomorrow’s successful financial advisor will be different than yesterday’s — not just more technology savvy, but more holistic,” says Fayerweather. “Clients want someone who can understand where they are today, where they want to be, and ask questions to help them think about things that weren’t necessarily top of mind. There is a lot of value and benefit in that.”

Scruton agrees that the next-gen advisor will be more adviceoriented. That could mean bringing in a specialist team member or partner to discuss non-investment financial products, like insurance, says Scruton.

“Advisors will serve a much bigger purpose, leveraging technology and digital tools to help them deliver a much wider breadth of service.”

Steve Scruton

President, Broadridge Advisor Solutions

Or it could mean using client data to give more proactive advice. “Because the advisor has a complete financial picture for a client — including a feed from the client’s retail bank accounts — she might see that he just got a raise,” he says. “She might send a congratulatory message and suggest how investing 50% of that raise might affect his financial and life goals."

However, Fayerweather believes that becoming more holistic may make it harder for advisors to keep adding more clients. “Trust is very important and it takes a long time to build. It’s not a volume game. The way to gain that trust — to give investors enough confidence and comfort to want to do business with you — is to have fewer relationships but have them be deeper and more meaningful.”

5. 24/7

The next-gen advisor will need to be always on, available to clients when they need them. In today’s Amazon world, investors have high expectations, demanding anytime, anywhere access to accounts, together with frictionless interactions and greater transparency.

ESI ThoughtLab’s research shows that over the next five years, having anytime, any device access to their advisors will become increasingly important to investors (see Figure 2.3), and more than half of investors surveyed cited this as a top criterion when selecting an advisor. To meet these rising demands, wealth managers must stay informed and connected, while exercising critical time management to service their clients.

“Investors want to have an advisor they can call any time and who can bring to bear the advice the whole firm has to offer,” says Darlington. “It’s just like all the 24/7 interactions we have in our lives today."

Scruton believes that most of these interactions will be in electronic form. “There has to be a personal touch, but I don’t see advisors taking phone calls at 1 a.m.,” he says. “The advisor might still get to go to sleep, but there needs to be a lot of data and technology working in the background on behalf of the advisor.”

While perhaps only a small percentage of clients will expect to reach their US-based advisors in the middle of the night after the Nikkei closes 500 points down, these kinds of expectations are nonetheless on the rise, particularly as advisors build overseas client bases. Having an advisor constantly on call at any time may be a challenge, particularly for smaller firms. To ensure seamless client service, advisors may need to work as a team or with outside partners.

Teams also make it easier to match advisors with different demographics, skills and specialist knowledge with client requirements and preferences. Having a range of specialists on call will make it easier for an advisory firm to offer clients holistic advice on all aspects of their financial lives. “Many younger advisors believe it isn’t realistic or even effective to try to represent themselves as having all the capabilities that a client truly needs,” says Darlington.

“Instead, independent advisors look toward partnerships, even those that extend beyond the firm. And they are pairing clients with advisors close to them in age to manage day-to-day contact. Advisors increasingly recognize that a team-based and open architecture approach better serves the individual’s needs.”

For next-gen advisors, it will be not only about being always on call, but also always on the lookout for how market developments will affect each client, using technology to track developments. “An advisor might have two customers — let’s call them Amy and Larry,” explains Scruton. “Data on their phone calls and emails to the firm make it clear that when there is a more than 1% drop in the market, Larry might begin to panic, while Amy doesn’t react.”

If the market falls more than 1%, the firm’s system could recommend that the advisor send a reassuring email to Larry, but not waste time sending one to Amy, who doesn’t need to be contacted. “In the long term, that’s going to lead to additional business,” says Scruton.

Driving Transformation with Technology

For wealth advisors, technology is both a disruptor and a panacea. Digitalization is raising investor expectations for lowcost, frictionless service, but at the same time providing forwardlooking advisors with new ways to meet client needs, make decisions and drive business.

“In almost any industry, technology can help you be a better you and this is especially the case in the investment industry,” says Kevin Darlington. “Given the mounting pressures for feefor-advice and lower cost investment vehicles, the industry’s economics are changing. Advisors will need to increase their productivity and service more clients to earn the same income as they did in the past.”

According to William Fayerweather, the trick is “to figure out how to make technology your friend and let it do the basic blocking and tackling. That way, you can derive the greatest benefits from technology, and concentrate on providing high-level personal service to your clients.”

REAPING THE BENEFITS OF DIGITAL INNOVATION

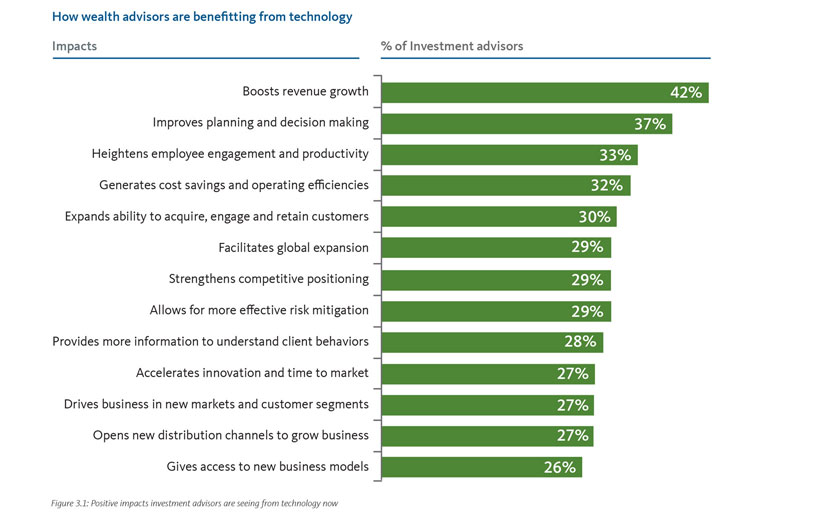

ESI ThoughtLab’s research shows that advisors derive myriad benefits from digital technology: 42% are already seeing higher revenue growth and 37% have found that technology is improving their planning and decision making. They are also seeing improved productivity, customer acquisition, cost savings and market share (see Figure 3.1).

Another key benefit of technology is its ability to drive greater productivity, according to Steve Scruton. “The number of clients you can service better probably goes up by about 25% to 35%.” For example, Scruton explains, an advisor with 300 clients could use technology to gather external data and determine that 75 of those clients — whose portfolios are under $250,000 and aren’t growing — need to be contacted only once a year. In addition, they will be able to automate part of that process. “That frees you up to focus on your top-tier clients and on cultivating additional customers. So you may be able to handle 25% to 35% more clients in a better way,” he says.

ESI ThoughtLab research shows that while most advisors currently offer digital tools for getting account information and personalized advice, only a minority offer them to support most other investor activities, such as tracking performance against life goals (38%), getting a consolidated view of accounts (29%), or connecting and interacting with their advisors (35%) (see Figure 3.2).

Although the benefits of going digital are clear, most wealth advisors are behind the curve.

Going digital is a challenge for most wealth advisors, according to Scruton. “The biggest gap is using technology to get to know your client better and using that knowledge to deliver better advice. It is an imperative for playing in the industry, but it is not easy to solve.” In Scruton’s view, only one out of ten wealth managers he talks to have that mindset, and only an equal number have the technology at their fingertips.

DIGITAL-FIRST ENGAGEMENT

If they want to maintain their market share, it will become increasingly important for wealth advisors to engage digitally first with their customers, who will look to the internet and social media for information on investments. Advisors will no longer be able to rely entirely on offline communication like phone calls and face-to-face meetings, but must ensure that they can communicate through smartphones, telepresence, webinars and online chats, all of which are set to grow substantially over the next five years (see Figure 3.3).

Scruton agrees that firms need to plan for customers whose first touchpoint will be digital. “We now live in the world of digital change,” he says. “I may not be a Millennial, but my smartphone is still attached to my hand. The way in which I interact with anybody is initially by my smartphone, or if I’m at home, on my desktop or laptop. I expect that now of my financial advisor.”

Simply adding new digital communication channels is not enough; they need to operate seamlessly with traditional channels, according to Scruton. “In many firms, everything is fragmented, with no integration between social media, websites and marketing campaigns,” says Scruton. “To get products and advice communicated to the end customer, all channels have to be working together.”

Research reveals that only 26% of advisors leverage data and analytics to understand clients, whereas 35% of all investment providers and 62% of digital leaders do.

For most wealth advisors, building such a seamless system is a huge undertaking. The first big challenge is dealing with the consolidation of the data. Putting the data into an environment that is right for marketing and transactional interactions.

“Getting the data straight first is very, very important. If you’re straight on the data, then you can layer in analytics and other technologies.” Scruton believes that all the data belongs in the cloud because it is more cost effective and secure.

Our research reveals the key measures that investment advisors are taking to create such a customer experience (see Figure 3.4). These include adapting the channel mix to support a customer’s journey (41%), putting the client at the center of the process (40%) and analyzing the impact of client servicing on channels (39%).

Rethinking the investor experience for a digital world is crucial, according to Darlington. “If I’m a client of a wealth management firm or financial advisor, I expect that wealth manager to know me well and tailor a solution for my needs. My frame of reference is not what I get from other wealth management firms. It’s based on my day-to-day life experience as a consumer.”

HARNESSING ARTIFICIAL INTELLIGENCE

To extract the maximum value from their data, wealth advisory firms will need to become cognitive enterprises drawing on a range of artificial intelligence (AI) technologies, such as machine learning, natural language programming (NLP) and robotic process automation (RPA). While investment firms can use AI for a wide range of functions, including cybersecurity, compliance and backoffice automation, one of AI’s first applications will be gathering, analyzing and marshalling of third-party investor data to bolster their customer servicing and marketing efforts.

“Artificial intelligence can facilitate the task of bringing together internal investor data with lifestyle data, psychographic data, public record data and credit data to get a 360-degree view of the client,” says Scruton.

“For example, a wealth manager may want to draw on external data to put existing customers into different categories: this person is a thinker, that person is risk averse, the other is a lifestyle buyer. There’s external readily available data, such as psychographic, demographic and credit data, which can predict those segments. AI not only automates the process but improves on it by learning from the data. You have attribute A, you have attribute B and the model creates a new attribute C."

While AI will help advisors gain insight from data, Darlington points out that it will not do the thinking for the advisor. “AI will do a better job of organizing and isolating data points that are worth a look from the advisor. But the advisor still ultimately has to quarterback all of that. Hopefully, AI in the short term will allow them to spend the limited time they have on being more thoughtful. It will enable them to spend their time on higher value activities.”

To effectively deploy the technology, it’s important to figure out what jobs can be automated, says Fayerweather. “Some may only lend themselves to semi-automation and others may require complete manual intervention,” he says. “But even on those jobs, the technology can still help, reminding you of when and how often you should be doing them.”

Unfortunately, wealth advisors are currently lagging behind other investment providers in using AI — and are falling dangerously behind digital leaders. While more expect to employ AI in the next five years, the percentages remain very low (see Figure 3.5). By 2022, 53% of digital leaders and 19% of all firms expect to use AI to find and attract investors, while only one out of ten investment advisors will do so.

THE ROI OF DIGITAL INNOVATION

While making a digital transition can be challenging, the payback can be significant. According to ESI ThoughtLab’s survey of 250 investment advisors, the use of digital technologies over the last year increased revenue by 6.9%, assets under management (AUM) by 4.6%, productivity by 10.6% and market share by 4.3% (see Figure 3.6).

Wealth advisors expect these returns to grow over the next five years. Specifically, they expect going digital to boost revenue by 9% a year, productivity by 14%, AUM by 5.5%, and market share by 6.1%. These are not trivial figures; although advisors expect costs to rise as well, the productivity and asset growth can make a big difference in payouts and profitability.

Wealth advisory firms that move too slowly not only will miss out on these benefits, but they will pay a “laggard penalty” in the form of poorer performance. To calculate a laggard penalty, ESI ThoughtLab economists determined the difference between the financial results of advanced firms and beginners.

We then calculated what this penalty might be in absolute dollar terms for firms in different sectors and varying sizes. For investment advisors, this penalty works out to be a loss equivalent to 5.2% of revenue.

“Firms that move too slowly will find themselves in a position where the things that they say they do well will be eroded by the very technology that’s helping other firms do them better,” warns Darlington. “Robo advisors, for example, have driven down the cost of providing advice, which may leave traditional wealth advisors stuck chasing price.”

Even worse, laggards risk falling out of the race altogether. “On a scale of one to ten, the consequences of the industry moving too slowly on technology is a 12,” Fayerweather adds.

“The younger generation wants to be with a technological leader, not a dinosaur.”

William Fayerweather

Vice President of Strategy,

Broadridge Advisor Solutions

He sees an even bigger price ahead for digital laggards: losing the business of future investors. “The younger generation wants to be with a firm they view as a technological leader even if its services aren’t materially different,” he says. “They don’t want to be involved with a dinosaur.”

Scruton sums it up. “The penalty for moving too slowly is early retirement.”

Calls to Action

Based on ESI ThoughtLab’s research and input from Broadridge experts, we have framed six calls to action to help investment advisors adapt to the new realities facing the industry as they look ahead to its future — and their own.

1. CONSIDER YOUR NICHE AND WHERE YOU ADD VALUE

Technology enables investment advisors to cast a wider net beyond clients in their own local areas. By broadening their reach, they can concentrate on clients with whom they have an affinity or for whom they can add more value through specialization.

“All clients aren’t equal, even if they make you the exact same amount of money,” says William Fayerweather. “You should do some honest self-analysis to understand which clients are the best fit, which you can help the most, and how you can best service them. It’s important to understand who you are, what your practice is, what you’re good at, what you’re not good at. You can use that understanding to find more clients that fit your practice in the future.”

2. BE DIGITAL FIRST, BUT NOT DIGITAL ONLY

Becoming a next-generation, bionic advisor means leveraging technology as much as possible, while continuing “high-touch” personal contact where it is really needed. While client service, client communications and prospect marketing should be digitally-enabled, it’s important to meet with clients in person from time to time and to reach out to them when they experience major life events.

Kevin Darlington agrees. “I don’t think that the purely virtual will overtake the tactile in-person experience any time soon,” he says. “At some point, clients — particularly at higher wealth levels — need to meet the advisor in person. There’s only so much they are going to get via a video share, phone call or email.”

“The most advanced firms realize that data strategy is not really about the mechanics of it. It’s about how you’re going to apply and use it.”

Kevin Darlington

Vice President of Product Management,

Broadridge Advisor Solutions

3. MAKE THE CLIENT YOUR NORTH STAR

How advisors choose to deploy technology should hinge on a deep understanding of what clients need and want from their advisor. “Firms need to be thinking about the advisor/client relationship lifecycle: what good service and a good client relationship looks like,” says Fayerweather.

“They need to ask, ‘How do we as a firm want our advisors to interact with their client bases?’ If they do that first, then they can determine how to apply technology and AI to make that job easier and more effective. Their advisors can shine as human sources and touchpoints, and they will do well.”

4. BECOME DATA-DRIVEN

Advisors should take a lesson from Silicon Valley companies like Amazon: getting and using customer data is essential to becoming a next-generation advisor. Advisors and their firms need to put the right technology in place to wrangle their internal data and to access a myriad of external databases to get a 360-degree view of their clients. “The consumer expectation now is that you should know what I need before I even need it — like Amazon does,” says Scruton. “Even if I haven’t told him, my advisor should know, for example, that in addition to my job, I’m a small business owner. He should be suggesting products and strategies especially for that. All of that data is out there.”

Darlington adds that with data, advisors can go beyond the basics to get at behavior and attitudes. “You can look at a client’s goals, dreams and values and start to find patterns where people who have similar aspirations have other commonalities that would be useful to know about.”

5. HARNESS ADVANCED TECHNOLOGY

Next-generation advisors should use newer AI-related technologies like robotics and machine learning to boost their productivity and turbocharge their marketing efforts. “It’s really important to leverage automation to take on a lot of routine tasks for clients,” says Fayerweather. “If you spend all your time trying to do things manually, you have zero time left for relationship building, servicing existing clients, upselling or finding new clients.”

Scruton argues that advisors who avoid AI will lose out. “My belief is that if you don’t use AI and apply it to relationships, then others will apply AI to your business model against you, providing more and more services at virtually no cost. We’ve seen it in so many industries and the results can be game-ending.”

6. CONSIDER A TEAM APPROACH

As clients raise their expectations for 24/7, specialized service, a single advisor — even one enabled by data and technology — may not be enough. Next-generation advisors and their firms should be creating client service teams or partnering with other firms and advisors to ensure they have the right skills and resources in place to meet client needs whenever they arise.

“I’ve seen independent advisors who might have in their firms pretty solid capabilities for tax and wealth planning and portfolio management, but who are very happy to use outside partnerships when it comes to insurance, for example,” says Darlington.

View a full list of references for this white paper.