Many of these new shareholders are comparatively younger—usually Millennials, but some Gen-Zers—buying positions on digital platforms and mobile apps that make investing easier and faster.

There’s enormous opportunity to engage these investors and help shape how they perceive and participate in the process. Below are three ways social media can strengthen your retail engagement strategy.

1. Boost proxy participation

Compared to institutional investors who regularly vote 90 percent of their shares, retail investors only vote 28 percent of their shares. In fact, more than 88 billion retail shares were not voted during the 2020 proxy season, according to ProxyPulse data.2

There’s an obvious need to bring more retail shareholders into the fold.

You can reach these investors by using social media advertising to enhance your proxy solicitation strategy.

It starts with data. The right shareholder data can offer unique insight into your shareholder base, voting habits, demographics, and communication delivery preferences. In real time, you can see which shareholders have voted and which haven’t, then deploy targeted ads to drive the vote and achieve quorum.

Complementing social media advertising with paid display ads enables issuers to create a persistent digital presence. Ads may feature management-friendly messaging and CTAs that solicit proxy participation.

When shareholders click the ads, it drives directly to the proxy voting site where they can enter their control number and immediately vote their shares. This simplified approach helps maximize conversion by taking the friction out of the proxy voting experience.

The best part: Yours is the last message they see before they vote.

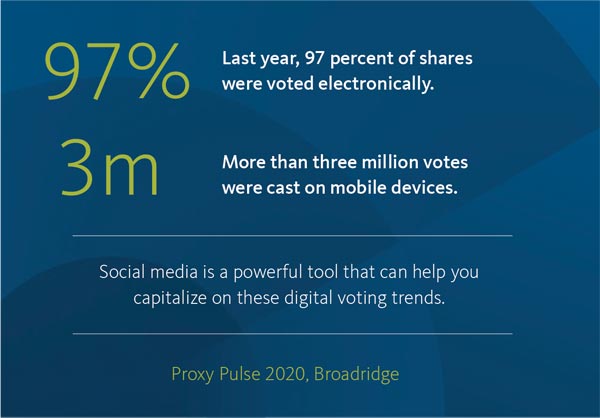

Last year, 97 percent of shares were voted electronically. And more than three million votes were cast on mobile devices.3 Social media is a powerful tool that can help you capitalize on these digital voting trends.

2. Maximize investor loyalty

Shareholders—especially retail shareholders—often develop a psychological bond with the brands they invest in. In this respect, investing can involve somewhat “irrational” factors well beyond numbers reported in the 10-K.

Consider Tesla investors or Berkshire Hathaway investors, for example. Of course, performance matters, but the shareholder communities around these brands indicate that something else is often at play.

That’s why IR professionals are thinking more strategically about ways to cultivate investor loyalty.

To that end, it’s valuable to think beyond proxy season. IR teams will need to adopt brand marketing principles to execute a year-round shareholder engagement program. Especially with retail investors, there’s real opportunity to maintain a constant presence, sharing your messaging and achievements throughout the year.

There’s perhaps no better tool for that than social media. According to the Pew Research Center,4 roughly two-thirds of U.S. adults (68%) now report that they are regular Facebook users. Millions more are on Instagram, Twitter and YouTube.

The biggest advantage of social media is that it’s a cost-effective way to engage on a long-term basis.

3. Own your ESG narrative

It’s no secret companies everywhere are under mounting pressure to increase transparency around environmental, social and governance practices. Climate change especially is pressing investors to think differently about materiality and risk. Most now believe climate change impacts financial risk.

In this landscape, it’s critical for issuers to get in front of the market and own an authentic ESG narrative. To be sure, sustainable practices are the main goal. But organizations also need a sophisticated engagement and messaging strategy to make sure their ESG achievements are widely disseminated.

Again, social media combined with display ads is a proven way to maximize reach and impact.

We often find that companies principally focus on the annual corporate sustainability report. But just like building brand loyalty, ESG storytelling requires year-round engagement. Social media empowers you to take control of the narrative and put your story in front of the audiences that matter most.

Most importantly, positive ESG narratives often appeal to wider consumer audiences (and can thus build brand goodwill). So, there’s opportunity for IR professionals to partner with their in-house social media marketing team to showcase ESG progress and achievements.

Social media is just the beginning

Although social media represents a powerful tool issuers can use to achieve their goals, retail shareholder engagement requires a more comprehensive strategy. Social media is but one piece of the puzzle.

Consider other tools available to you. For example, many issuers are successfully using virtual shareholder meetings to drive retail attendance. Virtual meetings don’t require travel, so it’s much easier for retail investors to log in and participate.

In addition, many issuers are now using enhanced proxy experiences to create a more rewarding proxy experience. Professionally designed mailers with QR codes drive shareholders to a digital proxy website where investors can watch videos, interact with data, and hear directly from your board.

Your social media presence can complement these digital experiences, rounding out a robust retail engagement strategy.