However, once the business migration risks are understood and planned for, deal risk reduction and financial benefits are too great for the industry not to see a wave of adopters of blockchain-driven technology in the coming years. Many firms are wrestling with an understanding of the practical and operational changes blockchain and DLT will have on their lines of business in assembling business cases and strategies for change to manage the migration risk.

This thought leadership piece will help bring clarity to the Fintech revolution that is underway in financial services with a specific focus on Broadridge DLT Repo Platform (DLR) by addressing common questions and concepts Broadridge Consulting Services (BCS) are seeing from firms assembling their strategic plans and migration blueprints for business, operations and technology in these spaces. It will address key business, systems and operational concepts as well as the largest elephant in the room associated with any paradigm shift – trust in the new way of conducting a traditional line of business.

WHY DLT FOR REPO?

Prioritization for the adoption in blockchain – and DLT specifically for this discussion – in financial services will mostly likely be led by deal types that eliminate the most systemic risk for firms and the global banking system in general (particularly in areas that can provide immediate and meaningful benefits, while ensuring low technology stack disruption). The cost benefits of adopting DLT repo will be a nice added bonus to the business risk reduction and will help fuel business cases to offset the necessary technology and operational investment and changes to achieve the target fintech environment – but that all requires planning.

In October 2017 when Broadridge announced it had successfully completed the industry’s first pilot for bilateral repo using blockchain, one of the questions BCS was asked was “what is the advantage of blockchain to equities?” The answer at the time and still today, is the trade types with higher execution and settlement risk other than vanilla equities would be the front runners for adopting blockchain. The industry will not likely prioritize blockchain solutions for equity trades any time soon as there are still many more areas of financial markets with greater deal risk and operational inefficiencies that will be way ahead of equities in the prioritization queue for migration to blockchain-oriented solutions.

While the equities market has not achieved straight-through processing (STP) and T+0 over two decades of trying to reach these goals on an end-to-end basis in North American markets, the amount of trade, systemic and operations risk has declined significantly. Equity trades are relatively stable and the infrastructure investment by the industry to get them closer to STP and reduce trade breaks is substantial. Despite the size of this market compared to other deal types that are highly fragmented and fraught with risk, equity trades will likely not lead the charge for business case spend on blockchain adoption for budgets in firms looking to invest in fintech with the goal to reduce business, deal and operational risk as a whole.

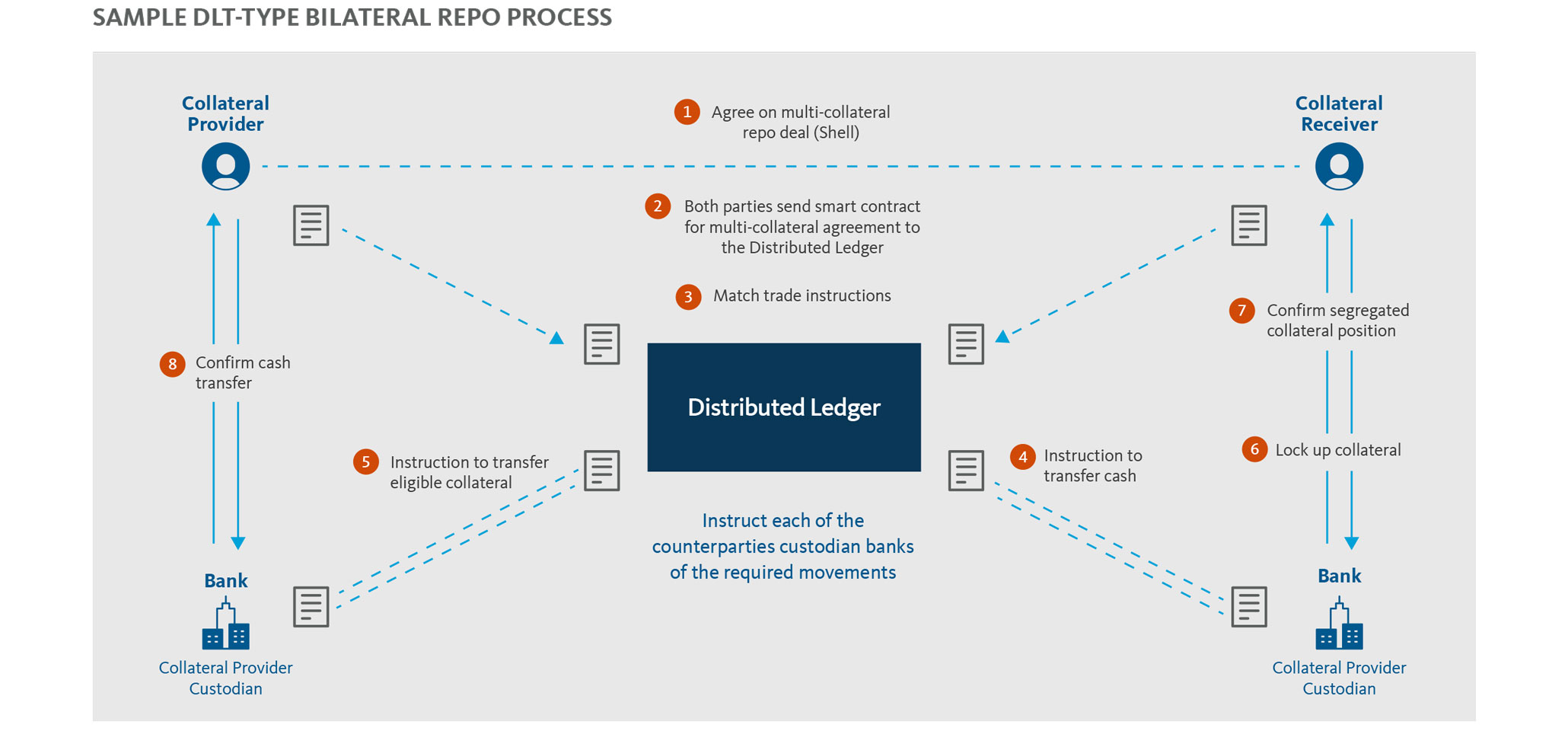

For technologies like blockchain and DLT, focus is emerging on other deal types that carry more trade and systemic risk. Most seasoned folks in financial services will have heard the adage related to deal making that” nothing good happens in the time between execution and settlement”. Narrowing that gap for some deal types has been elusive, blockchain and DLT in particular, will help reduce that gap and exposure. Blockchain for bilateral repo enhances efficiency of the deals on an end-to-end basis, reduces risk and provides data traceability, a record of the trade and collateral details (via digitization of collateral which allows for its immobilization at the depository location). Apart from being good for the firm and the parties in the repo trade, streamlined end-to-end deal capture helps firms adhere to increasing regulatory reporting on transparency and data lineage for initiatives like SFTR, CSDR and BCBS 239.

BACKGROUND

In 2016 and 2017, headlines started to appear as firms started piloting and launching various blockchain-based programs for DLT, bilateral repo and other fintech financial processes. Broadridge introduced blockchain-based proxy voting, virtual shareholder meetings and was awarded patents for repo technology, as examples. For seasoned traders and operations personnel in some deal-making areas of the industry still mired in relationship-based deal-making, telephone calls, emails, Excel for execution, fragmented collateral management and settlement, these new concepts of technology dominating a process that had been highly personal, human-driven and manual in nature for decades has been difficult to grasp and trust. A quick overview of repos and why they are a ripe target for DLT will help clarify the context of this discussion.

Repurchase agreements (repos) are a form of secured short-term financing in which the cash borrower, frequently a brokerage firm, sells securities (such as government bonds) to an investor and agrees to buy them back at a specified date and price. In bilateral repos, the parties are responsible for settling the transaction, rather than relying on a central counterparty. It’s these latter types of transactions that have been of strong interest for blockchain and DLT adoption in these early days of the fintech revolution coming to the repo space. Other areas seeing early exploration using DLT in the industry as well as digitization of collateral and cash, are starting to have some serious attraction as well, but we’ll save that for a separate discussion.

DLT REPO SERVES DOUBLE DUTY: RISK REDUCED, COMPETITIVENESS INCREASED

While reduced deal and business risk will help prioritize DLT repo adoption, they’re not the only drivers that are attractive to firms when assessing cost-benefit analysis. DLT repo is helping incentivize fintech investment budget approvals to help firms remain competitive going forward by reducing costs of deal making. In addition to fintech extending into day-to-day securities trading life with DLT repo, other aspects of the industry, such as securities lending and collateral management are undergoing changes that require investment and cost reduction to remain competitive. DLT repo adoption can play “double duty” and be an attractive component of their competitive landscape strategy in addition to reducing deal and business risk.

Fintech is beginning to level the playing field for financial services firms by enabling new entrants with white-labeled and quick-to-market financial services offerings. While the multi-national firms have branding and consumer confidence on their side, they also have the high costs associated with bricks and mortar operational environments. The erosion of market share away from traditional large players to fintech-driven financial services upstarts with lower overhead and no branches will be a growing trend through the decade. The Covid work-from-home and social distancing environments of the last year have accelerated this trend, as the push to digital has been prioritized in capital markets, wealth and asset management. DLT repo is one flavor of this change and it shares a similar cadence with other fintech changes: a domino effect on related areas such as accounting, risk, onboarding for DLT repo for business changes and, ultimately, have a ripple effect cost reduction, but the path to reducing the functional and operating costs is not a simple one. There will be more expenditure before the pendulum flows back to reduce costs. DLT repo can help trim the operating overhead in the long term and should be considered for the end-to-end business impact and cost reduction opportunities detailed in business cases in order to help flush out the cost-benefit analysis in the digital operational expansion. Below are key areas to address in business case approvals for DLT repo.

- Recordkeeping: As DLT will serve as the recordkeeping platform using public/private virtual data rooms for parties to verify ownership, reduction in recordkeeping by custodians,brokerages and other recordkeeping functions will follow.The long-term potential for cost reduction opportunities inaccounting, reconciliation and recordkeeping are strong but will require re-vamping business procedures and negotiation ofagreements with partners such as custodians, agent lenders and other financial partners on the street. Many of the recordkeeping function reductions will take time to migrate away from current state as firms run parallel to mitigate business and accountingrisk over fiscal quarters/years before retiring prior records andmanners of maintaining books of records.

- Legal: While Broadridge and the industry have begun toestablish best practices and templates for “Smart Contracts,”the legal complexity of moving to them and to DLT willrequire review of the end-to-end obligations and contractualenvironment inside firms and with external providers andclients. Once done, the cost of legal matters for deal making willreduce this function to more “rinse and repeat” and shift focusto consultation for deal anomalies and oversight assistance.This will be the case for the recalibration of onboardingdocumentation for clients as well under DLT initiatives.

- Technology optimization: As DLT moves transactions to T+0using automation, many of the functions performed at presentand its underlying technology can look to retirement and/orconsolidation of platforms by chipping away at carving functionsoff redundant platforms over time. Many financial servicesfunctions in capital markets work on the premise that overnightbatch processing, settlement, risk, reconciliation, etc., acrosssubledgers, general ledgers, third parties, securities lendingand collateral management drive the need for T+1 and T+2 torun these cycles. Offsetting overnight financial risk/exposurerelated to these cycles is an industry in itself. This pillar ofsecurities finance starts to dissipate with a move to T+0, as batchprocessing to bring disparate systems into alignment at end ofday becomes less critical along with planning for the overnightrisk/exposure in a real-time/near real-time trade, confirm,settle process. Moving to T+0 reduces the need for many ofthese overnight functions to manage exposure/risk and enablesan opportunity to identify synergies across the enterprisearchitecture for the T+0-driven workflows. The synergies andopportunities will present themselves but will require substantialwork and years to retire redundant infrastructure as the industrymoves slowly to T+0 across all asset classes.

WHERE DOES DLT REPO FIT IN THE SYSTEMS AND OPERATIONS ARCHITECTURE?

As financial services teams plan for the digitalization of capital markets to remain competitive, firms need to accommodate the end-to-end business impact and buy-in from the core areas that come to top of mind for DLT repo. Desks, operations and technology stacks are top of mind, but firms also need to get buy-in from other key business functions whose domains need recalibration for DLT repo, as well.

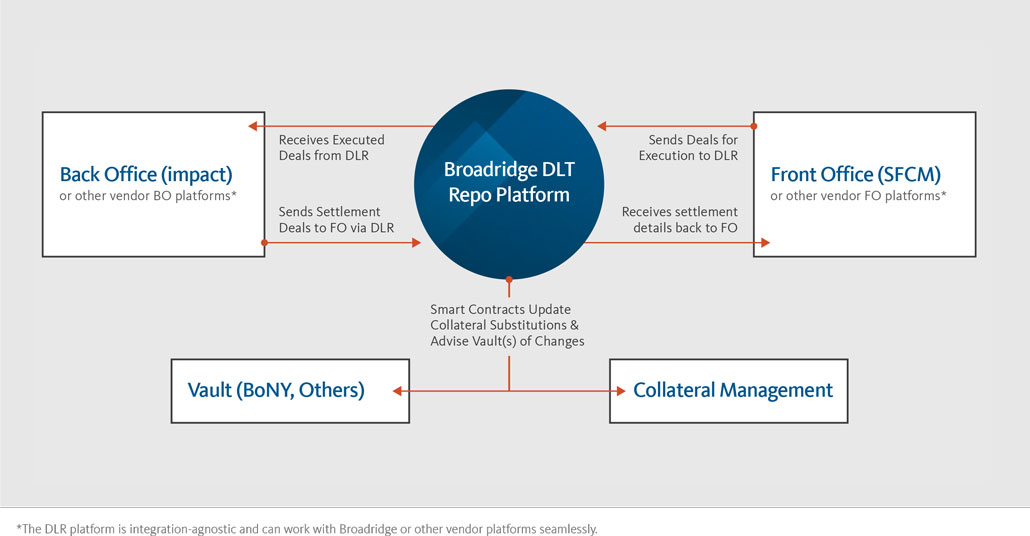

Many firms struggle with understanding the operational and systems impact of initiatives like DLT repo and where the technology fits into the current systems architecture and identifying which business units are most impacted by the adoption. The industry has become accustomed to terms such as front office, middle office and back office. Anyone who is a seasoned financial services professional can grasp where these front/middle/back office functions exist in an operational workflow. For many firms, DLT repo requires more clarity in terms of the hybrid position between front/middle/back office for integration into many firms. The diagram below represents a Broadridge-centric model for the sake of a sample model to aid the discussion:

Efficiencies from adopting DLT repo will come to several areas of the end-to-end repo process. As mentioned in the previous sections, recordkeeping (brokerage and custodial roles primarily), managing counterparty risk and the overall functions of risk and compliance related to repo trading will see an opportunity to reduce effort and optimize processes because of DLT repo. Overlaying deal workflow and functional swim lanes for the DLT environment will help pinpoint where to examine the costs associated with impacted functions.

SMART CONTRACT VIABILITY TRUST FACTORS: A PILLAR OF DLT REPO ADOPTION

Before we explore Smart Contracts for DLT repo, we will first review a history lesson of technology adoption challenges from the past. To ensure blockchain initiatives are launched on a healthy path for success, a brief history on the track record of data warehousing initiatives will help with lessons learned and, hopefully, course correct for better DLT repo adoption planning. Understanding the why is critical to engaging in a successful how for adoption.

As the industry began building consolidated data warehouses to solve fragmentation of data sources over two decades ago, one of the major failings of adoption and utilization was trust in the data by end users that many firms spent enormous budgets to assemble. Top of the wariness list for many firms were accounting groups who only trusted the data and processes they assembled in their GLs and subledgers for the truth so building that trust in data storage has been a challenge. The emphasis on many of these initiatives was on the how it would work, not the underlying business purposes the data warehouses would serve with the why.

Too much of the focus in many of these data initiatives was on assembling the consolidated data rather than understanding the end user needs. These initiatives were seen as technology changes, driven by IT, with limited input from the business of the underlying end uses. Vetting with business groups to get a comfort level with data being assembled for their uses should have been a critical communication task and in many cases was underestimated for its effort or importance. The importance of a ”snapshot in time” data on a daily basis to have a confidence level in sources of data performing their tasks as roles were important in data warehouse building, as it will be for DLT adoption for middle and back office folks. Getting buy-in from the end users and a comfort level in the data that it’s fit for purpose and meets the needs of the end users for the business is an important task for data warehouse initiatives as it will be for DLT and Smart Contracts for optimized adoption on an end-to-end basis.

Firms need to learn from previous projects like these to effectively adopt DLT repo and other blockchain initiatives. Concurrent to developing a business case and solid migration plan, ensuring the trust factors for the underlying users of DLT repo are equally important if not more important for success of this business shift. The key to garnering that trust is planning and education to understanding how the system, manual and mental decision-making processes that run similar functions today aretabled for end-to-end repo, including collateral substitutions and impacts upstream and downstream to functions such as corporate actions, tax, diversification/concentration, investment policy and regulatory adherence. This includes front, middle and back office personnel who will be charged with running the DLT repo environment and, typically, have a strong role in running the current similar book of businesses on the end-to-end basis.

Migrating from a fragmented and manual-supplemented processes to automation and instructions/ knowledge decision making that are subject to interpretation can create unintended risk in setting up an automated process. Planning for the adoption of concepts like Smart Contracts is a key factor in developing a migration to DLT repo and cultivating the trust factors in the technology that will be necessary for successful adoption across desks, risk and operations personnel. This is especially critical for exceptions handling: how do you automate this current function as much as possible on an automated basis? Taking deal making and deal settlement that has been done by seasoned professionals for years and translating the decision-making processes currently in their heads into programmable Smart Contracts is a key aspect of getting both the platform adopted to the firm’s needs and, as important, ensuring the end users have confidence in the decision-making process behind Smart Contracts. To add to the complexity, firms should take into account industry best/evolving common practices for DLT to infuse with the tempered current handling processes to ensure the firm is building for the future digital marketplace, not just copying the traditional handling into an automated smart contract.

Understanding Smart Contracts is a key to understanding how DLT repo works and for desks and operations to have a comfort level in embracing DLT repo. So, what is a smart contract? How does it differ from other fintech terms like artificial intelligence or business intelligence? A brief definition of each of these is outlined below to aid this discussion for DLT repo for firms looking to build business cases and assess their migration plans:

![]() Artificial Intelligence: AI’s intent is to create similar intelligence in technology that mimics human thought decision processes and to implement human intelligence. It leans heavily on computer science, math, sciences and psychology. AI needs to have checkpoints against it for the human rights of privacy, safety and dignity.

Artificial Intelligence: AI’s intent is to create similar intelligence in technology that mimics human thought decision processes and to implement human intelligence. It leans heavily on computer science, math, sciences and psychology. AI needs to have checkpoints against it for the human rights of privacy, safety and dignity.

![]() Business Intelligence/Machine Learning: BI starts with a formed set of rules derived from how a process or procedure is run today and uses predictive analysis to hypothecate what actions should be taken. BI works in the 80/20 zone; it will handle business decisions based on prior examples but escalate unresolved issues for handling by humans. As humans make decisions the program and adapts and learns from these new items to further improve its ability to handle business issues.

Business Intelligence/Machine Learning: BI starts with a formed set of rules derived from how a process or procedure is run today and uses predictive analysis to hypothecate what actions should be taken. BI works in the 80/20 zone; it will handle business decisions based on prior examples but escalate unresolved issues for handling by humans. As humans make decisions the program and adapts and learns from these new items to further improve its ability to handle business issues.

![]() Smart Contracts: Where AI is mainly science and BI is more interpretation of the rules for its operating goals, a Smart Contract captures more of the science part of AI with BI interpreted and set up to run automatically. One of the items leading the path to mutualized workflows in the industry, Smart Contracts are computer programs or a set of transaction protocols which are intended to automatically execute, control and/or document legally relevant events and actions according to the terms of a contract or an agreement. Digital mutual agreements providing a seamless ability to update the terms of a contract will begin to surface more frequently as part of the digitalization of financial services.

Smart Contracts: Where AI is mainly science and BI is more interpretation of the rules for its operating goals, a Smart Contract captures more of the science part of AI with BI interpreted and set up to run automatically. One of the items leading the path to mutualized workflows in the industry, Smart Contracts are computer programs or a set of transaction protocols which are intended to automatically execute, control and/or document legally relevant events and actions according to the terms of a contract or an agreement. Digital mutual agreements providing a seamless ability to update the terms of a contract will begin to surface more frequently as part of the digitalization of financial services.

Smart Contracts are not new to fintech but the level of complexity and sophistication that is being expected of them is increasing in financial services and are a fundamental pillar of DLT repo. Smart Contracts are very explicit instructions that are not subject to interpretation. Unlike BI which is consensus building for decision making and AI which is purely science driven, Smart Contracts rely on an exact set of rules, which is exactly what you want for DLT repo to ensure the deal runs smoothly – a firm will be less inclined to be looking for any interpretation here by a tech platform since the actual deal making is in flight. Recognizing the goals of Smart Contracts will help firms define how they want them to act for DLT repo or other fintech applications that employ them.

THE RISK AND THE REWARD: KEY BENEFITS AND CHALLENGES OF DLT ADOPTION

The promise DLT repo brings to the marketplace is attractive but the effort and business case approvals to enter into this new operating environment is daunting for many firms. Comprehensive business cases look to outline next stage goals that will be attainable as well for Day 2 with the initial steps into DLT adoption. Below is a summary list of key benefits, uses and challenges, many of which are discussed more fully in this paper.

| DAY 1 − LAUNCH | BENEFITS |

|---|---|

| Collateral management and optimization | Reduce fails/overnight exposures |

| Intraday liquidity management | Streamline operations, reduce costs |

| Optimization of custodial and other key relationships | Flexibility for ownership/pledging intraday |

| Increased regulatory data traceability/transparency | Framework for expansion to additional processes |

| Basel III LCR optimization | Better control over intraday credit exposure |

| DAY 2 − INSTITUTIONALIZATION | CHALLENGES |

|---|---|

| Expansion of network into bilateral executions | Capturing decision process in Smart Contracts |

| Readiness for growth of digitized assets | Re-inventing ops, business and tech workflows |

| Sponsored Repo mutualization | Re-aligning partner contractual fees and needs |

| Tri-party processing | Team education for repo recalibration in DLT |

| Issuance of securities on a chain | Varying readiness of business/technical partners |

CONCLUDING NOTES

Blockchain and DLT adoption is still in its early days and will require a seismic shift for most firms to adopt. There are five overarching trends that are governing the ramp-up of blockchain and DLT initiatives of fintech for financial services:

- Early adoptions will likely have a hybrid deployment between current state and target state

- Adoption of asset types will be prioritized by deals with systemic risk in the bank system

- Private vs. public vaults and interoperability will be fluid concepts as firms adapt to trusting DLT data

- Some firms will opt for DLT standalone adoption rather than integration into existing environments

- Once tackled for one asset class, ramping up DLT for other asset types/uses will be easier

If you learn how to drive an automatic car and then are presented a stick shift, you need to relearn many of the aspects of driving again and strip a few gears in the process, but once you do, your appreciation of what is happening under the hood and the efficiency of the driving process increases. There are many factors and uses in deciding on an automatic vs. a stick shift, just as migrating from current processes to blockchain, DLT and other fintech solutions will depend on a variety of variables.

Blockchain initiatives in financial services are prioritizing functions that could greatly improve efficiency and reduce risk. They represent a fundamental change to how some deals will be struck, how operations and desks handle them and how regulators will administer oversight. Firms will need to understand the business and operational implications of DLT repo at a granular level to finalize business cases, understand the costs, cost savings and risk tolerance changes as a result. It will be a steep learning curve for most firms, but the benefits will be worth the investment. There will be a few gear boxes replaced in the process on all sides of the street in the coming decade as firms navigate the adoption of DLT and blockchain for financial services deals.

ABOUT THE AUTHORS

As a Managing Director and a Practice Lead for Consulting at Broadridge, Carol brings three decades of experience to financial services mandates in helping firms achieve business goals and remain competitive. Carol has spearheaded many end-to-end transformational mandates by optimizing technology stacks, addressing data governance and migrating to more effective processes and workflows to service disruptive business impacts and demands. She has a BA from The University of Toronto, a Certificate in History from The University of Edinburgh and a Degree in Programming and Systems Analysis from The Institute for Computer Studies. Carol.Penhale@broadridge.com

Rick Stinchfield is a Senior Director and Assistant Practice Lead for Consulting at Broadridge. He has spent over 30 years developing and managing capital markets industry-critical technologies, from some of the earliest start-up innovators to major services providers and consultancies. He is a regular speaker at industry conferences and has been cited in financial industry publications and mainstream press. Richard.Stinchfield@broadridge.com